Create your onboarding page template for Tax resolution experts

Master your online marketing with this builder for onboarding page template for Tax resolution experts. Try more tools to create an immaculate landing page.

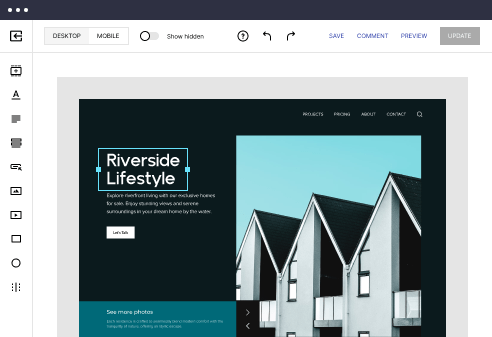

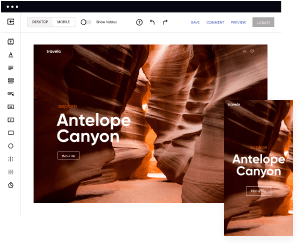

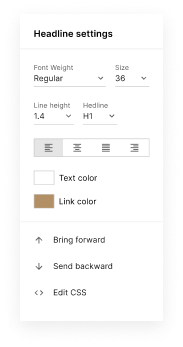

Easy to build without coding

With the intuitive drag-and-drop builder, anyone on your team can create high-converting pages without any knowledge of code or design. Make enhancements to your landing page with custom widgets using Javascript, HTML/CSS, or third-party scripts.

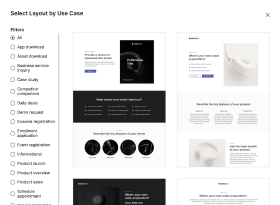

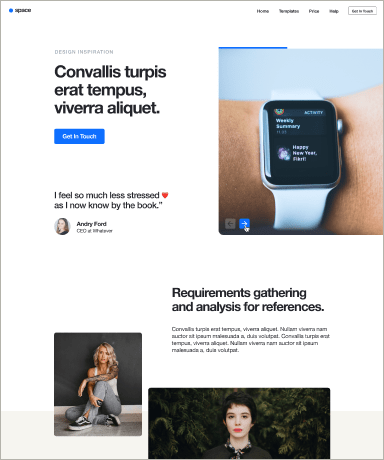

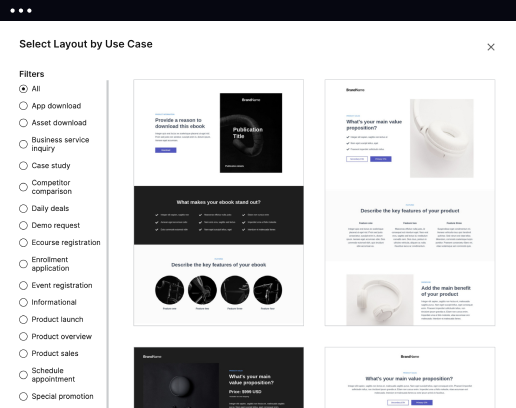

Multiple layouts for any industry and goal

Select from 500+ landing page layouts built to boost conversions across industry-specific scenarios. Customize them by adjusting fonts, adding images, and generating on-brand content with the AI assistant. Quickly scale with Instablocks® and Global Blocks that you can save, reuse, and update globally.

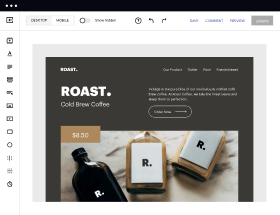

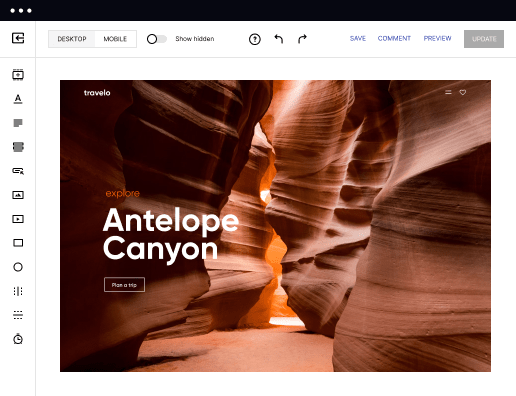

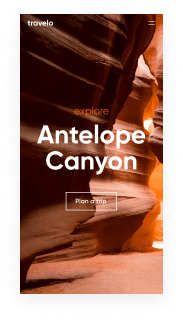

Loads fast and looks polished on any device

Every template is responsive, which means they present professionally on any device and load blazingly fast with our Thor Render Engine. You can also power them up with Google AMP technology to deliver an unparalleled mobile experience and drive higher conversions.

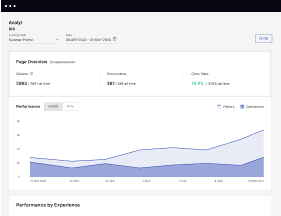

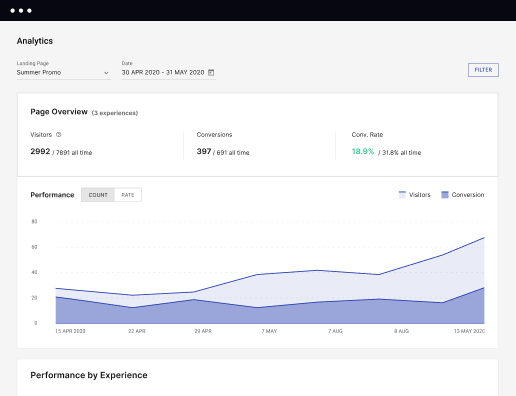

Robust analytics & experimentation

Get real-time updates and reporting across all your devices, showing the number of visitors, conversions, cost-per-visitor, and cost-per-lead. Launch AI-powered experiments, run A/B tests, and use heatmaps to analyze user behavior, then optimize your landing page to maximize conversions.

Easy to build without coding

With the intuitive drag-and-drop builder, anyone on your team can create high-converting pages without any knowledge of code or design. Make enhancements to your landing page with custom widgets using Javascript, HTML/CSS, or third-party scripts.

Multiple layouts for any industry and goal

Select from 500+ landing page layouts built to boost conversions across industry-specific scenarios. Customize them by adjusting fonts, adding images, and generating on-brand content with the AI assistant. Quickly scale with Instablocks® and Global Blocks that you can save, reuse, and update globally.

Loads fast and looks polished on any device

Every template is responsive, which means they present professionally on any device and load blazingly fast with our Thor Render Engine. You can also power them up with Google AMP technology to deliver an unparalleled mobile experience and drive higher conversions.

Robust analytics & experimentation

Get real-time updates and reporting across all your devices, showing the number of visitors, conversions, cost-per-visitor, and cost-per-lead. Launch AI-powered experiments, run A/B tests, and use heatmaps to analyze user behavior, then optimize your landing page to maximize conversions.

All the features you need to build lead-generating landing pages

Explore more featuresLearn how to build top-performing landing pages for any goal

FAQs

Leading the way in building high-performing landing pages

Create an onboarding page template for tax resolution experts

An effective onboarding page template serves as the first impression for tax resolution experts, showcasing their services and bringing potential clients onboard. Instapage's user-friendly platform makes it easy to design engaging onboarding pages tailored specifically for professionals in the financial and tax services sector. With ready-to-use templates and powerful customization options, tax resolution experts can increase lead capture and engagement.

Understand your audience

The first step in creating your onboarding page template is deeply understanding your audience. Identifying their needs, concerns, and preferences allows you to tailor your messaging effectively. Tax resolution experts should focus on the following key considerations for their audience:

- Pain points: Recognize the common tax issues your audience faces, such as tax debts or IRS notices.

- Demographic data: Understand the age, income level, and geographical location of your clients to better address their needs.

- Client motivations: Know what drives potential clients to seek tax resolution assistance, like avoiding penalties or recovering lost tax refunds.

Choose the right template

Once you understand your audience, the next step is to select an appropriate onboarding page template. Instapage provides a diverse range of templates and layout options, allowing tax resolution experts to customize their pages according to their branding. Here are critical factors to consider when choosing your template:

- Visual branding: Choose a template that aligns with your brand colors, fonts, and imagery.

- Structure: Opt for a layout that highlights essential information without overwhelming the visitor.

- Responsive design: Ensure your selected template is mobile-friendly for ease of access on all devices.

Implement engaging content

The onboarding page's content must engage visitors and convey your value proposition clearly. Start with a captivating headline that addresses the visitors' needs, then include informative sections that explain your services. Here are some key content elements to incorporate:

- Client testimonials: Social proof is vital. Include quotes from satisfied clients or case studies to build trust.

- Service descriptions: Clearly outline what services you offer and how they can resolve clients' tax issues.

- Call-to-action (CTA): Encourage potential clients to schedule a consultation or download helpful tax resources with clear CTAs.

With a comprehensive onboarding page template tailored for tax resolution experts, you can effectively convert leads into clients by addressing their needs and providing valuable resources.

Instapage empowers tax resolution experts to leverage these tools for enhanced campaign performance and client engagement.

Ready to boost your onboarding process? Start using Instapage to create an effective onboarding page template for your tax resolution services today!

People also ask about Onboarding page template for Tax resolution experts

Onboarding page template for tax resolution experts

Understanding the unique needs of tax resolution experts

The tax resolution industry faces numerous challenges that require tailored solutions and expert guidance. Professionals in this field must navigate complex tax laws, unique client circumstances, and often distressed financial situations. These complexities create a high-stakes environment where effective onboarding is crucial to set the stage for a successful client relationship.

Efficient onboarding for tax professionals not only streamlines the administrative aspects but also positions them to deliver superior client service. Onboarding is the critical first step in establishing trust and ensuring clients feel supported and informed from the outset. Its significance extends beyond mere paperwork; it influences clients' perceptions of their tax resolution experts and their ultimate satisfaction with the services provided.

Onboarding influences client satisfaction and retention significantly. A smooth and well-structured onboarding process can reduce anxiety for clients, who are often dealing with stressful tax issues. When clients feel that they are being guided through their tax resolution journey efficiently, they are more likely to remain loyal and recommend the firm to others. Understanding these unique needs is paramount for any tax resolution expert.

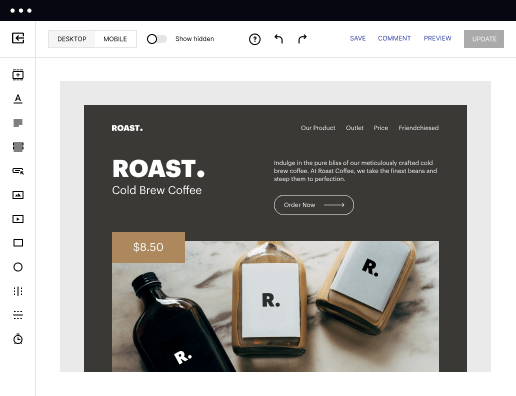

Key components of an effective onboarding page template

An onboarding page template serves as the digital gateway to a tax resolution expert's services, making it important to adopt key design and content strategies. Visual design elements are the first aspect of client engagement that should not be overlooked. The page must reflect the firm's brand through consistent use of colors and logos that align with the firm’s identity. An intuitive layout and user-friendly navigation facilitate quick access to essential information, reducing potential client frustration.

In terms of content strategy, compelling headlines are essential for capturing attention and communicating the value proposition effectively. Tax resolution clients may present diverse demographics, requiring personalized messaging that resonates with their distinct needs. For instance, potential clients facing IRS audits may have different emotional and informational needs than those seeking proactive tax planning. Tailoring the messaging not only enhances engagement but also boosts conversion rates.

Streamlining the client onboarding process

A streamlined onboarding process is vital for tax resolution experts to provide clarity and confidence to clients. The client onboarding journey consists of several essential steps that lay a solid foundation for the engagement. These include:

Initial contact and assessment – Understanding the client's specific tax issues and needs.

Setting expectations – Clearly outlining the timeline and deliverables from the onset to keep clients informed.

Collecting necessary documentation – This includes important tax forms and financial statements needed to begin the resolution process.

Creating an onboarding schedule with specific milestones – This allows clients to see the progress and stay on track.

To facilitate each of these steps, various tools and features can be integrated into the onboarding process. Automated emails serve as appointment confirmations and reminders, keeping clients engaged without overwhelming them with communication. Additionally, integrating client management forms simplifies the data collection process, allowing tax professionals to gather necessary information efficiently. Such tools foster smooth operations, ultimately creating a better experience for both the firm and its clients.

Enhancing client engagement through personalized onboarding

Personalized onboarding is crucial in maintaining client engagement throughout the tax resolution process. Tailoring communication to meet the unique demands of different clients can significantly improve their overall experience. This begins with segmentation where clients are categorized based on their specific tax resolution needs. For instance, clients experiencing financial hardship may require different communication than those who are seeking strategic tax advice.

Personalized email campaigns for each client segment can further enhance engagement. These campaigns can share relevant content, guides, or tips that align with their unique challenges. Moreover, investing in relationship-building initiatives, such as acknowledging milestones or celebrating progress during tax resolution, can foster a stronger bond. Implementing feedback loops to gather client insights about their experiences allows tax professionals to refine their onboarding processes continuously.

Leveraging templates to optimize efficiency

Templates play a vital role in optimizing the efficiency of the onboarding process for tax resolution firms. Utilizing pre-made templates can save time and ensure consistency in branding and messaging across various client touchpoints. These templates often come equipped with best practices designed to maximize conversion rates, making them ideal for tax professionals who want to hit the ground running.

However, customization is key. While pre-made templates offer numerous advantages, it’s important to adapt them to reflect the specific firm’s branding and unique value propositions. Successful onboarding page templates in the tax resolution sector often exemplify high functionality, intuitive design, and effective content strategies. Highlighting features such as client testimonials, service breakdowns, and FAQs has proven to increase trust and comfort for potential clients.

Integrating technology into the onboarding process

The integration of technology into the onboarding process can enhance efficiency and client experience dramatically. Utilizing digital forms not only streamlines data collection but also provides clients with a convenient method for submitting necessary information and consents. Electronic forms reduce the need for physical paperwork while ensuring secure and organized information management.

Moreover, integrating onboarding with bookkeeping software allows real-time updates and tracking of client progress. Effective communication can be channeled through multiple avenues, including emails, SMS messages, or dedicated client portals. By utilizing reminders and notifications, firms can maintain client engagement and keep them informed about upcoming deadlines, required actions, or other relevant information.

Measuring the success of your onboarding process

Tracking the success of the onboarding process through key performance indicators (KPIs) is essential for continuous improvement. Client satisfaction scores following onboarding provide invaluable insight into how well the process is received. Monitoring conversion rates from initial inquiry to full onboarding is another critical metric, allowing firms to analyze the effectiveness of their onboarding strategies.

To monitor these metrics, various software options are available for tracking client progress and pinpointing any bottlenecks in the process. Regularly analyzing client feedback is also vital. By collecting this feedback through surveys or follow-up communications, tax professionals can refine both their onboarding templates and the overall process to better meet client needs.

Best practices for continuous improvement in onboarding

The importance of regular staff training and development cannot be overlooked in a successful onboarding process. Ensuring that staff are up-to-date on onboarding best practices and relevant technologies fosters a customer-centric culture where clients feel valued. Identifying strategies to enhance service delivery through improved communication skills or technological training can significantly influence the onboarding experience.

Establishing iterative feedback mechanisms allows clients to provide insights into their onboarding experiences. By encouraging clients to share their thoughts and experiences, firms can gain a clearer understanding of what aspects work and what could use improvement. Using the collected data to refine templates, processes, and overall client interactions will improve client satisfaction and retention each time an onboarding cycle is completed.

Real-life case studies: Success stories in client onboarding

Highlighting successful tax resolution firms provides insights into effective onboarding strategies. For instance, Firm A underwent a comprehensive onboarding transformation that significantly improved its client satisfaction ratings. By adopting a more structured onboarding process, combining automation with personalized communications, the firm noticed a marked increase in client retention rates.

In another example, Firm B implemented a unique approach by fostering strong client engagement through regular communications and milestone celebrations. Celebrating progress not only kept clients motivated but also built a sense of partnership rather than a traditional client-professional dynamic. Each case brings lessons that other tax resolution practices can adapt to enhance their own onboarding processes.

Future trends in client onboarding for tax resolution firms

The onboarding landscape for tax resolution firms is evolving with the emergence of AI and automation tools. These technologies can streamline onboarding processes while enhancing personalization efforts. The future may likely see more firms using AI-driven tools to analyze client data and tailor onboarding experiences, thus fostering a more personalized client relationship from the very start.

Moreover, there is a growing shift towards holistic client experiences, integrating onboarding with long-term client management strategies. Tax resolution firms may need to adapt their practices in response to regulatory changes, ensuring that onboarding remains compliant while still effective. Staying ahead of these trends will be essential for firms aiming to maintain a competitive edge in the evolving financial landscape.

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages

Get started