Make your personalized pre-launch page for reverse mortgage companies

Deliver personalized experiences with pre-launch page that build brand trust for reverse mortgage companies and foster customer loyalty.

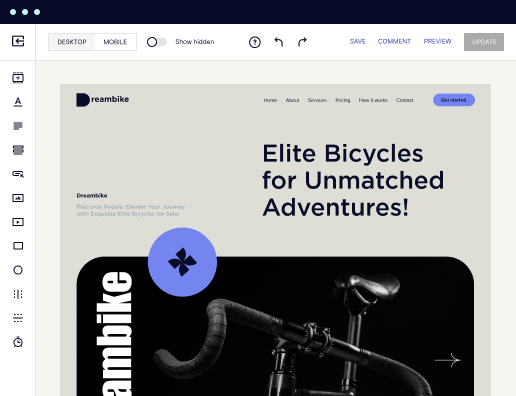

Build your pre-launch page for reverse mortgage companies effectively with Instapage

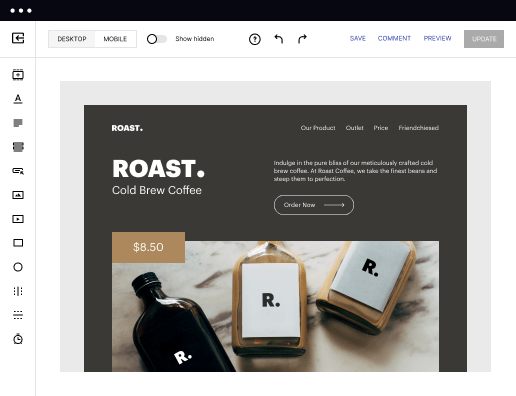

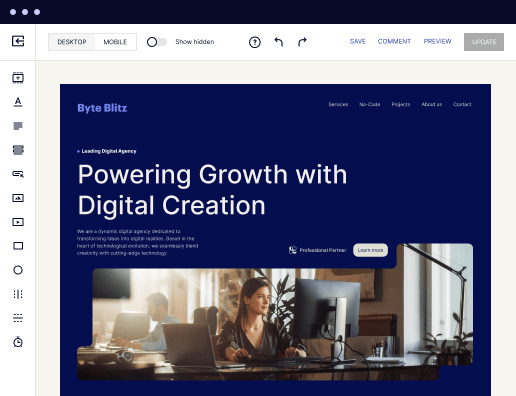

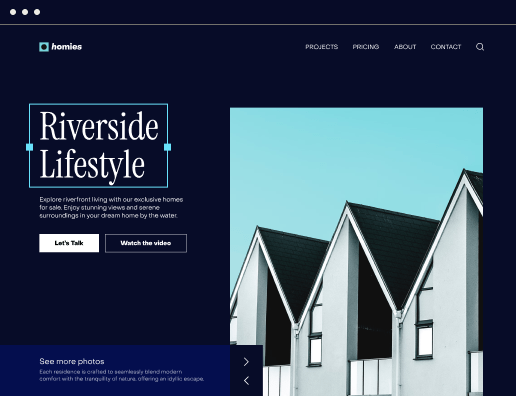

Creating an effective pre-launch page for reverse mortgage companies is essential in today's competitive landscape. Instapage offers marketers the tools they need to increase conversions through efficient landing page creation. With a library of over 100 customizable templates and a user-friendly interface, developing a dedicated pre-launch page has never been easier.

Step 1: Define Your Target Audience

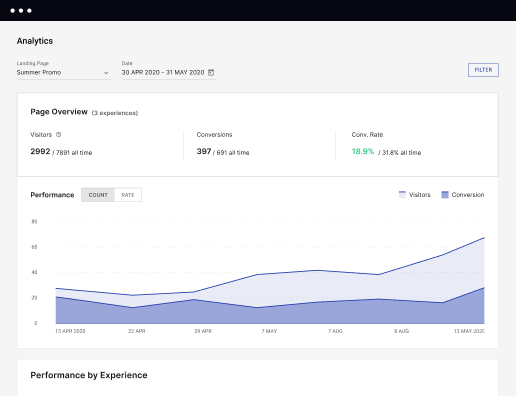

Understanding your target audience is crucial. For reverse mortgage companies, this often includes seniors, their families, and financial advisors. Identify the key demographics such as age, income level, and interests. Utilize Instapage's built-in heatmaps to visualize user behavior and tailor your content effectively.

- Seniors: Content should address their specific needs and concerns regarding reverse mortgages.

- Financial advisors: Create informative sections that advisors can discreetly share with clients.

- Family members: Ensure messaging resonates with those who might assist seniors in financial decisions.

Step 2: Choose a High-Conversion Layout

Selecting the right template is crucial to capture your audience's attention. Instapage provides a variety of conversion-oriented layouts. Consider layouts that flow naturally towards a clear call-to-action.

- Single-column layouts for straightforward messaging, ideal for guiding users through information.

- Video integration options to explain complex topics visually, enhancing user engagement.

- Form-focused designs that simplify lead capture while offering user assurance about their data security.

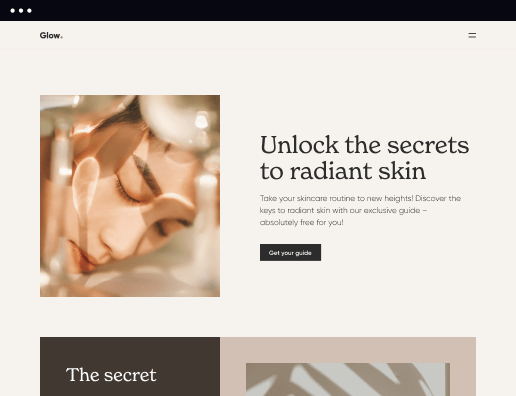

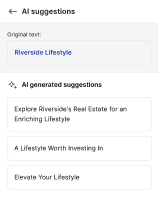

Step 3: Personalize the Experience

Personalization plays a significant role in user engagement. Leverage Instapage’s dynamic text replacement to customize messaging based on user sources, and ensure alignment between specific ads and landing pages with AdMaps.

- Customized greetings based on audience data, welcoming users personally.

- Content modifications based on referral sources to enhance relevancy.

- Employ detailed tracking tools to assess performance metrics, tailoring future campaigns.

Incorporating these steps will help reverse mortgage companies create compelling pre-launch pages that resonate with their target audience.

Ready to enhance your landing page? Utilize Instapage's flexible platform today to engage your audience and maximize conversions.

Start using Instapage now and watch your conversions soar with tailored experiences!

Get more out of Build your pre-launch page for reverse mortgage companies

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started