The intuitive web page software for Mortgage loan processors

Harness the potential of Instapage's web page creator for Mortgage loan processors and other intuitive solutions in the platform. Easily create impactful pages that resonate with your audience and achieve better outcomes.

Maximize your marketing effectiveness with a web page builder for mortgage loan processors

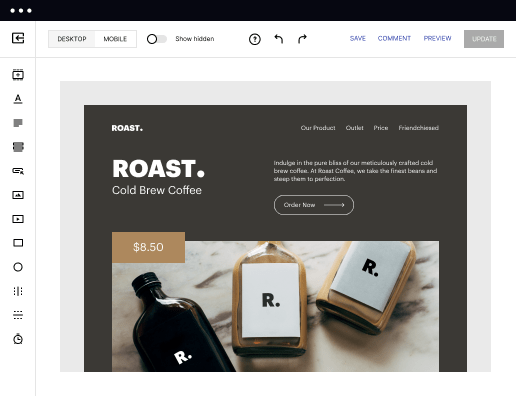

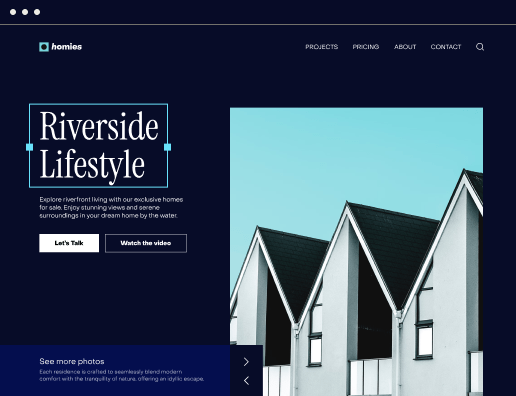

In the competitive financial services landscape, mortgage loan processors require a web page builder that is not only flexible but also highly effective in converting leads. Instapage provides an easy-to-use platform to create specialized landing pages designed for diverse customer segments. With over 100 customizable layouts and Instablocks, you can build engaging pages within minutes, regardless of your technical skills.

The significance of personalized landing pages

Personalization has become key in effective marketing strategies. By utilizing Instapage's dynamic content delivery, mortgage loan processors can provide individualized experiences that resonate with their audience's specific needs and preferences.

- Dynamic text replacement

- Adapt landing page content in real-time based on the visitor's information, ensuring they see the most relevant messages.

- AdMaps

- Align specific ads with tailored landing pages, enhancing user experience and increasing conversion potential.

- Audience-level metrics

- Track engagement and performance metrics for different audience segments, allowing for data-driven refinements and optimizations.

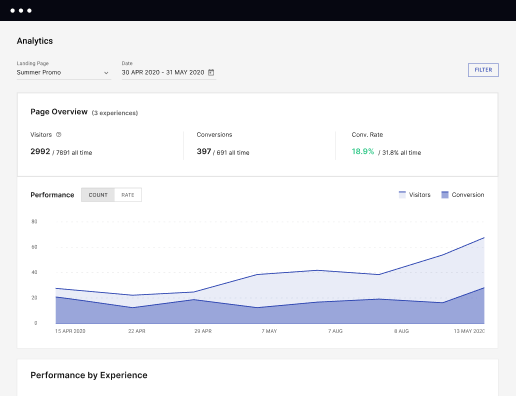

Effective optimization strategies for landing pages

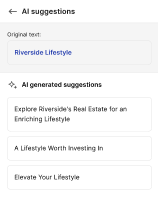

Optimizing your landing pages is crucial for higher conversion rates. With built-in experimentation features, Instapage enables you to conduct A/B tests seamlessly.

- Heatmaps

- Utilize detailed heatmaps to analyze user behavior, helping you adjust page elements for greater effectiveness.

- A/B testing

- Test different variations of your pages to identify which designs and messages generate the best results.

- Analytics dashboard

- Monitor overall performance through comprehensive analytics, gaining insights into what works and what needs adjustment.

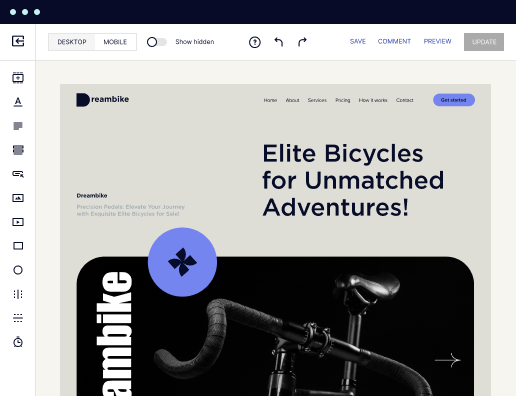

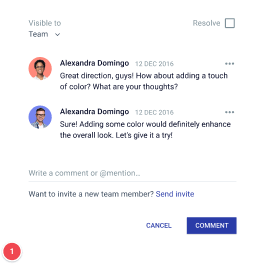

Streamlined collaboration for faster page production

Fast-paced marketing environments benefit from streamlined collaboration processes. Instapage allows marketers and stakeholders to work together efficiently.

- Real-time editing

- Encourage team collaboration by enabling simultaneous edits, facilitating quicker decision-making.

- Instant feedback

- Provide immediate input on designs and copy, ensuring all team members are aligned with the project's goals.

- Secure sharing

- Easily share landing pages with clients and partners, maintaining security throughout the review process.

Building a web page builder specifically for mortgage loan processors enhances conversion opportunities while ensuring pages are tailored directly to user needs. Instapage stands out as a leading choice for businesses aiming to improve their online marketing performance.

Take the next step in your marketing journey by exploring how Instapage can refine your approach to landing pages and elevate audience engagement.

Get more out of Web page builder for Mortgage loan processors

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See web page builder for mortgage loan processors in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started