Make your website tailored for debt relief companies

Command authority and trust with a website designed to meet your business needs. Instapage enables your global presence.

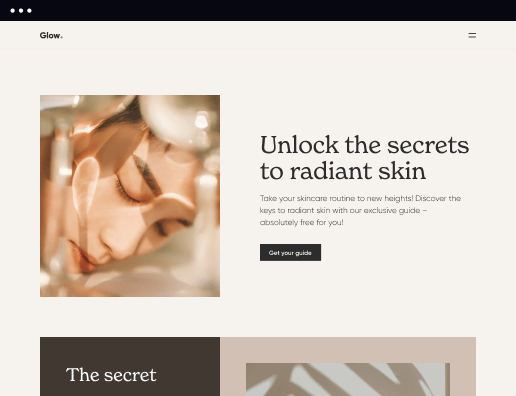

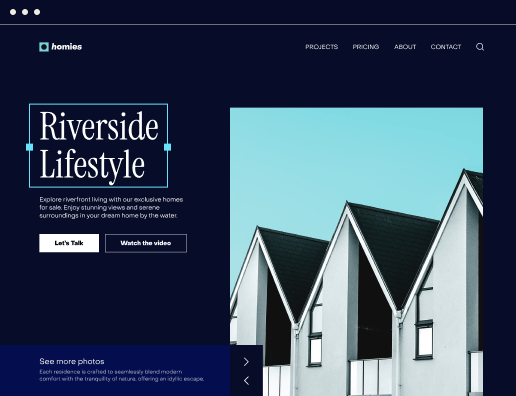

Effortlessly create your website for debt relief companies with Instapage

Increase your online presence and campaigns with Instapage, the leading landing page platform. In just a several quick steps, you may create a professional and high-converting webpage that may attract more visitors and improve your chances of converting them into clients or supporters.

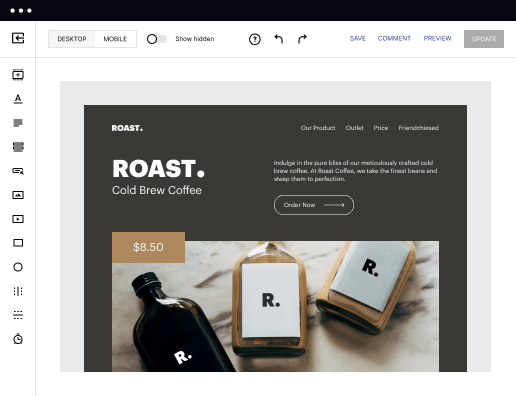

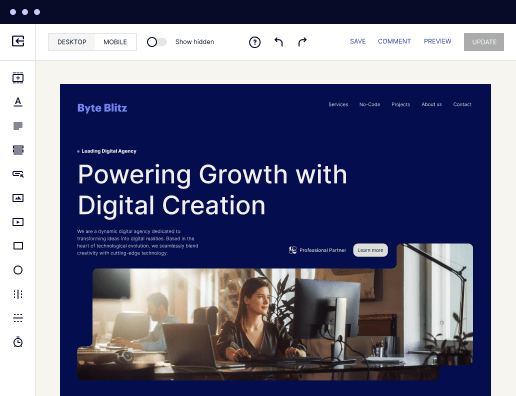

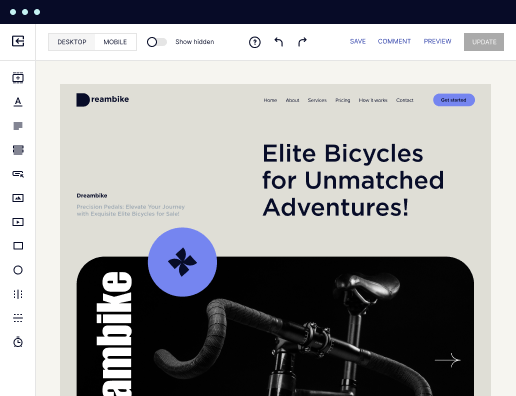

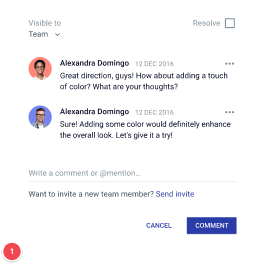

With our easy-to-use interface and powerful AI features, you may quickly create your website for debt relief companies. Our web page layout templates and personalized blocks make creating a visually appealing and engaging web page trouble-free. Plus, with our collaboration instruments, you may effortlessly work with your teammates to edit and review the web page before posting.

Follow these steps to build your website for debt relief companies

- Log in or sign up for a free Instapage account.

- Set up your profile and gain access to your Dashboard.

- Click on the Create Page button to make your website for debt relief companies.

- Start modifying the ready-made template or make the landing page completely from scratch.

- Include dynamic elements and blocks, modify fonts and colors, and more.

- Review your page and click Publish to launch it.

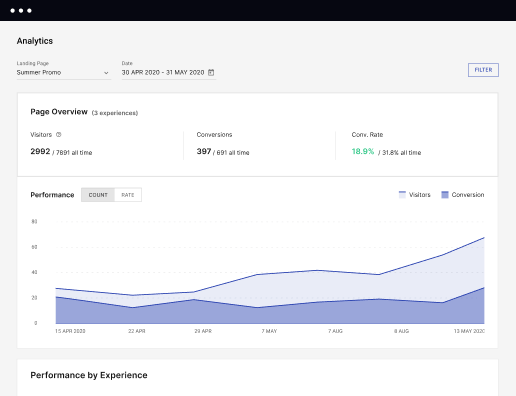

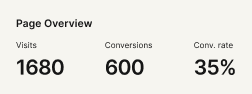

- Access your analytics, run AI A/B tests, and much more.

Get more out of Create your website for debt relief companies

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to create your website for debt relief companies in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started