Make your tailored click-through page for Private banking advisors

Empower Private banking advisors with Instapage to deliver impactful click-through page experiences and boost conversions.

Build Your Click-Through Page for Private Banking Advisors

Creating an effective click-through page for private banking advisors is crucial for engaging potential clients. Instapage empowers marketers to craft tailored landing pages effortlessly, optimizing for higher conversions and enhancing customer trust. The flexibility of our platform allows you to create and personalize landing pages that resonate with the unique needs of the financial sector.

Understanding Your Audience

Before diving into the design and features of your landing page, understanding your target audience is essential. Private banking clients often have specific expectations, including trustworthiness and a high degree of personalization.

- Identify target demographics: Understand who your ideal clients are, including their financial goals and preferences.

- Assess pain points: Determine the challenges your audience faces in financial management and investment.

- Create persona profiles: Develop specific profiles for your primary audience segments to guide messaging and design.

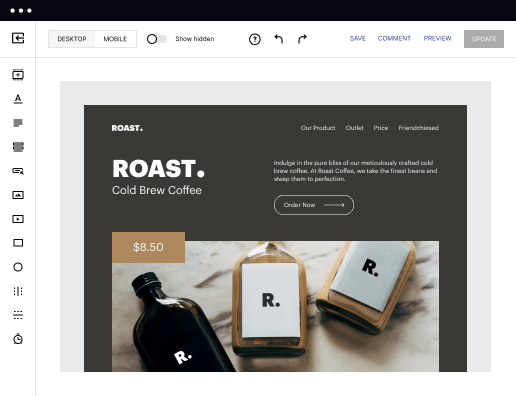

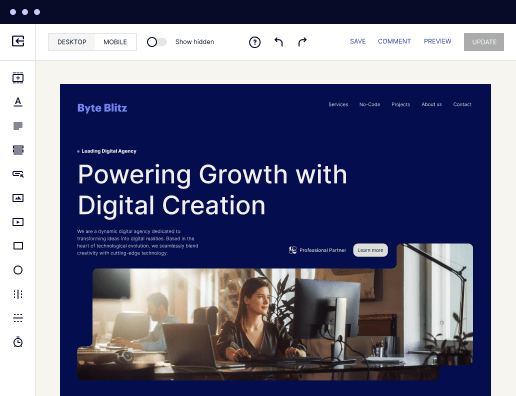

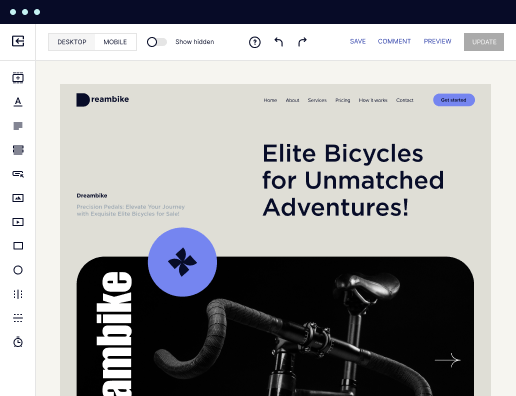

Designing Your Click-Through Page

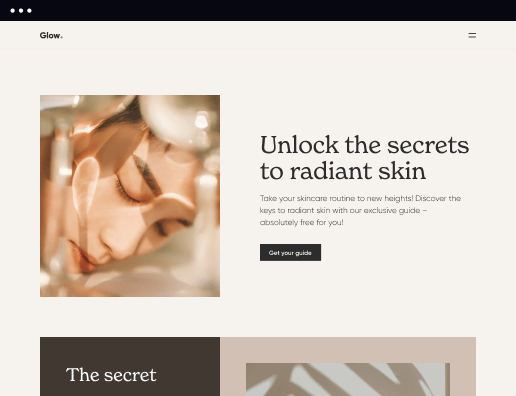

An eye-catching and user-friendly design is critical to keep visitors engaged. Instapage offers 100+ conversion-focused layouts to streamline this process.

- Use high-quality visuals: Professional images can enhance credibility and make your services more appealing.

- Incorporate clear headlines: Communicate the main benefit of your services immediately with concise headlines.

- Utilize white space: Effective use of space helps to improve readability and guides the viewer's focus.

Implementing Personalization Strategies

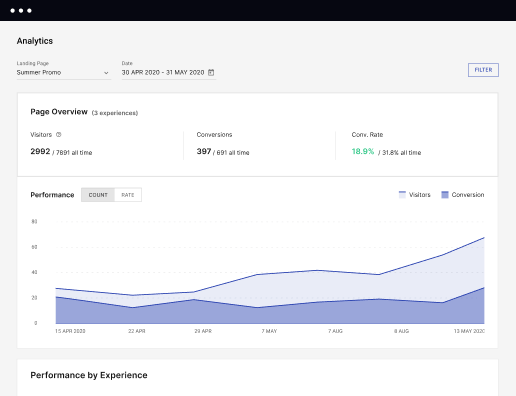

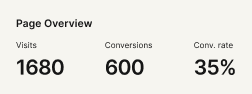

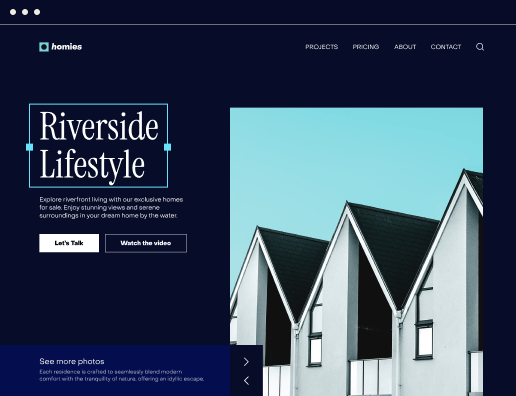

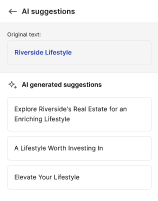

Personalization is key for finance-related landing pages. Instapage allows dynamic text replacement to tailor experiences for different audience segments.

- AdMaps for targeted messaging: Align specific ads with unique pages to provide a customized experience.

- Segmented content delivery: Tailor messages based on audience behaviors and metrics to enhance relevance.

- Using testimonials: Showcase success stories to build trust through social proof.

By focusing on audience understanding, design, and personalization, you can effectively build a click-through page that captures leads and grows conversations.

Ready to transform your landing page strategy? Explore Instapage's powerful features to start engaging your audience today.

Get more out of Build your click-through page for Private banking advisors

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to build your click-through page for private banking advisors in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started