Landing page template for Debt collectors

Use TemplateAbout template

Attract clients and showcase your skills with style using our landing page templates for Debt collectors. Let's convert those visitors into clients!

Recommended templates

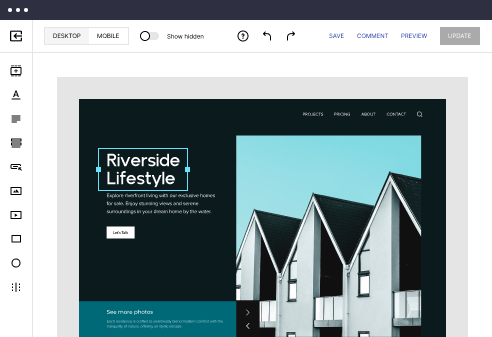

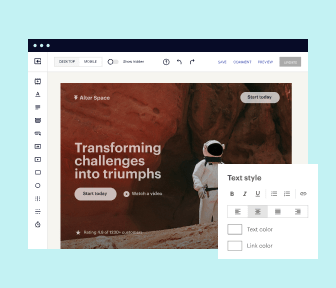

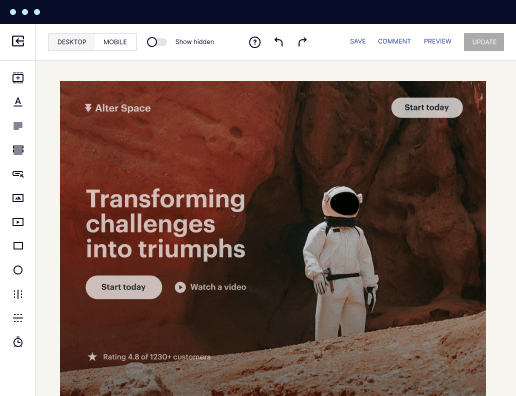

Easy to build without coding

With the intuitive drag-and-drop builder, anyone on your team can create high-converting pages without any knowledge of code or design. Make enhancements to your landing page with custom widgets using Javascript, HTML/CSS, or third-party scripts.

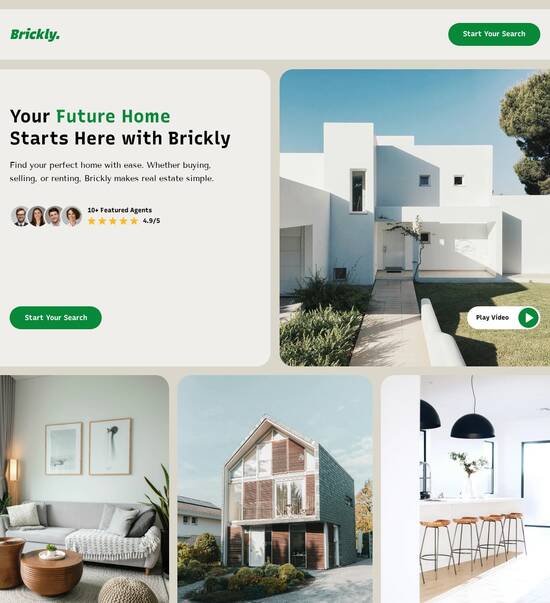

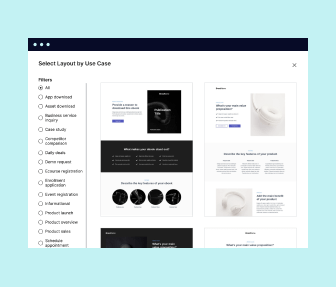

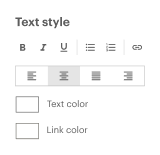

Multiple layouts for any industry and goal

Select from 500+ landing page layouts built to boost conversions across industry-specific scenarios. Customize them by adjusting fonts, adding images, and generating on-brand content with the AI assistant. Quickly scale with Instablocks® and Global Blocks that you can save, reuse, and update globally.

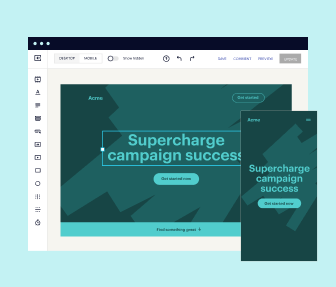

Loads fast and looks polished on any device

Every template is responsive, which means they present professionally on any device and load blazingly fast with our Thor Render Engine. You can also power them up with Google AMP technology to deliver an unparalleled mobile experience and drive higher conversions.

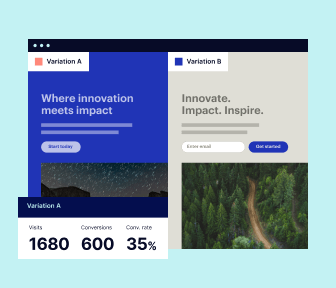

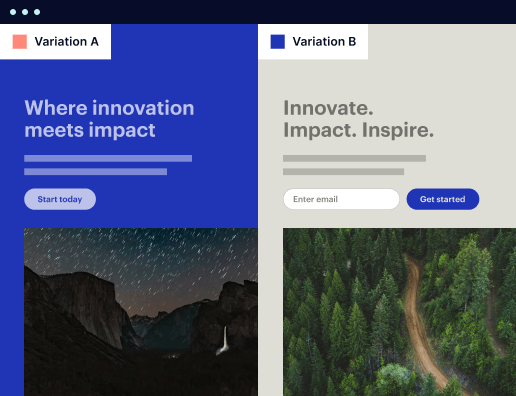

Robust analytics & experimentation

Get real-time updates and reporting across all your devices, showing the number of visitors, conversions, cost-per-visitor, and cost-per-lead. Launch AI-powered experiments, run A/B tests, and use heatmaps to analyze user behavior, then optimize your landing page to maximize conversions.

Easy to build without coding

With the intuitive drag-and-drop builder, anyone on your team can create high-converting pages without any knowledge of code or design. Make enhancements to your landing page with custom widgets using Javascript, HTML/CSS, or third-party scripts.

Multiple layouts for any industry and goal

Select from 500+ landing page layouts built to boost conversions across industry-specific scenarios. Customize them by adjusting fonts, adding images, and generating on-brand content with the AI assistant. Quickly scale with Instablocks® and Global Blocks that you can save, reuse, and update globally.

Loads fast and looks polished on any device

Every template is responsive, which means they present professionally on any device and load blazingly fast with our Thor Render Engine.

Robust analytics & experimentation

Get real-time updates and reporting across all your devices, showing the number of visitors, conversions, cost-per-visitor, and cost-per-lead. Launch AI-powered experiments, run A/B tests, and use heatmaps to analyze user behavior, then optimize your landing page to maximize conversions.

All the features you need to build collection agency website template

Explore more featuresLearn how to build debt collection website

Frequently asked questions about debt website template

Leading the way in building high-performing landing pages

A powerful landing page template for debt collectors

When it comes to debt collection, having a bespoke landing page template can significantly enhance your conversion rates. Instapage's dedicated templates allow you to create customized pages that not only attract attention but also drive leads effectively. With easy-to-use features designed for marketers, these templates enable you to optimize your campaigns in a way that maximizes your ROI.

Understanding the essentials of landing page templates

A landing page template serves as a pre-designed framework that simplifies the process of creating a dedicated web page for your marketing campaign. For debt collectors, this means you can quickly set up pages designed to capture leads, explain services, and even provide payment options, all while adhering to compliance requirements. Customized templates ensure that every aspect is geared towards increasing conversions.

- High-converting designs: Benefit from landing pages designed specifically for performance, ensuring a higher likelihood of capturing leads.

- Mobile responsiveness: Templates are optimized for mobile devices, ensuring potential customers can engage with your content regardless of the platform they're using.

- Integration with CRM: Seamlessly connect your landing pages with existing CRM systems to track leads and client interactions effectively.

Step-by-step guide to utilizing Instapage’s templates

Using Instapage's landing page templates is a straightforward process that can yield powerful results for your debt collection strategies. Here’s how to do it:

- Choose a relevant template: Select a template tailored for debt collection that resonates with your audience's needs. Instapage offers specific designs that are user-focused.

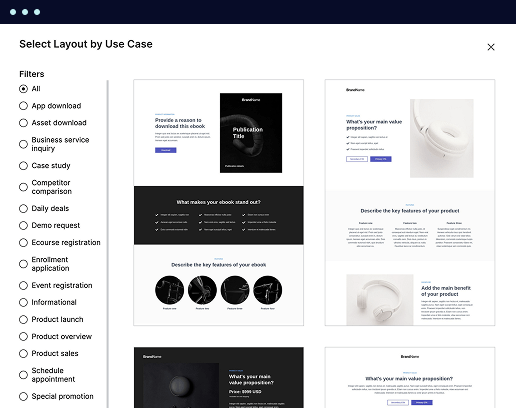

- Customize your content: Utilize the intuitive drag-and-drop interface to adjust graphics, text, and calls to action so they align with your brand’s voice and the objectives of your campaign.

- Implement A/B testing: Launch variations of your landing pages to see which layout performs better in capturing leads. Instapage allows you to measure these metrics effortlessly.

Optimizing for conversions with personalization

Once your landing page is set up, it’s crucial to optimize it for conversions. The following strategies can enhance your page's performance:

- Dynamic content replacement: Adjust messages based on user behavior or demographics to provide a more personalized experience.

- Ad mapping: Align specific ads to unique landing pages, ensuring that the messaging remains consistent and relevant to the users’ entry points.

- Analytics tracking: Continuously monitor performance metrics using Instapage’s built-in analytics dashboard to identify areas for improvement.

By employing these methods, debt collectors can transform their landing pages into effective lead generation tools that yield measurable results.

In conclusion, utilizing a specialized landing page template for debt collectors can streamline your marketing efforts while significantly improving conversion rates. This strategic approach can aid in better connecting with potential clients and driving your recruitment goals.

Take the next step in optimizing your debt collection campaigns with Instapage. Sign up today and start customizing your landing page templates for effective lead generation.

People also ask about Landing page template for Debt collectors

Creating a Landing Page Template for Debt Collectors

Understanding the unique needs of debt collectors

Debt collectors face specific challenges in marketing their services effectively. One significant hurdle is navigating the legal restrictions tied to debt collection, which can vary by region. These regulations require clarity in communication to ensure compliance while conveying trustworthiness to potential clients. Establishing a strong reputation is mandatory, especially in an industry where client relationships heavily depend on transparency and reliability.

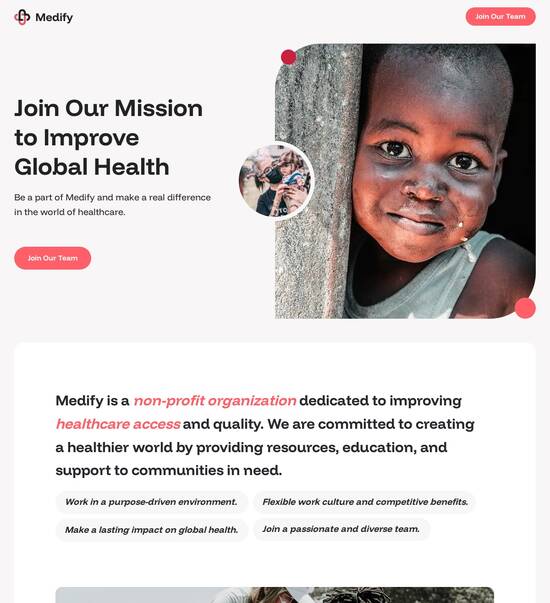

Given the sensitive nature of debt collection, it’s crucial that landing pages capture leads delicately and provide essential information efficiently. A specialized landing page not only enhances conversion rates but also aligns with the unique dynamics of the debt collection industry. The right design and content can significantly add to the effectiveness of campaigns aimed at reaching those who need assistance in managing their debts.

Core features of an effective debt collector landing page template

A good landing page template for debt collectors must incorporate visually compelling design elements. Color choices, images, and typography can significantly influence first impressions and build trust with visitors. A clean layout minimizes distractions and focuses the visitor's attention on crucial information. It is also important for the template to feature a responsive design that looks appealing on both mobile and desktop formats.

Attention-grabbing headline that clearly states the service offered.

Concise subheadings that convey trust and expertise.

Informative body copy that emphasizes solutions and benefits.

Strong testimonials and case studies to reinforce credibility.

Well-designed contact forms to facilitate lead generation.

User-friendly navigation further enhances the landing page experience. Visitors should easily find answers to their questions through simplified pathways to relevant information. Providing access to FAQs and support, along with quick links to related resources, is essential to ensure that users can navigate the page without frustration.

Innovative functionalities for enhanced performance

To maximize the effectiveness of a landing page template, debt collectors can incorporate innovative functionalities. Integrations with essential tools, such as CRM systems, allow for streamlined lead management. Automated email follow-ups can engage potential leads and leave a lasting impression, while social media sharing capabilities broaden the reach of marketing efforts.

A/B testing functionality to continuously improve page effectiveness.

Exit-intent pop-ups designed to capture leads before they leave.

Analytics tools that track performance metrics, allowing for data-driven adjustments.

These functionalities provide the needed insights to refine marketing strategies, ensuring that the landing page remains relevant and effective in achieving its primary goal: generating leads and converting visitors into clients.

Tailored marketing strategies for debt collectors

Creating compelling offers is crucial for debt collectors looking to attract potential clients. Offering free consultations or valuable resources can significantly boost engagement. Introducing pricing strategies, such as competitive initial consultation fees, helps to eliminate barriers for potential leads, transforming visits into inquiries.

Specialized payment plans tailored for clients in need.

Integrative links with additional marketing channels to create a cohesive approach.

Utilization of course homepage pages and thank you pages to enhance follow-up engagement.

The purpose of the landing page should fit seamlessly within a larger marketing ecosystem, ensuring all components work together effectively. By integrating multiple channels, debt collectors can provide a comprehensive view of their services, thus enhancing trust and converting potential clients effectively.

Cost breakdown and accessibility options

Understanding pricing models can significantly influence the choice of landing page templates. Analyzing costs associated with premium templates helps debt collectors find solutions that don’t compromise quality for budget. Generally, competitive pricing, including comprehensive templates priced around $119 or initial trial offers starting at just $1, makes these options accessible for businesses at various scales.

An equally important consideration is accessibility for varied clients. Creating multilingual pages can attract a broader audience while ensuring compliance with regulations such as the Americans with Disabilities Act (ADA) will increase usability and reach. Organizations should prioritize inclusive design practices to make their landing pages approachable for all potential clients.

Optimizing the landing page for lead generation

Effective lead generation is crucial for the success of a landing page template. It entails showcasing a debt collector's successful practices prominently. The landing page should highlight key metrics and achievements, constructing a narrative that reflects the agency's reliability and success in managing debts.

Implementing SEO techniques specific to the debt collection landscape to enhance visibility.

Exploring paid advertising options tailored for targeted reach.

Leveraging local search optimization to attract community clients.

By employing these strategies, debt collectors can drive targeted traffic to their landing pages, ensuring that they connect with individuals who genuinely need assistance in their financial journey.

Gathering feedback and iterating on design

Acquiring customer insights is paramount for maintaining relevance in the competitive debt collection market. Gathering feedback from clients can be done effectively through surveys, direct communications, or feedback forms on the landing page. Understanding user experiences provides an opportunity for organizations to implement changes that meet the needs of their audience.

Utilizing heat maps and session recordings to analyze user behavior.

Defining key performance indicators (KPIs) to measure landing page success.

Establishing a cycle of regular updates to adapt to changing client needs.

Creating a continuous improvement cycle involves not just gathering feedback, but also bravely trying new strategies based on the data collected. This responsive approach allows debt collectors to keep their landing pages effective and relevant.

Future trends and innovations in debt collection marketing

Emerging technologies shape the landscape of debt collection, and understanding future trends helps organizations stay ahead of the curve. AI and automation can enhance client interactions, fostering personalized experiences that build trust. Automated chat assistance can provide immediate answers to potential clients, further increasing the likelihood of conversion.

Using predictive analytics to enhance lead identification strategies.

Exploring blockchain technology for secure transactions.

Considering virtual reality technologies to enrich client relationships.

As the digital landscape continually evolves, debt collectors must prioritize future-proofing their landing pages to meet client expectations effectively. Keeping abreast of these changes will ensure that landing pages remain relevant and functional.

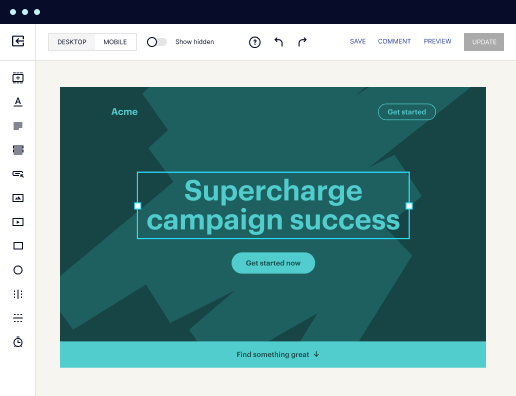

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages

Get started