HTML page template for insurance brokers

Use TemplateAbout template

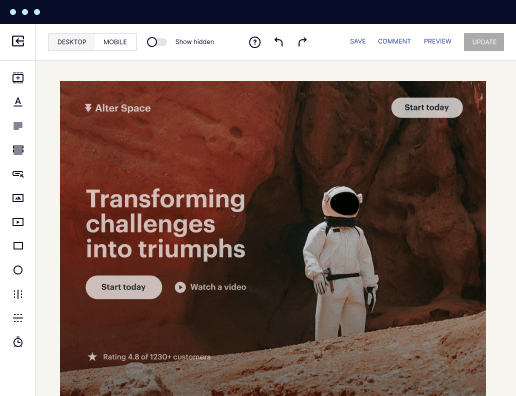

Engage your audience like never before with stunning landing page templates for insurance brokers. Make your online presence unforgettable!

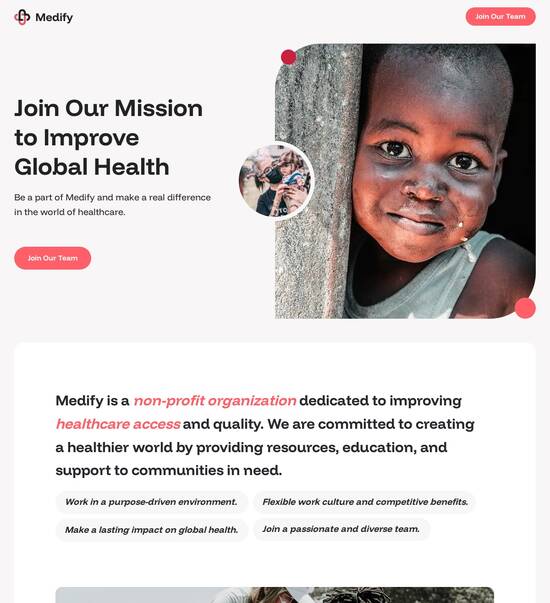

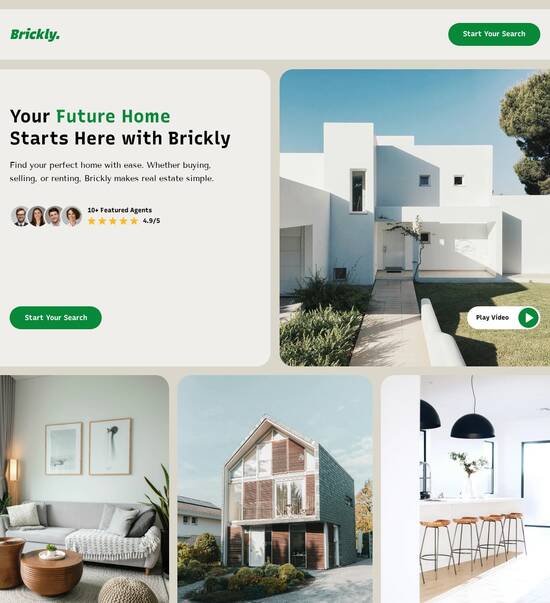

Recommended templates

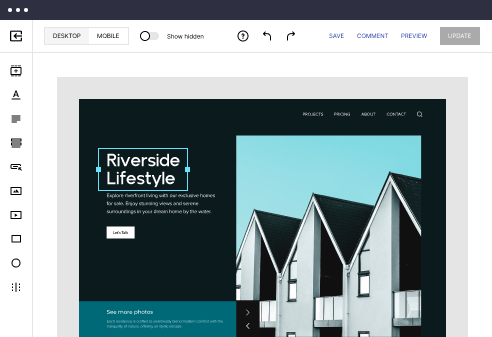

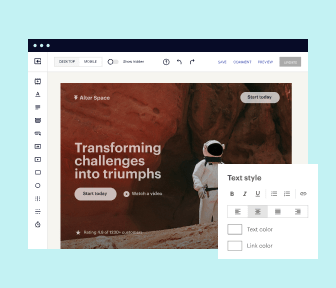

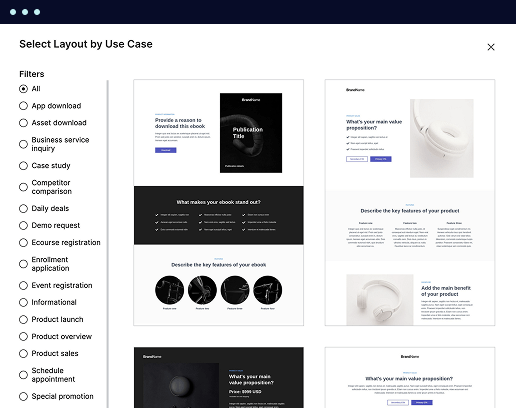

Easy to build without coding

With the intuitive drag-and-drop builder, anyone on your team can create high-converting pages without any knowledge of code or design. Make enhancements to your landing page with custom widgets using Javascript, HTML/CSS, or third-party scripts.

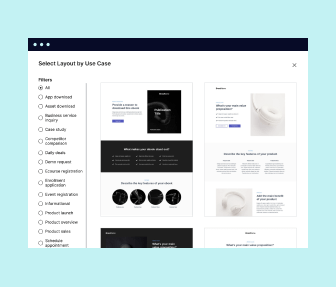

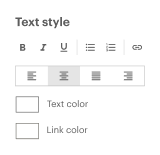

Multiple layouts for any industry and goal

Select from 500+ landing page layouts built to boost conversions across industry-specific scenarios. Customize them by adjusting fonts, adding images, and generating on-brand content with the AI assistant. Quickly scale with Instablocks® and Global Blocks that you can save, reuse, and update globally.

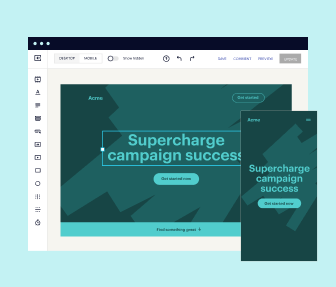

Loads fast and looks polished on any device

Every template is responsive, which means they present professionally on any device and load blazingly fast with our Thor Render Engine. You can also power them up with Google AMP technology to deliver an unparalleled mobile experience and drive higher conversions.

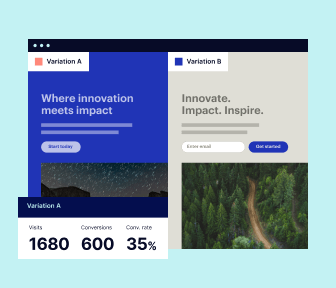

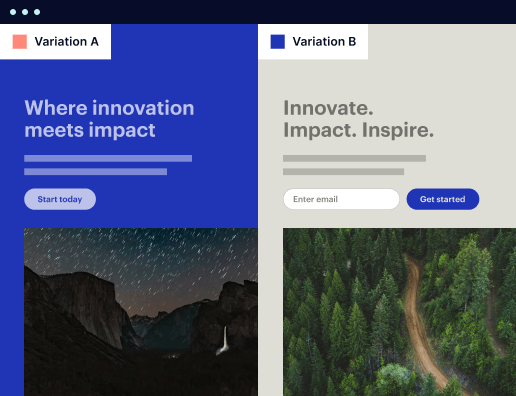

Robust analytics & experimentation

Get real-time updates and reporting across all your devices, showing the number of visitors, conversions, cost-per-visitor, and cost-per-lead. Launch AI-powered experiments, run A/B tests, and use heatmaps to analyze user behavior, then optimize your landing page to maximize conversions.

Easy to build without coding

With the intuitive drag-and-drop builder, anyone on your team can create high-converting pages without any knowledge of code or design. Make enhancements to your landing page with custom widgets using Javascript, HTML/CSS, or third-party scripts.

Multiple layouts for any industry and goal

Select from 500+ landing page layouts built to boost conversions across industry-specific scenarios. Customize them by adjusting fonts, adding images, and generating on-brand content with the AI assistant. Quickly scale with Instablocks® and Global Blocks that you can save, reuse, and update globally.

Loads fast and looks polished on any device

Every template is responsive, which means they present professionally on any device and load blazingly fast with our Thor Render Engine.

Robust analytics & experimentation

Get real-time updates and reporting across all your devices, showing the number of visitors, conversions, cost-per-visitor, and cost-per-lead. Launch AI-powered experiments, run A/B tests, and use heatmaps to analyze user behavior, then optimize your landing page to maximize conversions.

All the features you need to build insurance agent website templates

Explore more featuresLearn how to build insurance agency website templates

Frequently asked questions about website design for insurance brokers

Leading the way in building high-performing landing pages

Insurance broker website template: Your ultimate how-to guide

Creating effective landing pages is essential for insurance brokers seeking to improve their conversion rates and ROI. Instapage provides powerful tools tailored for crafting high-performing landing pages that enhance lead generation. This guide will walk you through the steps to leverage Instapage to accelerate your insurance marketing strategies.

Understanding the power of landing pages for insurance brokers

Landing pages serve as the first impression for potential clients. With Instapage, you can utilize over 100 pre-designed templates geared specifically for the insurance industry, ensuring your pages are not only visually compelling but also conversion-driven. This flexibility allows you to cater to diverse insurance needs, whether it's auto, home, or health insurance.

- High-converting templates tailored for insurance brokers: Instapage offers templates that include industry-specific elements like quote requests and policy comparisons, enhancing user engagement.

- User-friendly page builder: Leverage the drag-and-drop builder to customize your landing pages without any coding expertise, making the page creation process both efficient and straightforward.

- Integrated analytics: Track performance metrics directly from your landing pages to gain insights into user behavior, optimizing your marketing efforts in real time.

Step 1: Selecting the right template

Begin by selecting a template that resonates with your target audience and business goals. Instapage’s library features templates designed with insurance services in mind, allowing you to create pages that speak directly to potential clients’ needs.

Step 2: Customizing your landing page

Once you've chosen a template, you'll want to customize it to reflect your brand's identity. Include essential elements such as your logo, service offerings, and compelling call-to-action buttons. Here's what to focus on:

- Dynamic text replacement: Use this feature to personalize your content based on visitor data, increasing relevance and engagement.

- Call-to-action (CTA) specifics: Ensure CTAs are clear and action-oriented, such as 'Get a Free Quote Today' or 'Contact an Agent'.

- Visual appeal: Incorporate eye-catching images or videos that to illustrate the benefits of your insurance products.

Step 3: Implementing optimization and testing

After launching your landing page, it's vital to ensure it performs well. Utilize Instapage’s built-in A/B testing and heatmap features to see where users are clicking and how they interact with your content. Consider:

- A/B Testing: Compare two versions of your landing page to determine which performs better, allowing for data-driven decisions.

- Heatmaps: Analyze user interaction on your landing page to refine areas that may require adjustment or enhancement.

- Tracking performance: Regularly review your analytics dashboard to monitor key performance indicators like click-through rates and conversion rates.

By following these steps within Instapage, you can create optimized landing pages that significantly boost your conversion rates and drive ROI in your insurance marketing campaigns.

Ready to transform your insurance marketing strategy? Start your free trial with Instapage today and experience the power of expertly crafted landing pages.

Crafting the perfect HTML page template for insurance brokers

Understanding the landscape of insurance businesses

The insurance industry plays a crucial role in mitigating risks for individuals and businesses alike. It encompasses several key sectors, including auto insurance, health insurance, and life insurance. Furthermore, insurance can be categorized broadly into personal insurance, which caters to individual consumers, and commercial insurance, targeting businesses. This differentiation is vital as it shapes the specific needs and expectations of the target market, influencing how insurance brokers operate and the services they offer.

Insurance brokers serve as intermediaries between clients and insurance companies, guiding individuals and businesses in selecting the right policies. Their responsibilities encompass assessing clients' needs, providing expert knowledge on various insurance products, and facilitating the application and claims process. In this role, brokers are instrumental in helping clients navigate complex policies and find coverage that best suits their situation.

The evolution of insurance business websites

Historically, insurance business websites started as static pages with limited interactivity. Initially, these sites served as digital brochures, providing basic information about services and company backgrounds. However, the shift towards dynamic and interactive websites has transformed how insurance brokers engage with potential clients. Today, effective websites must provide tailored content, facilitate quotes, and enable clients to complete transactions online.

Given the unique characteristics of the insurance industry, there is a strong need for specialization in HTML templates. Unlike generic website templates, insurance broker templates must accommodate specific functionalities such as quote comparisons, policy details, and client communication features. Customization and adaptability play significant roles in ensuring that these templates meet the distinct requirements of various insurance sectors.

The significance of an HTML page template

An effective insurance web template comprises several essential features and components. Firstly, it must prioritize user engagement through clear calls-to-action and easily accessible information about products. Secondly, the importance of responsive design cannot be overstated, as clients will access the site through a variety of devices, including smartphones, tablets, and desktops. The ability for a website to adapt to different screen sizes directly influences user experience and engagement rates.

Moreover, understanding the user experience (UX) is critical for insurance clients seeking solutions. A streamlined navigation structure enhances customer satisfaction by allowing users to find the necessary information efficiently. A clear layout with well-organized sections for different insurance sectors and frequently asked questions can significantly improve the user journey.

Features and functionalities of an insurance agency website template

For insurance brokers, certain features can significantly enhance client engagement. Effective website templates need to integrate essential functionalities such as contact forms for inquiries, quote request forms, and consultation scheduling tools. Additionally, the incorporation of chatbots can offer immediate assistance, ensuring that potential clients receive prompt responses to their questions and concerns, thereby increasing the chances of conversion.

Moreover, having customizable sections for various insurance offerings is crucial. Brokers can benefit from templates specifically designed for auto insurance, health insurance, and life insurance, allowing for targeted marketing efforts. Including demo pages to showcase different insurance plans can also aid clients in understanding their options before making informed decisions.

The power of innovative design in insurance templates

Visual elements play a significant role in attracting clients to an insurance website. Using color schemes that symbolize trust and safety, such as blues and greens, can help build a sense of security. Additionally, engaging visuals, including quality imagery, infographics, and icons, can make complex information more digestible and enhance overall site aesthetics, encouraging visitors to explore further.

A well-thought-out content strategy tailored for different audience segments is essential for effective communication. For instance, creating persuasive copy that addresses common client pain points helps in positioning the broker as a knowledgeable and trustworthy resource. Utilizing storytelling techniques can also create emotional connections with potential clients, ultimately resulting in increased loyalty and a stronger brand presence.

Optimization for conversions

Optimizing an insurance website for conversions requires strategic planning and execution. One of the best practices is to create effective landing pages that focus on the services offered, such as insurance quotes. These pages should feature minimal distractions, clear benefits, and strong calls-to-action to guide visitors toward taking the desired actions. Coupled with A/B testing elements, brokers can determine the most effective structure for their pages, enhancing overall conversion rates.

SEO considerations are equally important for insurance websites. Including keyword optimization related to various insurance services and local SEO strategies can attract nearby clients. By conducting thorough keyword research, brokers can ensure that their site ranks well in search engine results, thus increasing visibility and ultimately leading to higher traffic and conversions.

Mobile optimization for modern insurance brokers

As mobile usage continues to grow, ensuring that insurance websites are mobile-friendly has become paramount. Statistics indicate that a significant percentage of potential clients browse insurance options directly from their mobile devices, emphasizing the need for responsive design. Insurance brokers must prioritize creating a seamless mobile experience that allows users to access essential information quickly and efficiently, leading to improved interaction rates.

To enhance the mobile experience further, tailored features such as click-to-call buttons and SMS notifications can facilitate immediate communication. These features not only improve UX but also encourage potential clients to reach out for questions or consultations, ultimately aiding in lead generation.

Integrating third-party tools and APIs

Integrating third-party tools and APIs can substantially enhance the functionality of insurance websites. For example, including payment gateways that allow clients to process insurance premiums online can streamline the transaction process and improve user satisfaction. Additionally, leveraging client relationship management (CRM) tools can help brokers manage client interactions more effectively, leading to a more organized approach to customer service.

Furthermore, implementing analytics tools to track user behavior on the site can provide crucial insights into client preferences and behaviors. This data-driven approach allows insurance brokers to refine their website designs and content continually, ensuring they remain relevant and effective in meeting their clients' needs.

Building trust through compliance and security

In an industry that deals with significant personal information, ensuring compliance with industry regulations is crucial for insurance websites. Brokers must be aware of legal considerations specific to their operations and ensure their websites reflect this understanding. Transparent privacy policies and terms of service are essential components of building trust with potential clients.

Security measures to protect client information should also be prioritized. Implementing encrypting protocols, SSL certificates, and other security measures can safeguard sensitive user data. Additionally, showcasing certifications and awards on the website can further enhance trust and credibility among potential clients while distinguishing the broker from competitors.

Future trends in insurance website templates

As technology evolves, insurance website templates will continue to be influenced by emergent trends. The integration of artificial intelligence and machine learning can facilitate improved client interactions, offering customized recommendations and faster response times. Predictive analytics will also play a critical role in shaping personalized insurance offerings, responding to clients' varying needs based on their previous interactions.

Moreover, client education is increasingly becoming a focal point in the insurance sector. Brokers should prioritize creating informative resources, such as blogs, videos, and tutorials, to guide clients in making informed decisions. Engaging with clients through community forums and social media platforms will also foster ongoing relationships and enhance brand loyalty.

Final thoughts on adapting to client needs

Adapting to the evolving expectations of clients in the insurance industry is imperative for ongoing success. As market trends shift and new technologies emerge, brokers must remain proactive in addressing these changes. Engaging with clients for feedback and support will ultimately foster trust and loyalty, all while ensuring that services provided align with client needs and expectations.

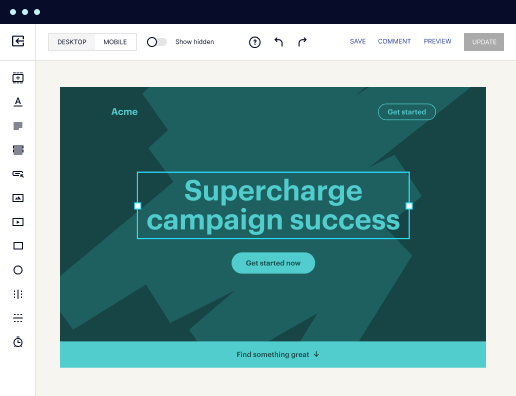

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages

Get started