A go-to website software for Credit officers to create professional websites

Enjoy a range of website building and optimization options our website creator for Credit officers offers, from affordable to premium, without needing technical skills.

Effective Website software for Credit officers: A Comprehensive Guide

Effective website software for credit officers enhances your ability to manage, analyze, and present financial information seamlessly. Using platforms like Instapage can greatly improve landing page experiences that not only drive conversions but also build brand trust among potential clients seeking services in business, education, and financial sectors.

Understanding Website Software for Credit Officers

Website software tailored for credit officers is designed to facilitate various tasks, including data collection, analysis, and client communications. By integrating personalized landing pages with conversion-focused layouts, credit officers can enhance customer engagement and streamline their processes, making them more efficient and effective.

Step 1: Choosing the Right Platform

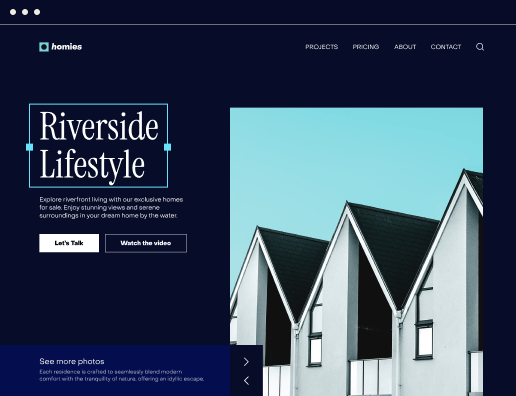

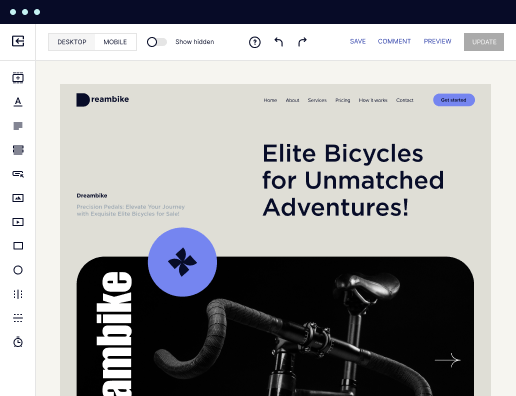

Selecting the best website software for your needs involves considering several factors. Focus on platforms that offer high personalization and optimization capabilities.

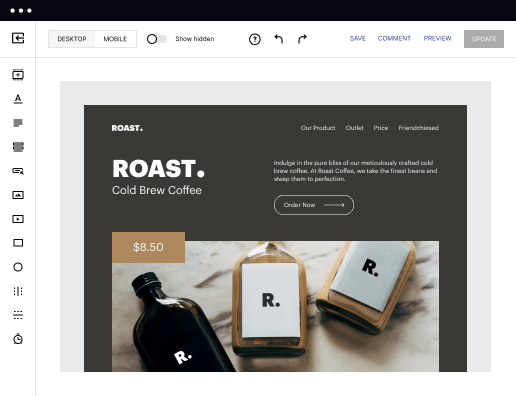

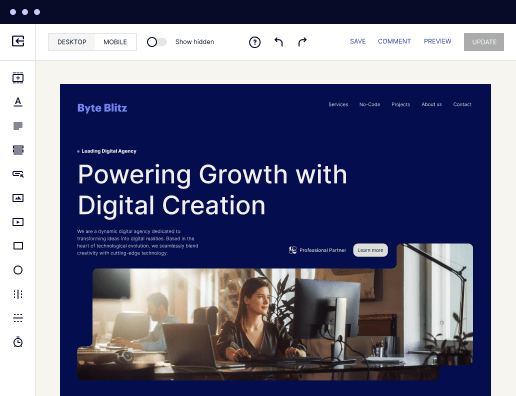

- User-Friendly Interface: Ensure that the platform is easy to navigate, allowing you to create and manage pages without needing developer assistance.

- Conversion-Focused Templates: Look for software that provides templates specifically designed for financial services to boost conversions.

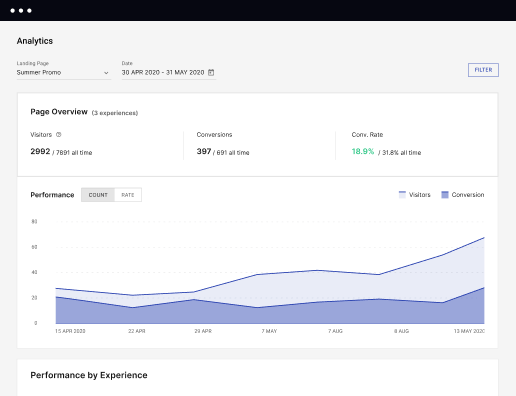

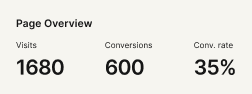

- Analytics and Reporting Tools: Having access to detailed analytics helps you understand user behavior and improve performance.

Step 2: Implementing Optimization Techniques

Once you've chosen a platform, it’s crucial to implement techniques that enhance landing page performance. Techniques that enhance user engagement are vital for credit officers dealing with competitive markets.

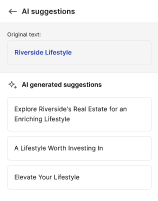

- A/B Testing: Use this technique to compare landing page performance and make data-driven adjustments for better results.

- Heatmaps: Analyze where users click to determine the most engaging sections of your landing page.

- Dynamic Content: Customize messaging based on the audience visiting your page to improve relevance and engagement.

Step 3: Monitoring and Analyzing Performance

After implementing your strategies, continuous monitoring and analysis is essential. This will not only identify areas for improvement but will also help in tailoring content to specific audience needs.

- Data Tracking: Monitor key metrics that indicate user behavior and engagement levels on your website.

- Feedback Loops: Collect input from clients regularly to refine and adapt your landing page strategies.

- Continuous Improvement: Implement iterative changes based on analytics to enhance overall performance.

By following these steps, credit officers can leverage effective website software that not only enhances functionality but also drives brand loyalty through improved customer experiences.

Ready to transform your approach to website management? Explore how Instapage can empower your credit operations through enhanced landing page experiences today.

Get more out of Website software for Credit officers

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See website software for credit officers in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started