Make your personalized blog page for invoice factoring companies

Deliver personalized experiences with blog page that build brand trust for invoice factoring companies and foster customer loyalty.

Factoring blog: Your ultimate how-to guide

Developing a compelling blog page for invoice factoring companies is crucial for attracting clients in the competitive financial landscape. With Instapage’s flexible and user-friendly landing page platform, marketers can create tailored pages that enhance brand trust and boost conversion rates. This guide provides a structured approach to designing your blog page effectively.

Understanding your audience

It’s essential to identify your target audience to build a blog that resonates with them. Marketing departments in sectors like Business Services, Education, and Financial Services have specific needs that your content should address. Use market research to gather insights about your audience, tailoring your messaging accordingly.

- Identify audience pain points: Understanding challenges helps create relevant content.

- Research industry trends: Incorporate the latest topics in invoice factoring to stay ahead.

- Analyze competitor content: Learn from existing blogs to identify gaps in information and unique angles.

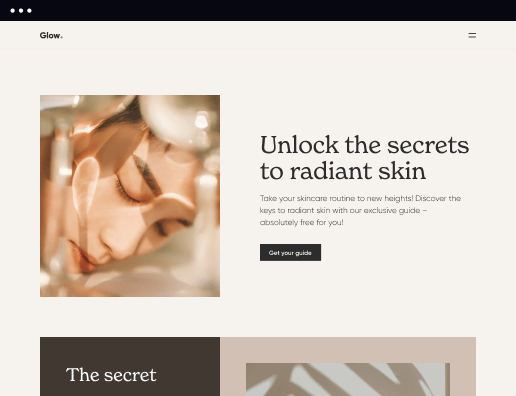

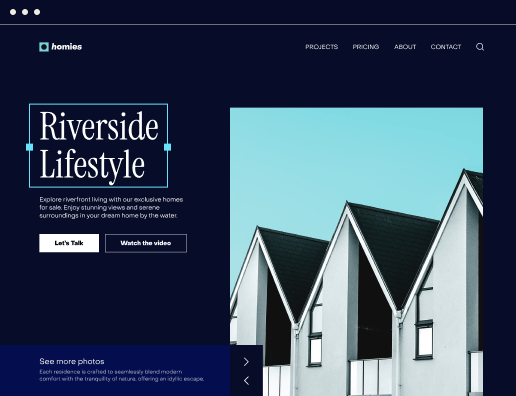

Designing the landing page

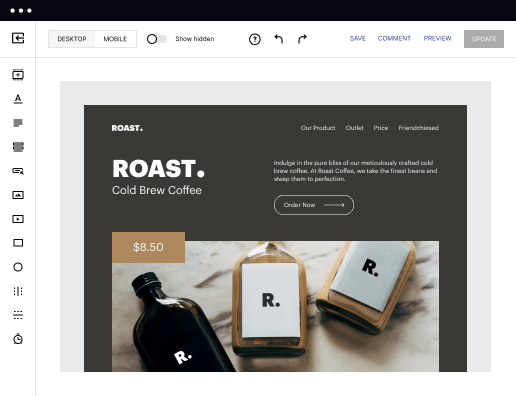

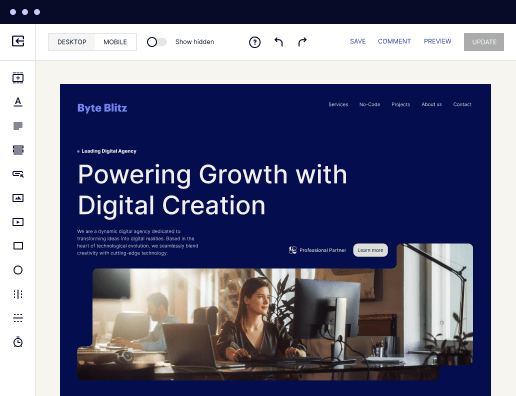

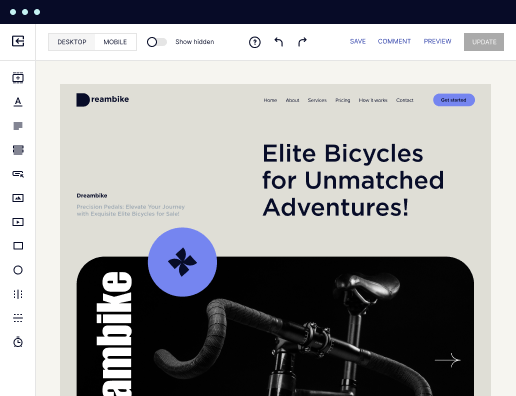

A well-designed landing page is key to maintaining engagement. With Instapage, you can utilize over 100 conversion-focused templates and customization features.

- Select a visually appealing template: Choose one that aligns with your brand aesthetics.

- Utilize Instablocks for ease: These pre-built blocks save time while ensuring consistency.

- Incorporate call-to-action buttons: Strategically place CTAs to guide user behavior towards conversion.

Optimizing for conversions

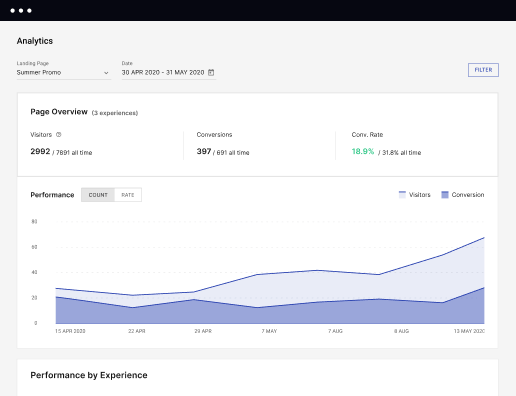

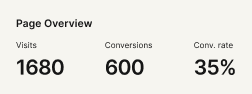

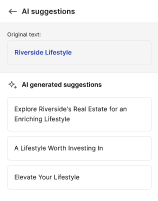

Once your page is designed, it’s important to optimize it for higher conversions. Instapage provides built-in experimentation features, such as A/B testing and heatmaps.

- A/B Test different headlines: Evaluate which headlines generate more clicks.

- Analyze heatmaps: Understand how users interact with your blog to refine layout.

- Use analytics dashboard: Track performance metrics to identify areas of improvement.

In conclusion, by using Instapage to create a blog page tailored for invoice factoring companies, you streamline the process while ensuring a focus on conversions.

Ready to elevate your marketing strategy? Start building your landing pages with Instapage today and transform your blogging experience for invoice factoring companies.

Get more out of Make your blog page for invoice factoring companies

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to make your blog page for invoice factoring companies in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started