Pitch page template for credit card companies

Explore Similar TemplatesAbout template

Reach out to the right audience with pitch page template for credit card companies

Recommended templates

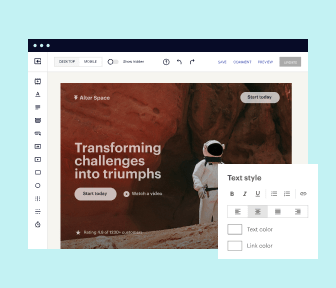

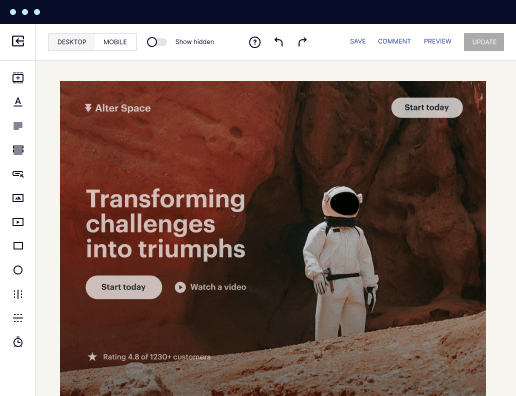

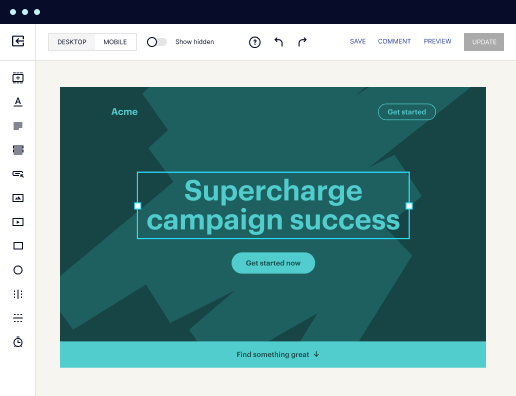

Easy to build without coding

With the intuitive drag-and-drop builder, anyone on your team can create high-converting pages without any knowledge of code or design. Make enhancements to your landing page with custom widgets using Javascript, HTML/CSS, or third-party scripts.

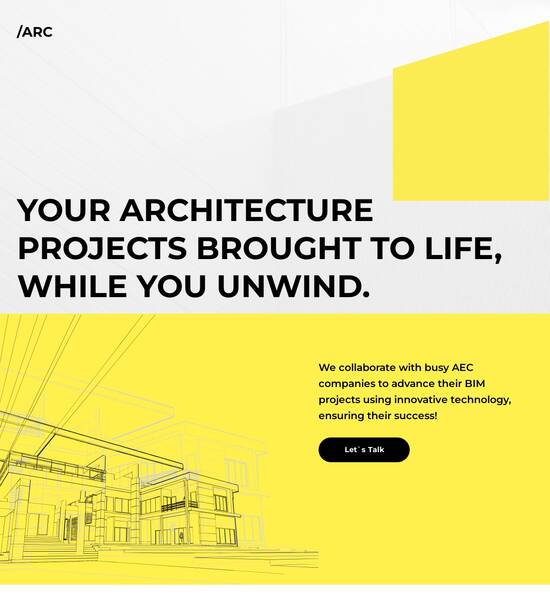

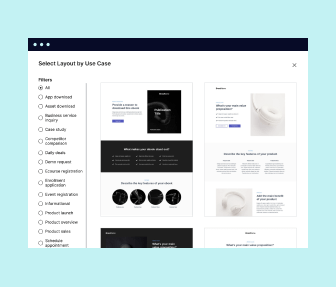

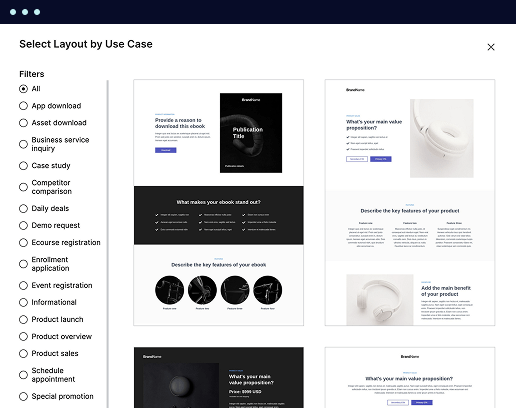

Multiple layouts for any industry and goal

Select from 500+ landing page layouts built to boost conversions across industry-specific scenarios. Customize them by adjusting fonts, adding images, and generating on-brand content with the AI assistant. Quickly scale with Instablocks® and Global Blocks that you can save, reuse, and update globally.

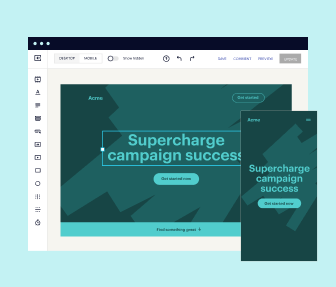

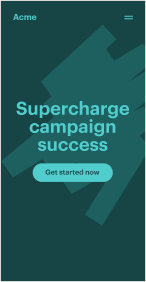

Loads fast and looks polished on any device

Every template is responsive, which means they present professionally on any device and load blazingly fast with our Thor Render Engine. You can also power them up with Google AMP technology to deliver an unparalleled mobile experience and drive higher conversions.

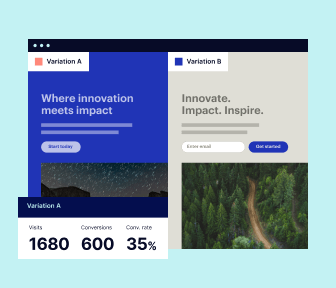

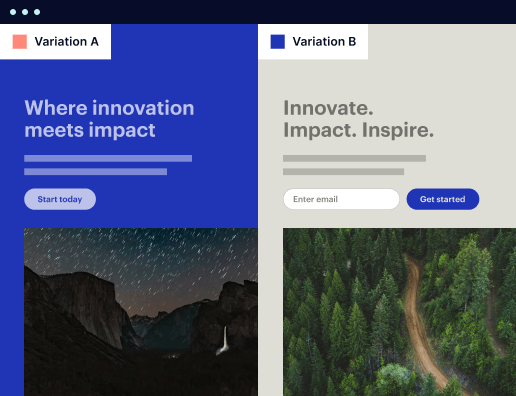

Robust analytics & experimentation

Get real-time updates and reporting across all your devices, showing the number of visitors, conversions, cost-per-visitor, and cost-per-lead. Launch AI-powered experiments, run A/B tests, and use heatmaps to analyze user behavior, then optimize your landing page to maximize conversions.

Easy to build without coding

With the intuitive drag-and-drop builder, anyone on your team can create high-converting pages without any knowledge of code or design. Make enhancements to your landing page with custom widgets using Javascript, HTML/CSS, or third-party scripts.

Multiple layouts for any industry and goal

Select from 500+ landing page layouts built to boost conversions across industry-specific scenarios. Customize them by adjusting fonts, adding images, and generating on-brand content with the AI assistant. Quickly scale with Instablocks® and Global Blocks that you can save, reuse, and update globally.

Loads fast and looks polished on any device

Every template is responsive, which means they present professionally on any device and load blazingly fast with our Thor Render Engine.

Robust analytics & experimentation

Get real-time updates and reporting across all your devices, showing the number of visitors, conversions, cost-per-visitor, and cost-per-lead. Launch AI-powered experiments, run A/B tests, and use heatmaps to analyze user behavior, then optimize your landing page to maximize conversions.

All the features you need to build lead-generating landing pages

Explore more featuresLearn how to build top-performing landing pages for any goal

FAQs

Leading the way in building high-performing landing pages

A comprehensive guide to using Instapage for your credit card company pitch page template

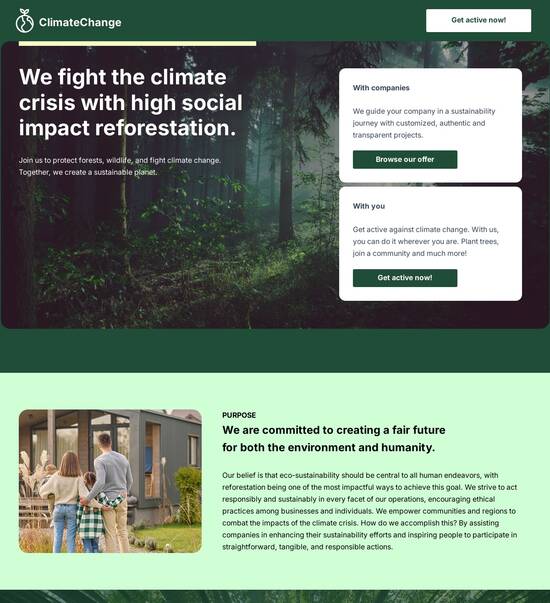

Creating a compelling pitch page template for credit card companies is essential in today's competitive market. Instapage offers sophisticated landing page solutions that can significantly enhance your conversion rates and boost lead generation. Leveraging its high-converting templates streamlines the process of marketing credit card services, ensuring your page captures attention and drives action.

Understanding the importance of a strong pitch page

A well-designed pitch page acts as the first impression for potential customers. It needs to convey critical information clearly and compellingly. Here are reasons why a powerful pitch page is crucial:

- Establish trust: Showcasing customer testimonials can build credibility and foster trust among prospects.

- Highlight benefits: Clearly articulate the advantages of your credit card offerings to connect emotionally with users.

- Facilitate decision-making: Simplifying the advantages and features helps customers make informed choices quickly.

Steps to create your pitch page using Instapage

Creating your pitch page with Instapage can be streamlined through its user-friendly interface. Here’s how to do it effectively:

- Choose a template: Instapage offers over 100 ready-to-use templates specially designed for different industries. Select one suited for financial services to start with a winning design.

- Customize your layout: Utilizing Instablocks allows drag-and-drop customization, ensuring the page reflects your brand identity and messaging.

- Incorporate lead capture elements: Use built-in lead generation forms and CTAs strategically placed throughout your page to enhance conversions.

Optimizing for higher conversions

To maximize the efficacy of your pitch page, focus on optimization strategies:

- Implement A/B testing: Test different variations of headlines and CTAs to identify which performs better among your target audience.

- Utilize heatmaps: Analyze visitor behaviors on your page, pinpointing the areas of high engagement that can lead to adjustments in your design.

- Personalize content: Employ dynamic text replacement to tailor your messaging for different customer segments, enhancing relevancy.

By following these strategic steps, your pitch page will not only look appealing but also function effectively to convert leads into customers.

In conclusion, Instapage provides the necessary tools to build a pitch page template that stands out in the crowded credit card marketplace.

Ready to elevate your credit card company's marketing strategy? Start building your customized pitch page with Instapage today and see how you can increase your conversion rates.

People also ask about Pitch page template for credit card companies

Pitch page template for credit card companies

Understanding the significance of a pitch page for credit card companies

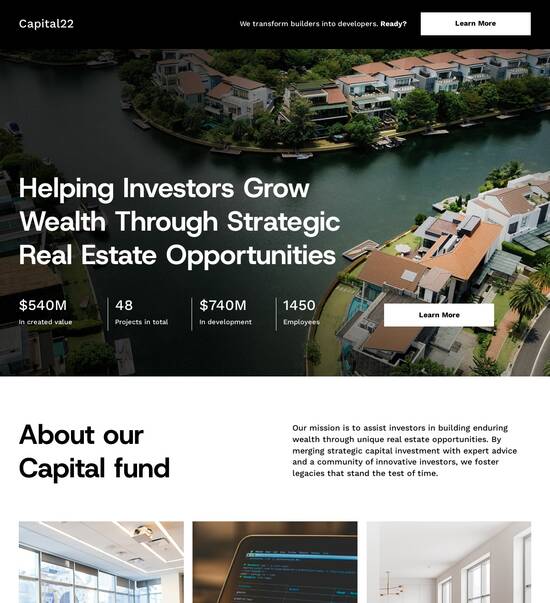

In the competitive world of credit card offerings, a well-constructed pitch page can be a key differentiator. With an increasing number of players in the market, companies must present their financial products compellingly to appeal to potential customers. A targeted pitch page not only aids in customer acquisition but also enhances the conversion rates of marketing campaigns.

As consumers increasingly lean towards digital platforms for financial decisions, understanding their behavior becomes essential. The ease of online comparison shopping leads to higher expectations regarding information accessibility and presentation from credit card companies. Therefore, the importance of a pitch page cannot be overstated—it's not just about showcasing a product; it’s about creating a narrative that resonates with consumers and encourages them towards conversion.

Insight into the competitive landscape for credit card offerings

Importance of a targeted pitch page in enhancing customer acquisition

Trends in consumer behavior: How digital platforms shape decision-making

Essentials of a pitch page template

Crafting an effective pitch page requires careful consideration of its key components. A compelling headline serves as the first point of contact between potential customers and the credit card product. This attention-grabbing statement should succinctly explain the unique benefit of the offering, enticing visitors to explore further. Following up with a supportive subheadline further articulates the value proposition.

Visual elements play a crucial role in bolstering the appeal of a pitch page. High-quality images and branding that accurately reflect the company's values and products can significantly enhance user engagement. It is also essential to integrate well-placed call-to-action buttons that encourage users to take specific actions, driving higher conversion rates.

Headline: Crafting the attention-grabbing statement

Subheadline: Supporting the value proposition and FAQs

Visual elements: Importance of high-quality images and branding

Call to action buttons: Placing effective CTAs for engagement

Essential sections of the pitch page

Starting with the hero section, the first impression is vital. This area showcases the most crucial information attractively and compellingly. Next, the benefits overview succinctly communicates the value of the credit card, making it approachable for users. Outlining key features allows the company to highlight unique selling points clearly.

To build credibility, testimonials and social proof are essential in showing potential customers the real-world value the product has provided to others. An FAQ section addresses common concerns proactively, allowing leads to feel more informed and secure in their decision-making process. Lastly, including multiple contact information options creates excellent opportunities for user engagement.

Hero section: The first impression matters

Benefits overview: Communicating value succinctly

Key features: Highlighting unique selling points

Testimonials and social proof: Building credibility with customer stories

FAQs section: Addressing concerns proactively

Contact information: Offering multiple touchpoints

Optimizing the pitch page for audience engagement

Understanding the target audience is the first step to creating an engaging pitch page. Marketers need to define their demographic accurately—age, spending habits, and lifestyle choices all play a part in how the messaging is perceived. Developing audience personas can help further refine strategies, ensuring communication aligns with the preferences of potential customers.

Once the audience is identified, tailoring content becomes crucial. Utilizing language and tone that resonates with consumers will foster a stronger connection. Structuring the content for easy readability will help maintain attention, ensuring that users remain engaged throughout their journey. Incorporating storytelling techniques can humanize the brand and make the financial offering more relatable.

Identifying the target demographic for credit card offerings

Creating audience personas: Characteristics and preferences of potential customers

Leveraging strategic marketing insights

Clear and concise communication is vital for a successful pitch page. Lengthy paragraphs and complex phrases can lead to disengagement. By incorporating bullet lists and maintaining short paragraphs, marketers can make information easy to digest, ensuring that prospective customers quickly grasp the key benefits of their credit card offers.

The content strategy for credit card companies should focus on addressing customer pain points and highlighting the solutions the credit cards provide. For instance, emphasizing the benefits of cash back, rewards, or travel perks can significantly impact a consumer's decision-making process. Additionally, addressing common financial concerns can assist potential customers in visualizing the product's relevance to their lives.

Addressing pain points of customers

Highlighting solutions that credit cards provide

Visual presentation: Designing for impact

Visual elements play an integral role in the effectiveness of a pitch page. Engaging graphics and icons can break up large blocks of text, making pages more inviting. Infographics are especially beneficial for representing complex data clearly and concisely, allowing visitors to absorb information rapidly.

Considering that many users will access these pages via mobile devices, ensuring mobile responsiveness is critical. A mobile-friendly design enhances the user experience and enables credit card companies to reach a broader audience effectively. Coupled with a cohesive brand image—consistency in colors, fonts, and imagery—credit card companies can create a visually appealing presentation that resonates with consumers.

Incorporating engaging visuals

The power of graphics and icons to break up text

Using infographics to represent data clearly and effectively

Importance of mobile responsiveness in design

Enhancing conversion rates with strategic techniques

An enticing offer can significantly improve conversion rates, making it essential to craft promotions or incentives that appeal to potential cardholders. Examples of successful promotional strategies include bonus reward points for sign-ups or cash back during the first few months of usage. These limited-time offers create urgency and incentivize consumers to make quick decisions.

Integrating customer feedback is another important aspect of refining the pitch page. By analyzing survey results and online reviews, credit card companies can gain valuable insights into what works and what doesn’t. Iterating based on this feedback allows businesses to improve their pitch page continuously, adapting to shifting consumer demands and preferences.

Crafting irresistible promotions or incentives for sign-ups

Examples of effective promotional strategies

Utilizing the power of A/B testing

A/B testing is essential for optimizing the effectiveness of a pitch page. By comparing different pitches, layouts, and calls to action, marketers can identify what resonates best with their audience. Determining key metrics to track success is also critical. Key performance indicators like conversion rates and click-through rates can provide invaluable data on the effectiveness of various strategies.

Interpreting the results of A/B tests allows companies to make informed decisions regarding adjustments to their pitch pages. Understanding which elements lead to better performance helps refine future iterations, ensuring marketers remain agile and responsive to consumer trends. By continuously experimenting and learning, credit card companies can stay at the forefront of marketing innovation.

Importance of testing different pitches, layouts, and CTAs

Identifying metrics to track success: Conversion rates, click-through rates, etc.

Integrating pitch deck elements for investor presentation

Integrating elements of a pitch deck into the pitch page can create a more compelling narrative for potential investors and consumers alike. A clear problem statement outlining why the market needs this credit card is crucial. Providing statistical backing about market opportunities helps excite investors while also informing consumers of the product's relevance.

In addition, presenting profit projections with data supporting long-term viability can help attract funding. Aligning consumer needs with business objectives not only benefits customer perception but also enhances the effectiveness of fundraising efforts for credit card companies looking to bolster their market presence.

Problem statement: Why does the market need this credit card?

Market opportunity: Statistical backing to excite investors

Profit projection: Data supporting long-term viability

Using interactive slides in presentations

Adding interactive components to pitch pages creates a more dynamic experience for users. Interactive elements can include slides that provide additional context or explanations regarding the credit card offering. Successful integration of these presentations can capture attention and keep users engaged in learning more about the product.

Analyzing trends and future innovations

Staying informed of emerging technologies in digital marketing is essential for credit card companies looking to remain competitive. Upcoming trends such as AI and chatbots can significantly improve customer service experiences and personalizations. Incorporating these technologies into the pitch page and broader marketing strategy can streamline the customer journey and create a lasting impression.

Looking ahead, the future of pitch pages in financial services is likely to include further advancements in user experience design, increased personalization, and automation to cater to the evolving demands of consumers. The adaptability of credit card companies in leveraging these innovations will be crucial in maintaining market relevance and ensuring sustained growth.

Upcoming trends shaping credit card marketing strategies: AI, chatbots, etc.

Predictions for the future of pitch pages in financial services

Final thoughts on crafting an innovative pitch page

In conclusion, pitch pages play a powerful role for credit card companies in a saturated market. By employing strategic marketing insights, incorporating effective design techniques, and enhancing content relevance, companies can drive customer engagement and higher conversion rates. As the landscape of financial services continues to evolve, maintaining a learning mindset and remaining open to innovation will be key to ongoing success.

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages

Get started