Make your app page for refinancing companies with conversions reinvented

Reinvent your digital marketing strategy with Instapage. Create your app page for refinancing companies, showcase your company's brand, optimize content that appeals to your target audience, and get unmatched conversions with minimal effort and investment in your pages.

Build your app page for refinancing companies with Instapage

Creating an optimized app page for refinancing companies is an essential step to enhancing your online presence and driving conversions. Instapage provides a flexible, user-friendly platform for marketers in the USA, enabling them to build high-converting landing pages tailored specifically for their target audience in the financial services sector.

Understanding the Importance of Landing Pages

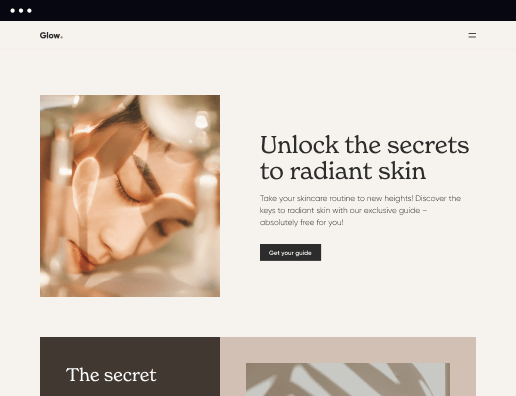

An effective landing page acts as the first impression for potential customers looking for refinancing options. By leveraging Instapage's library of conversion-focused layouts, businesses can create tailored experiences that resonate with their audience's needs, increasing brand trust and customer loyalty.

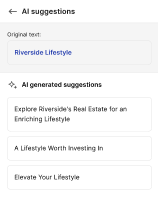

- Customization: Tailor your landing page with personalized content to engage each audience segment effectively.

- Mobile Optimization: Ensure your pages are responsive and visually appealing across all devices to capture mobile users looking for refinancing options.

- A/B Testing: Use built-in experimentation tools to compare different versions of your landing page and find the most effective elements.

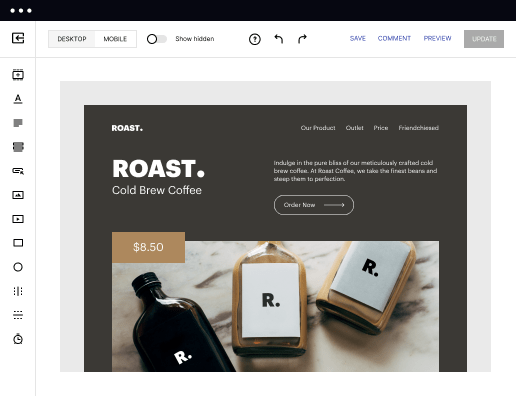

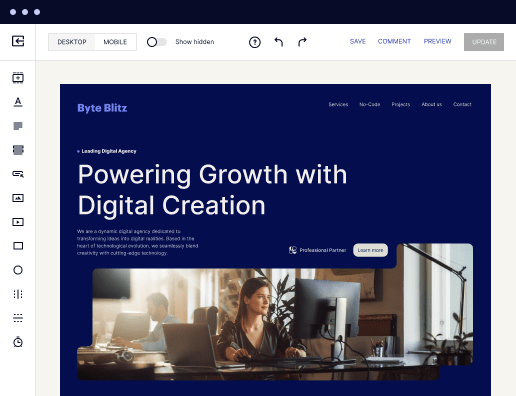

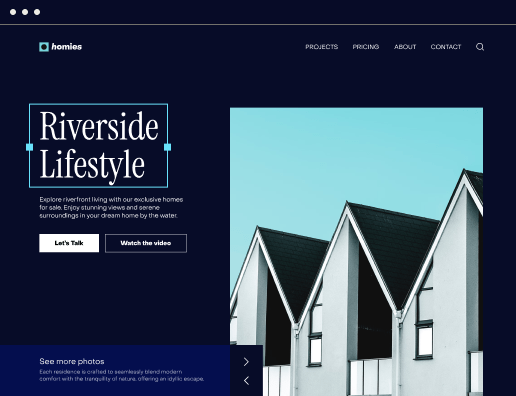

Step 1: Choose the Right Template

Selecting the right template is critical in creating your app page for refinancing companies. Start by exploring the 100+ conversion-focused layouts available on Instapage, designed specifically for financial services tasks. Choose a template that aligns with your branding and messaging strategy.

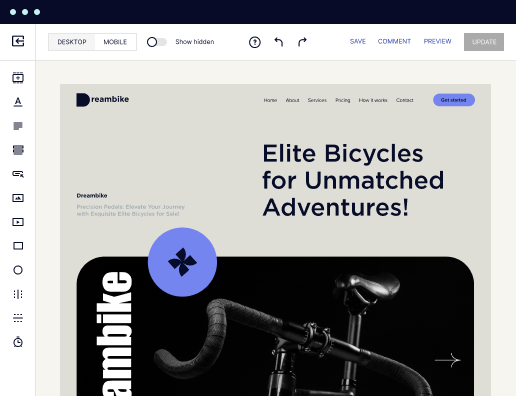

Step 2: Optimize for Conversions

Once your template is selected, the next step involves optimizing your app page for converter efficacy. Follow these actions:

- Incorporate persuasive copy that highlights the benefits of refinancing services tailored to the user’s needs.

- Utilize Instablocks for reusable sections of content, ensuring consistency throughout your pages.

- Engage with interactive elements like forms and chatbots to facilitate customer engagement and streamline inquiries.

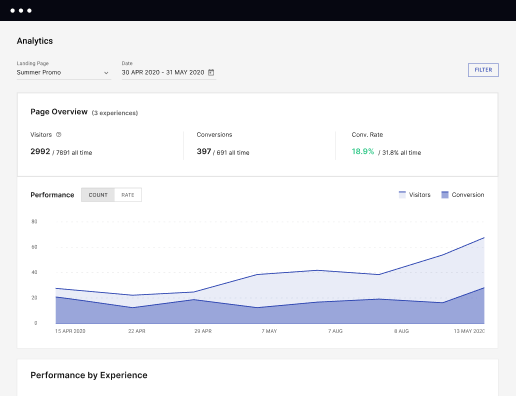

Step 3: Monitor and Adjust

The final step in creating your refinancing app page involves ongoing monitoring and adjustments based on performance metrics. Utilize Instapage's analytics dashboard and heatmaps to track user interactions and identify areas that require changes.

- Analyze data from A/B testing to understand which page elements perform best.

- Adjust your content dynamically based on audience insights gathered from data tools.

- Regularly update your landing page content to reflect the latest refinancing offers and industry trends.

Incorporating these steps ensures that your app page for refinancing companies not only attracts visitors but also converts them into loyal customers.

Ready to boost your conversions? Start building your optimized landing page with Instapage today and experience the enhanced trust and loyalty that follows.

Get more out of Build your app page for refinancing companies

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to build your app page for refinancing companies in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started