Landing page template for loan companies

Use TemplateAbout template

Give your loan companies a boost with our professional landing page templates. Ready to turn visitors into customers?

Recommended templates

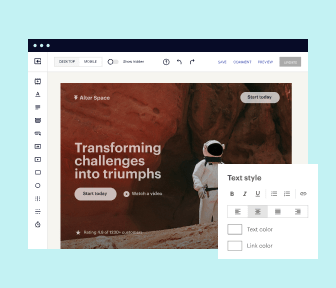

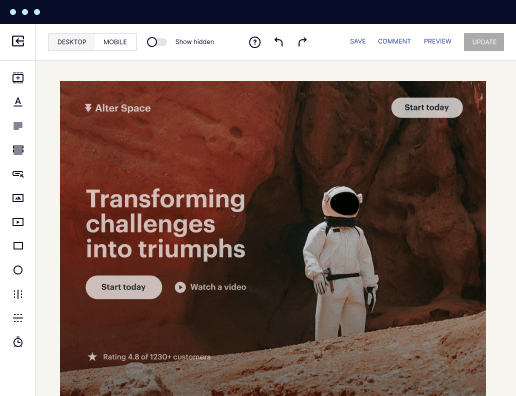

Easy to build without coding

With the intuitive drag-and-drop builder, anyone on your team can create high-converting pages without any knowledge of code or design. Make enhancements to your landing page with custom widgets using Javascript, HTML/CSS, or third-party scripts.

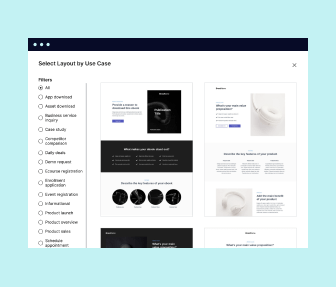

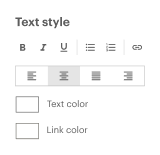

Multiple layouts for any industry and goal

Select from 500+ landing page layouts built to boost conversions across industry-specific scenarios. Customize them by adjusting fonts, adding images, and generating on-brand content with the AI assistant. Quickly scale with Instablocks® and Global Blocks that you can save, reuse, and update globally.

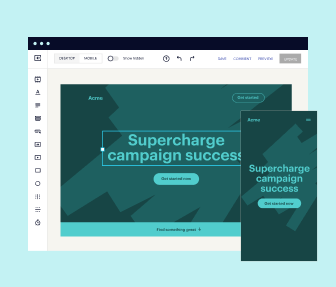

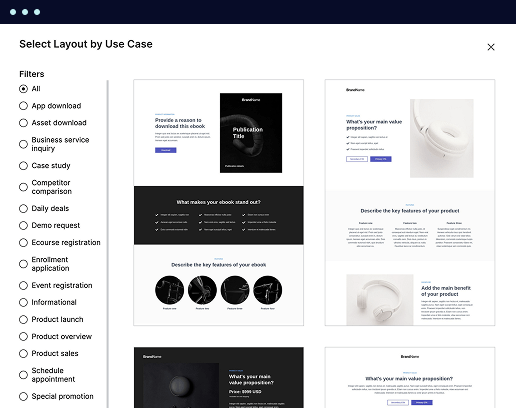

Loads fast and looks polished on any device

Every template is responsive, which means they present professionally on any device and load blazingly fast with our Thor Render Engine. You can also power them up with Google AMP technology to deliver an unparalleled mobile experience and drive higher conversions.

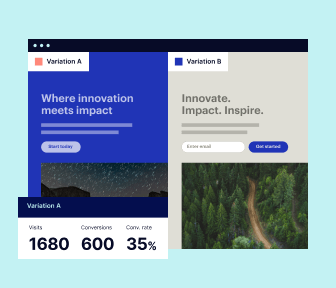

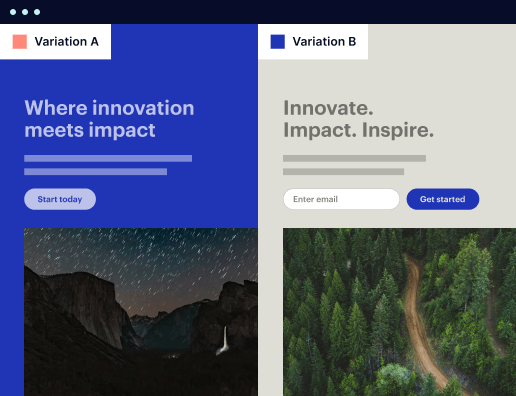

Robust analytics & experimentation

Get real-time updates and reporting across all your devices, showing the number of visitors, conversions, cost-per-visitor, and cost-per-lead. Launch AI-powered experiments, run A/B tests, and use heatmaps to analyze user behavior, then optimize your landing page to maximize conversions.

Easy to build without coding

With the intuitive drag-and-drop builder, anyone on your team can create high-converting pages without any knowledge of code or design. Make enhancements to your landing page with custom widgets using Javascript, HTML/CSS, or third-party scripts.

Multiple layouts for any industry and goal

Select from 500+ landing page layouts built to boost conversions across industry-specific scenarios. Customize them by adjusting fonts, adding images, and generating on-brand content with the AI assistant. Quickly scale with Instablocks® and Global Blocks that you can save, reuse, and update globally.

Loads fast and looks polished on any device

Every template is responsive, which means they present professionally on any device and load blazingly fast with our Thor Render Engine.

Robust analytics & experimentation

Get real-time updates and reporting across all your devices, showing the number of visitors, conversions, cost-per-visitor, and cost-per-lead. Launch AI-powered experiments, run A/B tests, and use heatmaps to analyze user behavior, then optimize your landing page to maximize conversions.

All the features you need to build loan landing page template

Explore more featuresLearn how to build instapage

Frequently asked questions about loan landing page

Leading the way in building high-performing landing pages

Loan landing page design: Your ultimate how-to guide

A landing page template for loan companies is crucial for attracting and converting potential borrowers. With Instapage's expertly designed templates, you can create high-performing landing pages tailored specifically for the loan industry. This guide will take you through the steps to maximize your campaign effectiveness using these templates, ensuring that you generate quality leads and drive higher ROI.

Understanding the components of an effective loan landing page

An effective loan landing page should include several key elements. Start with a clear and persuasive headline that highlights your unique value proposition. Below the headline, add concise content that emphasizes the benefits of your loan offerings. Always include a strong call to action, guiding users to apply or learn more about your services.

- Strong Headline: Capture attention with a clear statement about your loan offerings.

- Compelling Benefits: Highlight what sets your loans apart, such as competitive rates or flexible terms.

- Urgent Call to Action: Encourage visitors to apply now with strong, actionable phrases.

Step 1: Selecting a suitable landing page template

Begin by exploring Instapage's diverse range of over 100 customizable landing page templates specifically designed for loan companies. Choose a template that aligns with your brand and campaign goals. Remember to consider elements like color schemes, layouts, and responsive design to ensure compatibility across all devices.

Step 2: Customizing your landing page for your audience

Once you've chosen a template, customize it to meet the specific needs of your target audience. This can include:

- Using dynamic text replacement to personalize messages based on the audience segment.

- Aligning your ad copy with the landing page's messaging to maintain consistency.

- Implementing lead generation elements, such as forms and chat functions, to enhance user engagement.

Step 3: Analyzing and optimizing performance

Monitor your landing page performance using built-in analytics tools from Instapage. Pay attention to metrics such as bounce rate, conversion rate, and user engagement to gain insights. To improve performance further, conduct A/B testing on various page elements to identify what best resonates with prospective borrowers.

By adhering to these three crucial steps and utilizing our landing page templates for loan companies, you can significantly enhance your marketing campaigns. This strategic approach ensures that your pages are not only visually appealing but also optimized for conversions.

Start utilizing Instapage’s powerful landing page templates today and elevate your loan marketing strategy to the next level. Create compelling campaigns that attract and convert customers with ease!

People also ask about landing page template loan

Understanding landing page templates for loan companies: A comprehensive guide

The importance of landing pages for loan companies

Landing pages serve as a crucial component in the marketing arsenal for loan companies. Unlike traditional websites that provide a broad array of information, landing pages are focused on a singular goal: converting visitors into leads or customers. They streamline the pathway for potential clients to understand loan products quickly, while increasing the likelihood of lead capture.

Statistics indicate that conversion rates for landing pages can be significantly higher than standard websites. According to recent studies, dedicated landing pages can deliver conversion rates as high as 25% compared to an average of 2% for conventional sites. This stark difference underscores the need for loan companies to prioritize well-designed landing pages in their digital marketing strategies.

Loan companies often face unique challenges, such as strict regulations and a competitive market landscape. Potential borrowers may have numerous options at their disposal, making it vital for companies to craft landing pages that not only capture their interest but also build trust and facilitate informed decision-making about financial products.

Essential elements of an effective loan company landing page

Clear and compelling headline

Concise and informative messaging

Visual design and branding

Trust signals and credibility indicators

Each of these elements plays a pivotal role in ensuring that a landing page effectively engages visitors. A clear and compelling headline not only grabs attention but also sets the tone for the visitor's experience. For instance, headlines like 'Get approved for a loan in minutes!' can create urgency and entice users to proceed.

Additionally, concise and informative messaging ensures that potential borrowers understand exactly what is being offered. Avoiding industry jargon while clearly outlining terms and benefits can demystify the loan process for applicants. Every piece of content should be crafted to emphasize clarity and relevance.

Visual elements must correspond with branding to foster a trustworthy image. Consistency in color schemes, fonts, and imagery can help reinforce brand identity, while trust signals like client testimonials and security certifications serve to validate the company's reliability. Building this trust is essential for capitalizing on conversions.

Features of a premium landing page template builder

Choosing the right landing page template builder is critical for loan companies looking to enhance their online presence. An ideal template builder should be intuitive and equipped with features that accommodate both novice and experienced marketers. This not only streamlines the landing page creation process but also ensures effective implementation.

Drag-and-drop functionality allows users to create pages seamlessly without needing technical skills.

Mobile responsiveness is essential for optimizing the user experience on phones and tablets, given that a considerable portion of traffic originates from mobile devices.

Robust SEO capabilities ensure that landing pages can effectively attract organic traffic, a critical component for lead generation in the competitive loan market.

A/B testing functionality enables companies to experiment with different headlines, visuals, and calls to action, helping to identify what resonates best with the target audience.

By implementing these features, loan companies can enhance engagement and conversions. A drag-and-drop builder, for instance, simplifies creating visually appealing pages without the need for extensive coding knowledge. Furthermore, as mobile users continue to dominate the online landscape, ensuring a mobile-responsive design will significantly impact user experiences and conversion rates.

Innovative sections and pop-up integration

Organizing content effectively within landing pages is critical. Utilizing clearly defined sections can make it easier for visitors to navigate information. Best practices include employing headers, bullet points, and consistent formatting to break down content into digestible pieces. For instance, informative sections could explore loan types, rates, or eligibility criteria, all while keeping the user engaged.

Lead magnets like eBooks or checklists can encourage visitors to provide contact information.

Newsletter sign-ups entice users to stay connected with updates related to loan offerings.

The strategic use of pop-ups can further enhance user interaction. Timing and placement are key; for instance, a well-timed pop-up that appears as a visitor scrolls may be less intrusive and thus more likely to convert. When used judiciously, these elements can assist in capturing valuable leads while also providing additional value to users.

Crafting compelling text and messaging

The effectiveness of a landing page often hinges on its textual content. Psychological principles suggest that incorporating urgency and scarcity can motivate users to take action. Phrases like 'Limited time offer' or 'Only 3 spots left' can instill a sense of urgency that encourages immediate engagement. Language should be simple yet powerful and should strike a personal note with visitors.

Additionally, navigating sensitive topics—such as interest rates and fees—requires a sympathetic approach. It's essential to present this information transparently while emphasizing financial literacy and empowerment. This transparency builds rapport and trust, enabling users to feel secure when considering their loan options.

Personalization in messaging can also yield impressive results. Tailoring content based on user demographics ensures that communications are relevant and resonate deeply with potential borrowers, making them more likely to convert.

Visual content: The power of images and videos

Visuals play a pivotal role in conveying messages and establishing trustworthiness. Selecting the right images is crucial in promoting an appealing brand image. Using photographs of real people rather than generic stock images can significantly impact perception. Trust-bolstering visuals can help narrate the story behind a loan company and its values.

Incorporating video content can further engage visitors by explaining complex loan concepts in simplified terms. Storytelling through video can show a customer's journey, highlighting how to navigate the loan process effortlessly. Positioning engaging videos strategically on the landing page can improve retention and increase conversion rates.

Ultimately, the placement of images and videos should be carefully considered to maximize impact. Utilizing a mix of formats, such as infographics, short clips, and clear calls to action, can provide a stimulating user experience while delivering vital information.

Utilizing analytics to enhance page performance

Understanding performance through analytics is essential for optimizing landing pages in the loan sector. Having a comprehensive dashboard allows companies to monitor clicks, engagement, and conversion rates, enabling data-driven decisions for future campaigns. This insight is invaluable for assessing the effectiveness of different landing page configurations.

Click-through rates provide insight into how many visitors are taking action.

Bounce rates indicate the percentage of visitors leaving the page without further interaction.

Conversion rates showcase the effectiveness of the landing page in capturing leads.

Setting up events to track user interactions can also provide granular data that is crucial for performance evaluation. For example, monitoring specific actions such as form submissions or button clicks can help identify bottlenecks or areas for improvement, ensuring that landing pages is always evolving.

The future of landing pages and continuous improvement

As the demand for effective digital marketing continues to evolve, landing pages within the loan industry are expected to change significantly. The growing trend of personalization will increasingly influence design and functionality, enhancing user experience and engagement. Automation and artificial intelligence are also likely to play a notable role, helping marketers analyze data and implement changes more swiftly.

Ongoing testing and iteration post-launch should not be neglected. Continuous improvements based on data insights will enable loan companies to refine their landing pages, ensuring alignment with the shifting preferences and behaviors of target markets.

Real-world case studies: Success stories from loan companies

Analyzing successful case studies can reveal valuable insights into effective landing page implementations. For instance, one prominent loan company revamped its landing page to focus on user experience, which resulted in a 50% increase in conversion rates within just a few months. This improvement was attributed to streamlined messaging and enhanced trust signals.

Another company successfully employed A/B testing to optimize their call to action, resulting in a notable uptick in applications. By examining what resonated with their audience, they adapted their approach to align with customer needs effectively. Lessons from these experiences can illuminate best practices for other loan companies striving for success.

Operational considerations in landing page creation

Collaboration with professionals can enhance the efficacy of landing page designs. Marketers should consider leveraging skilled designers and copywriters who can translate complex loan products into appealing and persuasive content. Striking a balance between aesthetic allure and functional utility is key for optimal user experience.

Additionally, navigating regulatory and compliance issues within messaging and design cannot be overlooked. Loan companies must ensure that all content adheres strictly to financial marketing regulations, which adds another layer of complexity to the landing page creation process.

Conclusion

Utilizing landing page templates provides loan companies with numerous advantages. These templates enable efficient design, allowing marketers to create compelling and conversion-oriented pages swiftly. The positive impact of optimized landing pages extends beyond lead generation; they build brand trust and cultivate customer loyalty.

A proactive approach toward harnessing modern tools and techniques in landing page design can result in substantial growth in conversions for loan companies. As the landscape continues to evolve, staying ahead with effective landing pages will ensure that companies not only attract but also retain valuable customers.

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages

Get started