Make your web page for factoring companies with conversions reinvented

Reinvent your digital marketing strategy with Instapage. Create your web page for factoring companies, showcase your company's brand, optimize content that appeals to your target audience, and get unmatched conversions with minimal effort and investment in your pages.

How to switch factoring companies: Your ultimate how-to guide

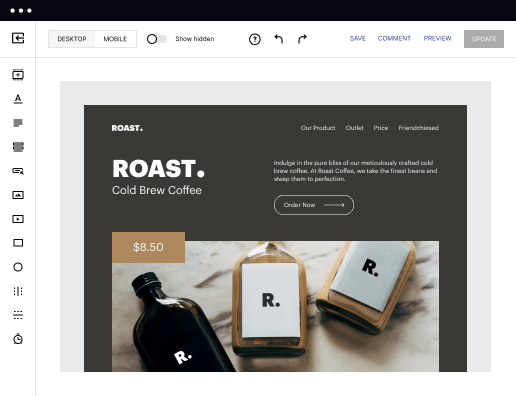

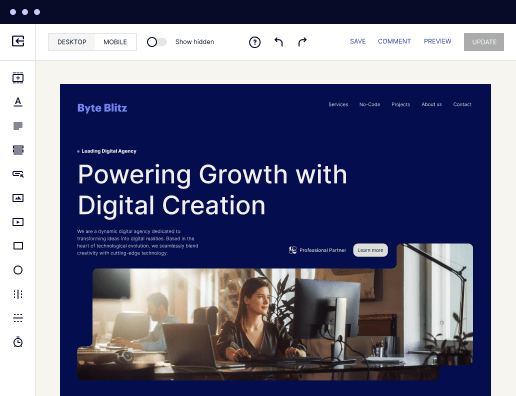

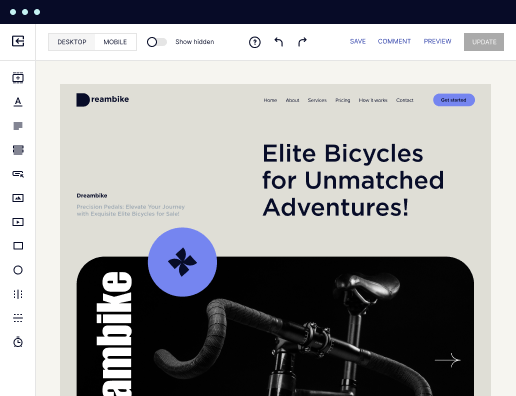

A well-structured web page is essential for factoring companies seeking to attract clients and enhance conversion rates. With Instapage's intuitive landing page platform, businesses can build customized pages that effectively communicate their services while driving customer engagement. The easy-to-use interface allows you to launch landing pages swiftly without any coding expertise, allowing marketers in sectors like finance, education, and business services to optimize ROI.

Understanding Your Audience

Before creating a web page tailored for factoring companies, it's crucial to identify your target audience. Engaging with specific segments within finance, government, or utilities can significantly influence your design and messaging. Each audience has unique pain points and needs, which, when addressed accurately, can enhance your brand's relevance and trust.

- Identify the unique challenges faced by your target audience, such as cash flow issues or slow invoice collecting.

- Understand the demographics and preferences of your target market, including their behaviors and expectations from a financial service provider.

- Research competitors’ web pages to identify effective strategies and areas for improvement.

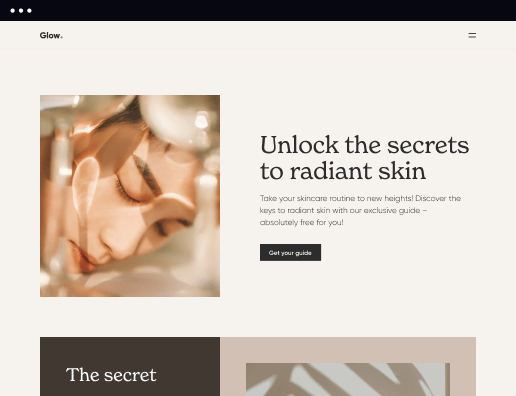

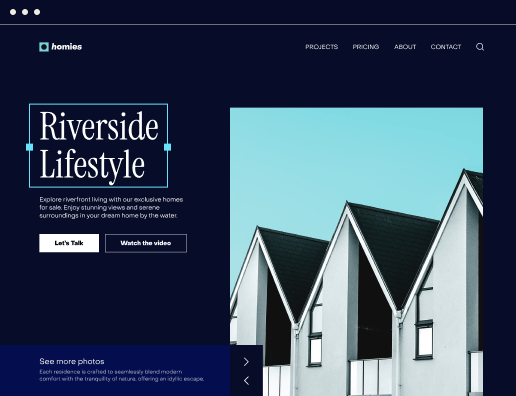

Crafting Your Landing Page Design

With a clear understanding of your audience, the next step involves designing the landing page. Keep in mind the principles of simplicity and relevance in your layout to maximize user engagement.

- Utilize Instapage's library of conversion-focused templates to streamline the design process, providing a professional look without extensive design skills.

- Incorporate effective call-to-action buttons that guide users toward making inquiries or requesting quotes for factoring services.

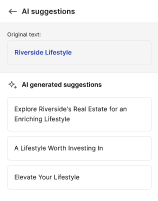

- Leverage dynamic text replacement to personalize your message depending on user demographics or referral sources.

Optimize for Performance and Conversion

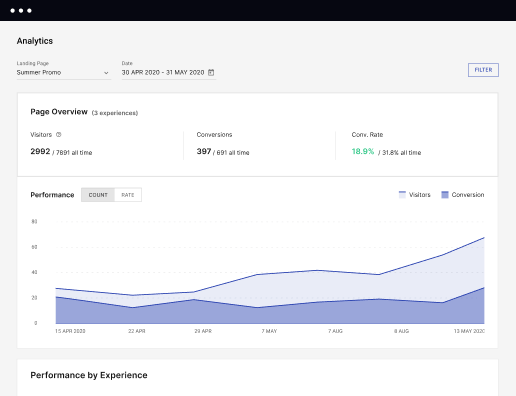

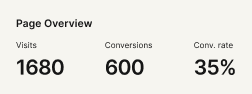

Once your web page is live, it's essential to monitor its performance and make adjustments based on user interaction. Using Instapage's built-in optimization tools can provide invaluable insights.

- Implement A/B testing to compare different layouts and messaging to determine what resonates best with your audience.

- Utilize heatmaps to visualize how users interact with your content, allowing for informed design updates.

- Regularly analyze your conversion rates and adjust your strategies based on real-time feedback from analytics.

In conclusion, designing an effective web page for factoring companies involves understanding your audience, optimizing design, and continually refining based on data insights. These steps lead to increased brand trust and customer loyalty.

Ready to transform your online presence? Start using Instapage today and enjoy creating stunning, conversion-ready landing pages tailored for your factoring company!

Get more out of Make your web page for factoring companies

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

Frequently asked questions about advertising factoring

See web factoring company feature in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started