Make your tailored sign-up page for Mortgage loan processors

Empower Mortgage loan processors with Instapage to deliver impactful sign-up page experiences and boost conversions.

Creating your sign-up page for mortgage loan processors

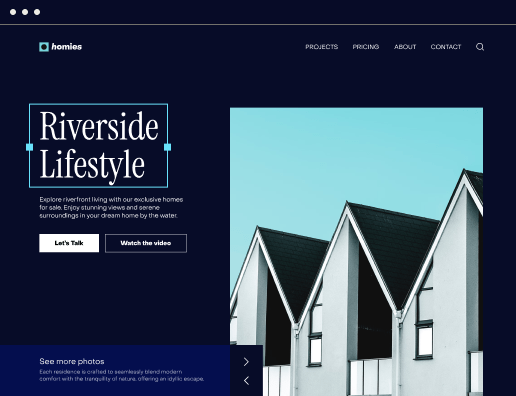

Building an effective sign-up page for mortgage loan processors is critical for maximizing conversions in today's competitive financial services landscape. Instapage empowers marketers to develop high-quality landing pages that not only capture leads but also establish trust and loyalty. With an extensive library of over 100 conversion-focused templates and no coding required, creating an impactful page has never been easier.

Why a sign-up page is crucial for your mortgage offerings

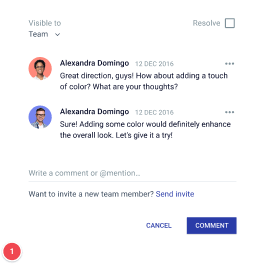

A well-designed sign-up page acts as a direct line of communication with potential customers, providing them with necessary information and reasons to feel confident in their choice. By utilizing Instapage’s features, you can tailor these pages to ensure they meet specific needs of different audiences. Here are the key reasons why having a specialized mortgage sign-up page is vital:

- Enhanced user experience: Your sign-up page should be intuitive and easy to navigate, ensuring users can efficiently input their information and proceed without friction.

- Increased trust: Incorporate testimonials, security assurances, and professional design elements to bolster credibility.

- Improved conversion rates: Optimize your page based on A/B testing results to continually enhance your sign-up strategy.

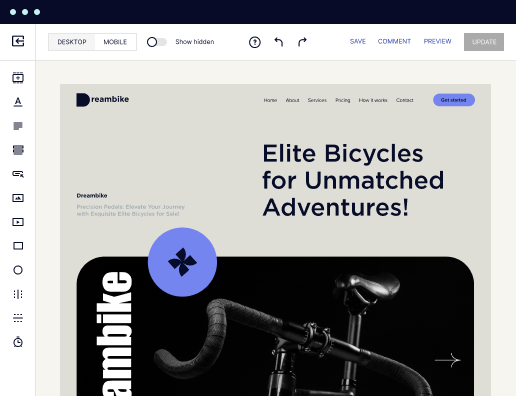

Step 1: Designing your sign-up page layout

Begin by selecting a layout from Instapage's extensive library tailored for mortgage services. Focus on a clean design that highlights critical information such as loan rates, terms, and application steps. Utilize Instablocks for reusable sections to streamline your design process.

Step 2: Optimizing for higher conversions

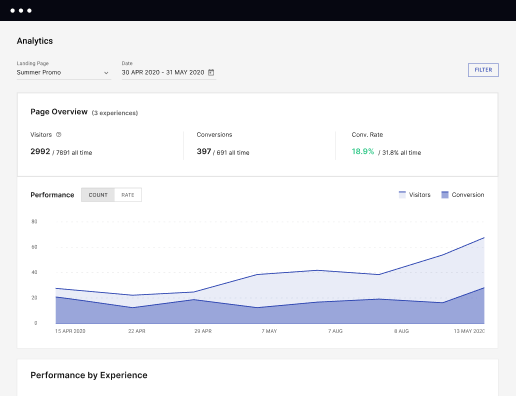

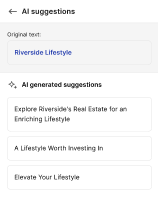

Enhance your sign-up page with optimization tools available in Instapage. Utilize built-in A/B testing features to experiment with different headlines, call-to-action (CTA) buttons, and layouts. It's crucial to monitor how changes affect page performance, leading you to the most effective setup.

- Use heatmaps to visualize user interaction and identify areas of potential improvement.

- Regularly assess analytics to inform your strategies and adjustments based on real user behavior.

- Utilize dynamic text replacement to ensure messaging resonates with varied audiences such as first-time buyers versus refinancers.

Step 3: Personalizing the user experience

Tailor content to engage with specific segments of your audience. Whether targeting millennials or seasoned investors, leveraging dynamic text replacement features allows you to deliver personalized messaging. Incorporate special offers relevant to specific audience segments to increase engagement levels.

- Segment your audience based on loan types (e.g., FHA, VA, Conventional) to offer tailored solutions.

- Employ AdMaps for aligning ads directly with the most relevant landing pages, enhancing user flow.

- Track audience-specific metrics for continuous improvement and targeted marketing efforts.

By focusing on these steps, you build a comprehensive sign-up page that not only attracts users but also transforms them into valuable leads.

Ready to enhance your mortgage loan processing sign-up page? Start using Instapage today to leverage these powerful features and watch your conversion rates soar.

Get more out of Create your sign-up page for Mortgage loan processors

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to create your sign-up page for mortgage loan processors in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started