Make your mobile page for financial institutions and meet your unique needs

Stay unique and impactful with Instapage. Use the platform to create your mobile page for financial institutions, raise awareness among potential audiences, and turn web clicks into signups and higher earnings.

Build your mobile page for financial institutions with Instapage

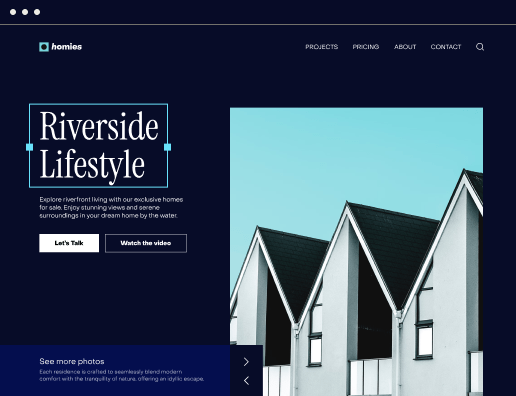

Creating a dedicated mobile page for financial institutions can significantly enhance your marketing strategy. Instapage provides a robust landing page platform that enables quick and easy page creation without the need for coding expertise. With a library of over 100 conversion-focused layouts and the innovative Instablocks feature, you can craft mobile-optimized financial pages tailored to different customer segments, ultimately reducing costs and boosting conversions.

Understanding the importance of mobile pages

Mobile pages are essential as they cater to the growing number of users accessing financial services via smartphones. A well-designed mobile page ensures that your target audience finds relevant information quickly and efficiently. This capability becomes crucial in industries such as banking, insurance, and financial services. Additionally, user experience directly influences brand trust and customer loyalty.

- Responsive design: Ensure your mobile pages adapt seamlessly to various device sizes for better accessibility.

- Fast loading times: Leverage Instapage's optimization features to reduce page load times, improving user experience and conversion rates.

- Engaging content: Utilize dynamic text replacement to deliver personalized messages that resonate with diverse audience segments.

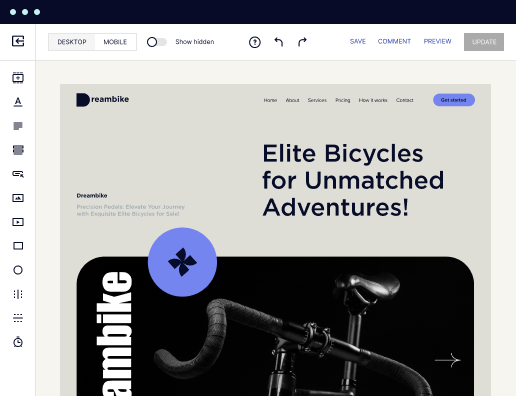

Step 1: Choose the right template

Select a template from Instapage's extensive library specifically designed for financial institutions. The versatility of these templates allows for easy customization to align with your brand identity.

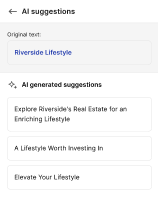

Step 2: Personalize your mobile experience

Include personalized content to cater to the varied needs of your audience. Here are some strategies:

- Dynamic text replacement: Tailor headlines and content based on user data, enhancing engagement.

- AdMaps: Align specific ads to relevant landing pages to increase the chances of conversion.

- Audience-level tracking: Use Instapage's data tools to analyze metrics specific to different segments.

Step 3: Optimize and test your page

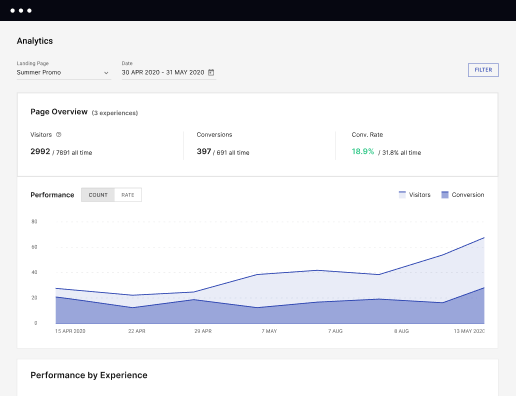

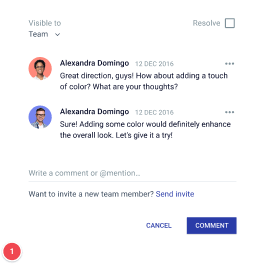

Conduct A/B testing to determine which elements resonate most with your audience. Utilize the analytics dashboard to assess performance and make informed adjustments.

- Heatmaps: Gain insights into user behavior on your page, understanding which elements attract attention.

- Conversion metrics: Focus on key performance indicators such as click-through rates and form submissions.

- Iterative improvements: Implement changes based on data-driven insights for continued optimization.

With Instapage, creating a mobile page for financial institutions that drives conversions while keeping costs low is manageable. Every feature is designed to help you deliver engaging and relevant user experiences.

Start building your mobile page for financial institutions with Instapage today and transform your marketing approach. Sign up now to leverage our user-friendly platform and boost your conversions!

Get more out of Make your mobile page for financial institutions

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to make your mobile page for financial institutions in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started