Landing page template for Credit managers

Use TemplateAbout template

Attract clients and showcase your skills with style using our landing page templates for Credit managers. Let's convert those visitors into clients!

Recommended templates

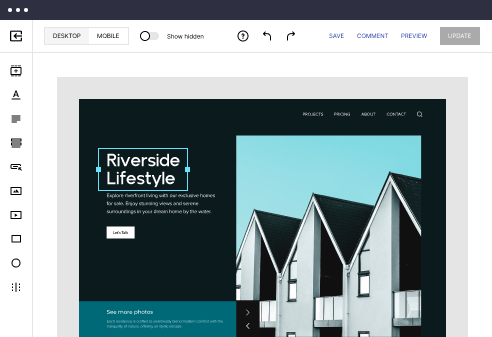

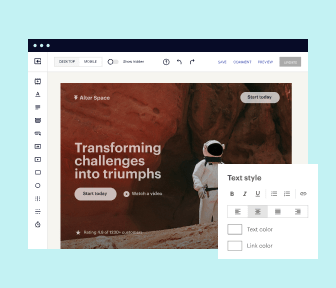

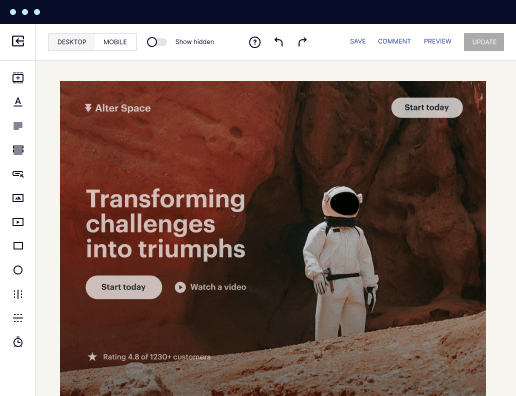

Easy to build without coding

With the intuitive drag-and-drop builder, anyone on your team can create high-converting pages without any knowledge of code or design. Make enhancements to your landing page with custom widgets using Javascript, HTML/CSS, or third-party scripts.

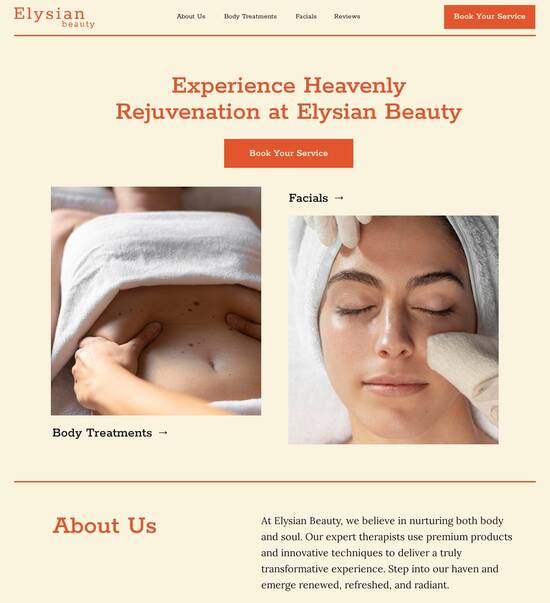

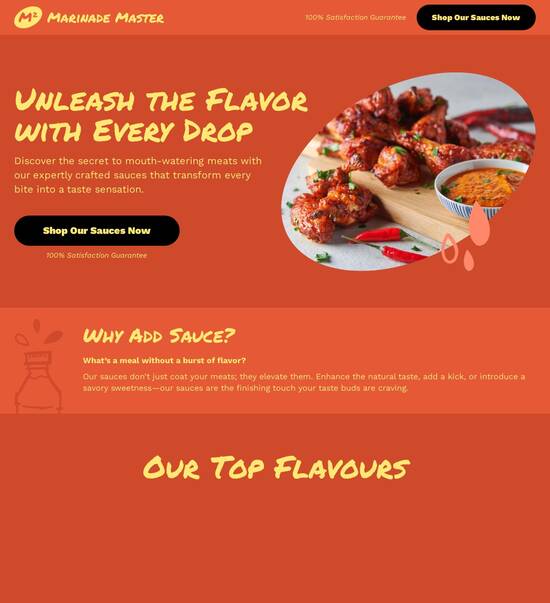

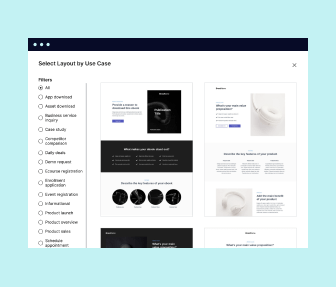

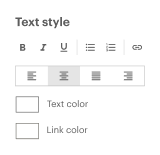

Multiple layouts for any industry and goal

Select from 500+ landing page layouts built to boost conversions across industry-specific scenarios. Customize them by adjusting fonts, adding images, and generating on-brand content with the AI assistant. Quickly scale with Instablocks® and Global Blocks that you can save, reuse, and update globally.

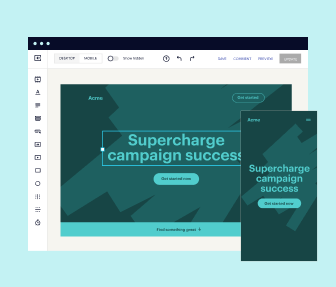

Loads fast and looks polished on any device

Every template is responsive, which means they present professionally on any device and load blazingly fast with our Thor Render Engine. You can also power them up with Google AMP technology to deliver an unparalleled mobile experience and drive higher conversions.

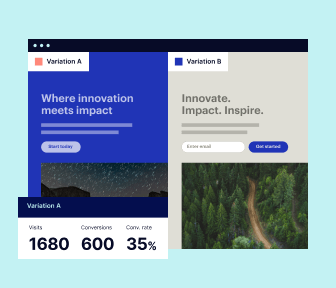

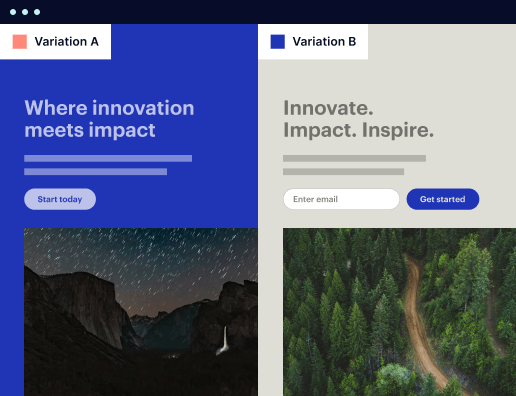

Robust analytics & experimentation

Get real-time updates and reporting across all your devices, showing the number of visitors, conversions, cost-per-visitor, and cost-per-lead. Launch AI-powered experiments, run A/B tests, and use heatmaps to analyze user behavior, then optimize your landing page to maximize conversions.

Easy to build without coding

With the intuitive drag-and-drop builder, anyone on your team can create high-converting pages without any knowledge of code or design. Make enhancements to your landing page with custom widgets using Javascript, HTML/CSS, or third-party scripts.

Multiple layouts for any industry and goal

Select from 500+ landing page layouts built to boost conversions across industry-specific scenarios. Customize them by adjusting fonts, adding images, and generating on-brand content with the AI assistant. Quickly scale with Instablocks® and Global Blocks that you can save, reuse, and update globally.

Loads fast and looks polished on any device

Every template is responsive, which means they present professionally on any device and load blazingly fast with our Thor Render Engine.

Robust analytics & experimentation

Get real-time updates and reporting across all your devices, showing the number of visitors, conversions, cost-per-visitor, and cost-per-lead. Launch AI-powered experiments, run A/B tests, and use heatmaps to analyze user behavior, then optimize your landing page to maximize conversions.

All the features you need to build lead-generating landing pages

Explore more featuresLearn how to build top-performing landing pages for any goal

FAQs

Leading the way in building high-performing landing pages

An empowered landing page template for credit managers

Credit managers play a vital role in the financial services sector, overseeing the management and mitigation of credit risks. Instapage's landing page template for credit managers provides customizable, high-converting designs tailored specifically to attract and engage potential clients in need of credit management services. With a user-friendly interface and extensive optimization features, you can create landing pages that resonate with your audience immediately.

Understanding the significance of a specialized landing page

A dedicated landing page for credit managers is crucial because it provides a focused environment for potential clients. Unlike generic pages, these templates can highlight key services, case studies, and testimonials specific to credit management. This direct approach helps in capturing leads effectively and enhances conversion rates significantly.

- Customization: Tailor content and visuals to reflect your brand's identity and values.

- Optimization: Utilize built-in A/B testing features to continuously improve your page’s performance.

- Analytics: Monitor user interactions through detailed heatmaps to refine your marketing strategies.

Step 1: Selecting the perfect template for your needs

Choosing the right landing page template is critical. Start by exploring Instapage's extensive library of over 100 customizable templates designed specifically for financial services. Look for one that allows you to showcase your unique services while aligning with your brand image.

Step 2: Customize for your target audience

Once you have chosen your template, the next step is customization. Focused content will help you connect with your audience effectively. Use personalized messages, dynamic text replacement, and relevant images to make your page more dynamic and appealing.

- Engaging headlines: Craft compelling headlines that address common credit management concerns.

- Clear CTAs: Include calls-to-action that guide users toward your service offerings, such as 'Get a Free Consultation.'

- Contact forms: Integrate quick and easy-to-fill contact forms to capture lead information effortlessly.

Step 3: Optimize and analyze results

The final step involves optimizing your landing page. Use Instapage's built-in analytics tools to monitor the performance of your page. Look at metrics such as conversion rates, bounce rates, and average time spent on the page to determine what's working and what needs improvement.

- A/B testing: Conduct experiments with different headlines and images to see which combinations yield better results.

- Track user behavior: Use heatmaps to understand where visitors click and spend their time.

- Refine based on data: Adjust your layout, content, and CTAs based on insights gained from analytics.

By following these steps, credit managers can effectively utilize Instapage to create powerful landing pages that convert leads into clients.

Start transforming your credit management campaigns today! Leverage Instapage’s powerful tools and templates to boost your online presence and maximize your conversion rates.

People also ask about Landing page template for Credit managers

Crafting the Ideal Landing Page Template for Credit Managers: An In-Depth Exploration

Understanding the needs of credit managers

Credit managers face a unique set of challenges in managing credit risk and ensuring financial stability within organizations. They must navigate varying credit policies, assess customer creditworthiness, and manage cash flows while ensuring compliance with regulations. This often requires them to communicate complicated financial information clearly and concisely to both internal and external stakeholders.

The targeted messaging and customer engagement strategies are crucial for credit managers. Using a landing page template can greatly assist in these efforts by presenting information in a straightforward manner, optimizing the user experience, and ensuring that visitors can quickly find the information they need. Overall, the goal of these pages should be to convert visitors into leads or clients, which necessitates a clear understanding of the key objectives for the landing page.

Minimize complexities around credit applications and customer verifications.

Establish trust through effective communication of credit services.

Highlight unique selling points relevant to each audience segment.

Distinct features of tailored landing page templates

Tailored landing page templates for credit managers provide an array of customizable features aimed at meeting the specific requirements of credit services. These templates are designed not just for aesthetic appeal but also for functionality, ensuring compatibility with various budgeting tools, financing products, and customer management software. This level of compatibility allows for seamless integration of existing systems, making it easier for credit managers to maintain their workflows.

When selecting a template, it is essential to consider features like built-in compliance checks, user-friendly dashboards, and customizable forms that accommodate diverse financial scenarios. The ability to change elements based on feedback and performance metrics strengthens the proposition that a well-designed landing page can substantially improve customer interactions and conversions.

Pre-built forms tailored for different types of credit inquiries.

Integration with financial analysis tools and customer databases.

A/B testing features to optimize engagements continuously.

Simplified design process: The drag-and-drop functionality

One of the standout features of modern landing page templates is the drag-and-drop functionality, which empowers credit managers to design their pages effortlessly. This feature allows users to rearrange content blocks, images, and forms without needing advanced coding skills. Consequently, credit managers can devote time to their core responsibilities rather than becoming bogged down in technical details.

To customize elements effectively, users can follow a simple step-by-step guide. Start by selecting a layout that aligns with your goals, then modify headings, images, and calls to action as needed. Further, ensure all text aligns with the brand voice and presents clear value propositions to potential customers. A user-friendly interface promotes efficiency, significantly benefiting those who may not be as tech-savvy.

Choose a layout that resonates with your target audience.

Use visual elements to break up text and enhance readability.

Preview changes in real-time to ensure optimal presentation.

Optimized messaging for higher conversion rates

Crafting compelling headlines is fundamental for engaging visitors to credit management landing pages. Your headlines should outline the value proposition clearly and attract attention, guiding customers toward the services you offer. Use data-driven insights to inform your messaging and ensure it covers various customer pain points, such as financial stability, quick approvals, and transparency in pricing.

In addition to accurate headlines, applying effective copywriting techniques will ensure your content resonates with visitors’ needs. Create a narrative that not only discusses the features of your services but also highlights the benefits that they stand to gain. This approach turns curious visitors into engaged users, ultimately driving conversion rates higher.

Focus on the key benefits specific to your target audience.

Use simple language and an approachable tone.

Incorporate user scenarios to illustrate practical applications.

Strategic placement of calls-to-action (CTAs)

The psychology behind effective CTAs in credit management should not be overlooked. A well-placed, compelling CTA guides users toward the next steps—whether that be signing up, requesting more information, or applying for a service. Best practices suggest placing CTAs above the fold while ensuring they are visually distinct and clearly worded.

In practice, effective CTAs often include action-oriented phrases that create a sense of urgency or exclusivity, prompting immediate responses from users. For instance, phrases like 'Get Started Today' or 'Apply Now for Fast Approval' can drive visitors to take timely action, thereby increasing the potential for conversions.

Position CTAs prominently on the landing page.

Use contrasting colors to make CTAs pop.

Test different wording and placements to optimize engagement.

Services showcase: Highlighting diverse offerings

When it comes to showcasing financial services, a dedicated landing page can highlight your unique offerings effectively. Use visually rich elements such as icons, images, and infographics to present service packages clearly. This approach not only enhances the visual appeal but also fosters a better understanding of the services available.

Incorporating testimonials and case studies into your service overview is an excellent strategy for building trust among potential customers. Displaying real-world experiences reaffirms the value of your services and allows prospective clients to connect with your brand on a deeper level.

Use structured layouts to highlight key services effectively.

Incorporate visuals to break up dense text.

Leverage genuine customer feedback for authenticity.

Importing existing content and data seamlessly

Importing existing content, customer data, and service offerings into new landing page templates can be a smooth process if handled correctly. Credit managers can utilize automated tools that streamline these tasks, enabling a quick turnaround for updates while maintaining the integrity of the data.

Benefits of seamless integration extend to ongoing content revisions as well. When updates are necessary, automated tools ensure brand consistency across all engagements. Maintaining a uniform brand voice reinforces trust, crucial when addressing financial matters.

Leverage data import features for efficiency.

Use templates as a framework to ensure consistency.

Regularly audit imported data for accuracy.

Enhancements through A/B testing and analytics

A/B testing plays a pivotal role in improving landing page performance over time. By experimenting with different headlines, CTAs, and visuals, credit managers can identify which components elicit the best responses from users. This data-driven approach ensures that investments in marketing efforts yield the highest returns.

Focus on key performance metrics to measure the success of your landing pages. Metrics like conversion rates, bounce rates, and session duration provide valuable insights into user behavior and help credit managers to make informed decisions regarding further optimizations. Ongoing analysis allows for continuous improvement.

Monitor conversion funnels to identify drop-off points.

Adjust strategies based on user engagement data.

Iterate and optimize frequently to enhance performance.

The role of mobile optimization in capturing visitors

Mobile optimization is critical for landing pages in the credit management sector. With more users accessing information through their smartphones and tablets, ensuring an optimal user experience across various devices is essential. A well-optimized mobile landing page retains visitors and drives higher engagement, ultimately leading to increased conversion.

To achieve mobile optimization, credit managers can implement responsive designs that automatically adjust based on screen size. Ensure all text is legible, buttons are easily clickable, and visuals don’t detract from essential information. Testing pages on different devices helps uncover any potential issues before launching.

Utilize responsive design practices for mobile viewing.

Optimize images for faster loading on mobile devices.

Regularly test the mobile experience and adjust as necessary.

Building trust with secure and professional layouts

Trust is essential in financial services, and a professional, secure landing page layout can enhance customer confidence. Design elements that convey professionalism—such as a clean design, appropriate use of space, and high-quality images—foster a sense of security among potential clients.

Incorporating necessary elements for credibility, such as a visible privacy policy, security badges, and easy access to contact information, further reassures visitors. Providing soft touches, like customer support options through chatbots or FAQs, embellishes the trust factor significantly.

Focus on visual consistency and quality in layout.

Showcase trust signals like certifications and reviews.

Maintain a strong and accessible customer support framework.

Future trends in landing page development for financial services

Adapting to future trends in landing page development is crucial for credit managers. Technologies such as AI-driven personalization, machine learning, and enhanced data analytics will likely play a pivotal role in refining customer interactions. As these tools become increasingly accessible, credit managers can create tailored experiences that resonate with individual user needs.

Predicting how credit management will evolve digitally suggests a constant adaptation of communication strategies. Credit managers must remain agile to leverage technological innovations while understanding the nuances of consumer behavior in a digital context. This adaptability will ensure their services continue to meet the demands of modern consumers.

Stay abreast of emerging technologies to enhance customer engagement.

Monitor changes in regulations and customer expectations consistently.

Innovate continuously to meet evolving market demands.

Maximizing engagement through continuous updates

Keeping landing pages fresh and relevant encourages returning visitors to engage consistently. Credit managers can implement a strategy of regular content updates that reflect changing industry trends, customer feedback, and modifications to service offerings. This approach not only attracts new visitors but also keeps existing clients informed.

Utilizing customer insights helps in pinpointing areas that require enhancement. Engaging actively with audiences through surveys or feedback tools can inform landing page updates while showcasing the company’s commitment to customer satisfaction. This ongoing evolution ultimately increases return on investment.

Regularly refresh content to maintain relevance.

Actively seek customer feedback for insights.

Track metrics to identify update effectiveness and trends.

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages

Get started