Make your tailored opt-in page for Financial advisors

Empower Financial advisors with Instapage to deliver impactful opt-in page experiences and boost conversions.

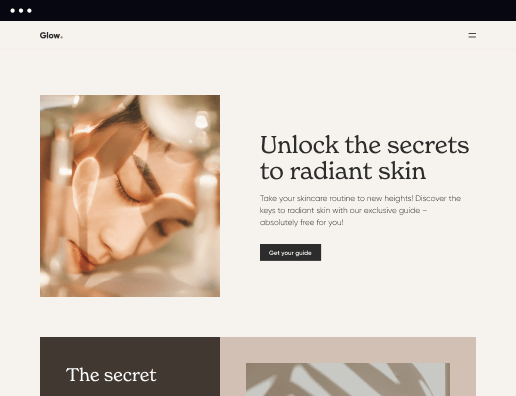

Build your opt-in page for financial advisors

Creating an effective opt-in page for financial advisors is essential for capturing leads and enhancing client relationships. With Instapage, financial advisors can leverage a flexible platform that simplifies the landing page creation process. This guide will walk you through the steps necessary to build a powerful opt-in page that not only drives conversions but also fosters trust among potential clients.

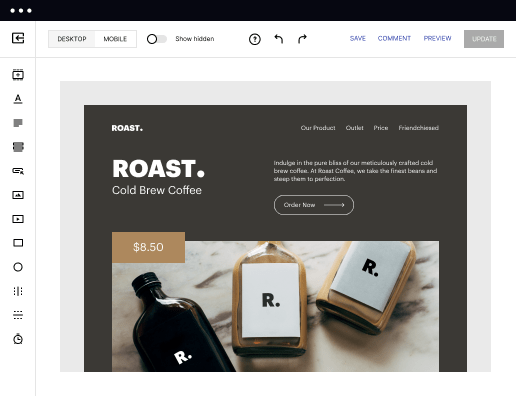

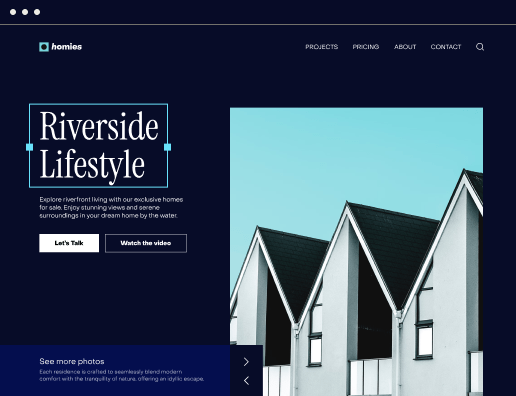

Step 1: Choose the Right Template

Selecting a template is the first step in building your opt-in page for financial advisors. Instapage offers over 100 conversion-focused layouts tailored for different audience segments. Here’s what to consider when choosing a template:

- Target Audience: Pick a template that resonates with your desired demographic, such as high-net-worth individuals or young professionals seeking financial advice.

- Visual Appeal: Choose a layout that is visually appealing and aligns with your brand's identity, which helps increase brand trust.

- Call to Action: Ensure the template features a strong call to action that compels visitors to easily opt-in, whether through newsletters, consultations, or resource downloads.

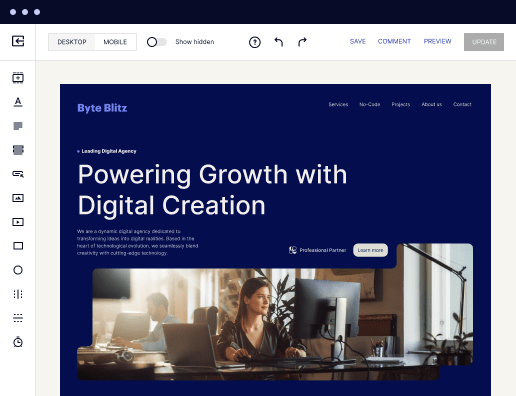

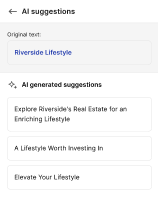

Step 2: Customize for Personalization

Once you've chosen a template, it's time to customize it. Use Instapage’s personalization tools to create unique experiences for different audience segments. Consider the following techniques:

- Dynamic Text Replacement: Tailor the content dynamically based on the source of the traffic, allowing messages to speak directly to specific audiences.

- AdMaps: Align your targeted ads with tailored landing pages for better relevance and context, improving overall conversion rates.

- Audience Metrics: Analyze user behavior with heatmaps and analytics to understand what resonates with your visitors, allowing for continuous improvement.

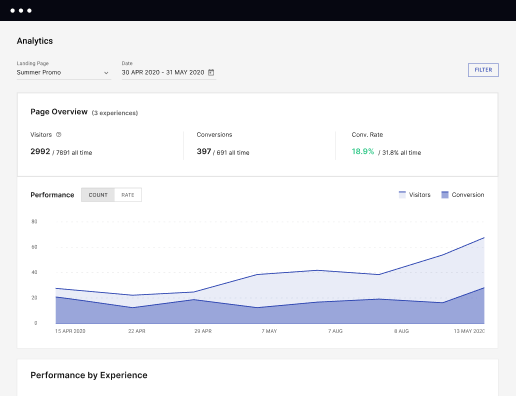

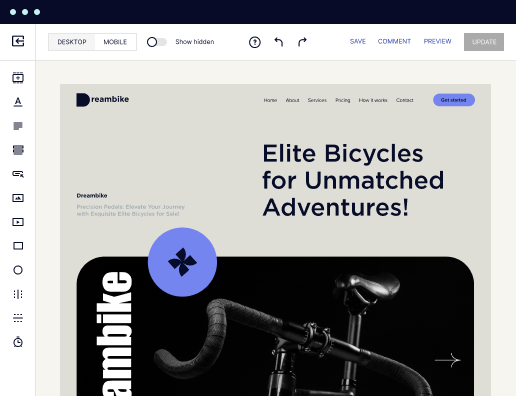

Step 3: Optimize for Performance

Optimizing your opt-in page is crucial for maximizing conversions. Implement the following strategies using Instapage's built-in features:

- A/B Testing: Use A/B testing to compare different versions of your landing page and identify which elements lead to higher conversion rates.

- Analytics Dashboard: Regularly check your performance metrics to understand visitor engagement, traffic sources, and drop-off points.

- Continuous Iteration: Based on data collected, continuously tweak your content and design to enhance effectiveness, ensuring your opt-in page stays relevant in a changing market.

By following these steps, you can build an effective opt-in page that not only looks great but also drives meaningful engagement with potential clients. Utilizing Instapage allows you to create, optimize, and personalize your landing pages effortlessly.

Ready to start building your opt-in page? Sign up for Instapage today to unlock the full potential of your marketing strategy!

Get more out of Build your opt-in page for Financial advisors

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to build your opt-in page for financial advisors in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started