Make your tailored opt-in page for Loan processors

Empower Loan processors with Instapage to deliver impactful opt-in page experiences and boost conversions.

Build your opt-in page for Loan processors

Creating an effective opt-in page specifically for loan processors can significantly enhance marketing efforts and lead conversion rates. By utilizing Instapage, marketers can design landing pages tailored to meet the specific needs of their audience, thereby reducing acquisition costs and increasing customer loyalty. A focus on delivering relevant experiences helps maximize brand trust.

Understanding the Importance of an Opt-in Page

An opt-in page plays a crucial role in defining the initial interaction between potential customers and your loan processing service. By ensuring that the page is optimized, you can guarantee that visitors feel confident in providing their information. The strategic implementation of tools available on Instapage can lead to higher conversion and engagement rates. Factors to consider include:

- Target Audience: Tailoring your content specifically to the needs of loan seekers to improve relevance.

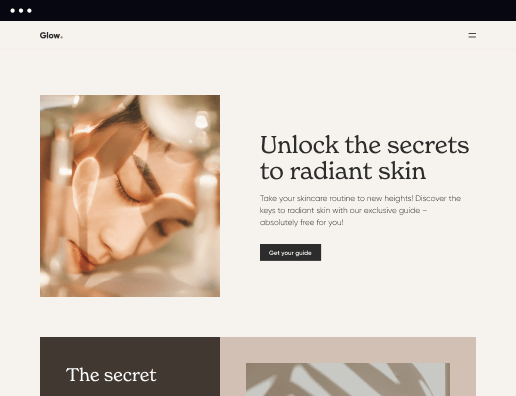

- Visual Appeal: Utilizing Instapage's 100+ layouts to capture attention and convey trust.

- User Experience: Ensuring your opt-in page is easy to navigate to facilitate user sign-up.

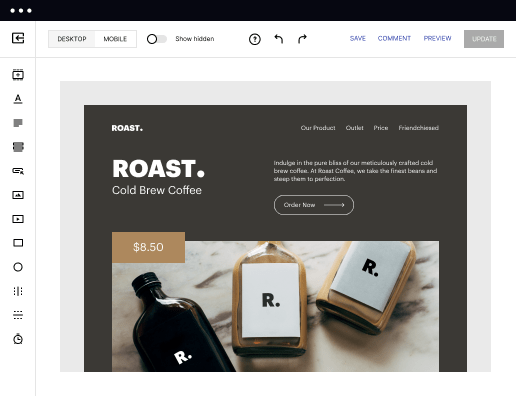

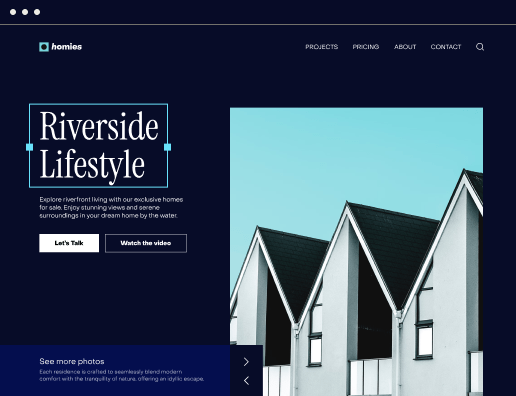

Step 1: Utilize Instapage's Templates and Blocks

First, take advantage of the flexible page creation features offered by Instapage. The platform provides a variety of customizable templates and pre-built blocks that can swiftly align with your branding. This means no coding skills are required, allowing you to focus on crafting the perfect opt-in page.

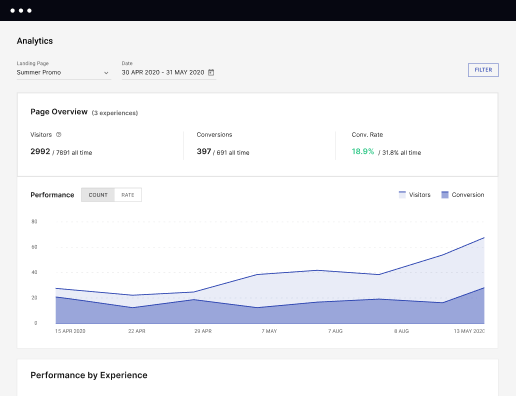

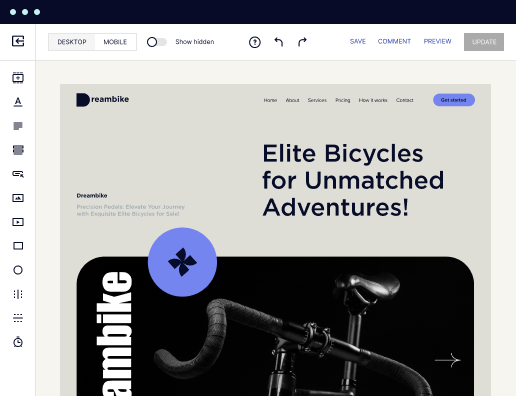

Step 2: Optimize for Conversion

Now that you have your page set up, it’s time to optimize for conversion. Here are some key tactics to implement:

- A/B Testing: Leverage built-in experimentation features to test different layouts and copy.

- Heatmaps: Utilize Instapage's heatmaps to analyze user behavior and make data-driven decisions.

- Analytics Dashboard: Regularly check performance metrics to track effectiveness.

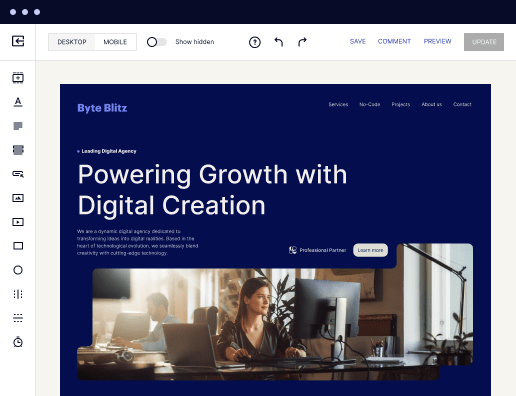

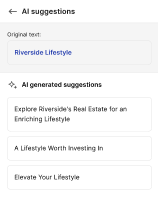

Step 3: Personalize Your Landing Page

Personalization is critical in today's competitive market. By dynamically delivering tailored content, you can increase engagement and retention. Consider the following techniques:

- Dynamic Text Replacement: Customize your content according to the visitor’s previous interactions.

- AdMaps: Align your ads with specific landing pages to enhance relevancy and conversion.

- Audience Tracking: Leverage data tools to understand which segments convert the best.

In summary, a well-designed opt-in page for loan processors can improve your marketing strategy significantly. With Instapage's easy-to-use features, you can create pages that resonate with your audience, optimize for conversions, and build long-term relationships.

Don't miss out on converting more leads from your loan processor campaigns. Start creating your opt-in page today with Instapage!

Get more out of Build your opt-in page for Loan processors

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to build your opt-in page for loan processors in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started