Easily generate Tax Adjustment Request Form to streamline requests

Now you can generate Tax Adjustment Request Form effortlessly. Build single, multi-step, or pop-up forms with various fields, dropdowns, radio buttons, and additional elements to collect prospect information and enhance user engagement.

How to generate Tax Adjustment Request Form using Instapage's Form Builder

Creating a Tax Adjustment Request Form is crucial for businesses needing to streamline their tax processes. With Instapage's Form Builder, you can generate Tax Adjustment Request Forms quickly and effectively, helping you enhance your business services and improve customer relations. Follow these simple steps to get started.

Step-by-step guide to generate Tax Adjustment Request Form

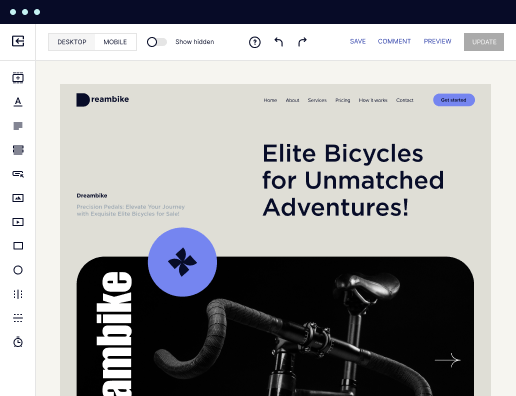

- Sign up for your free Instapage account and get a 14-day trial of the chosen plan.

- Customize your account and fill in your company details to make it unique.

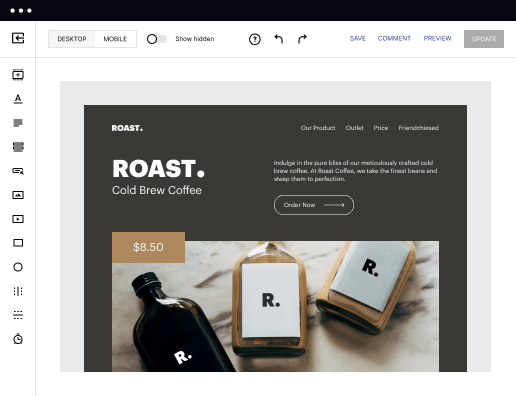

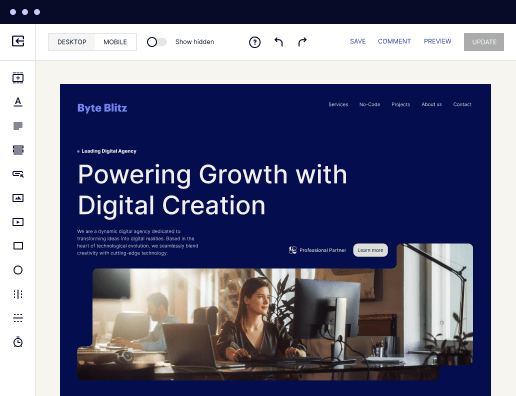

- On the Dashboard, click Assets -> Forms -> Create Form to begin the process.

- Start to generate Tax Adjustment Request Form with Instapage’s Form Builder.

- Customize the form by adding essential fields such as text, drop-down options, buttons, and email input.

- You may need additional options. Choose and implement the necessary features based on your requirements.

- Finally, select SAVE to keep your changes or hit CLOSE to discard any edits made.

By following these steps, you'll not only generate Tax Adjustment Request Forms but also streamline your processes effortlessly. Start using Instapage today to enhance your online presence and optimize your landing pages!

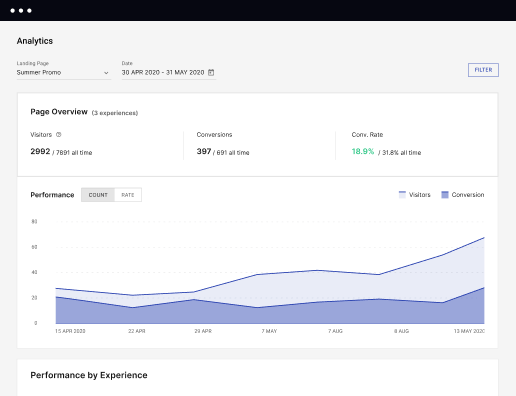

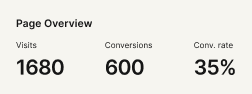

Get more conversions with generate Tax Adjustment Request Form

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

Frequently Asked Questions

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started