Make your web page for reverse mortgage companies with conversions reinvented

Reinvent your digital marketing strategy with Instapage. Create your web page for reverse mortgage companies, showcase your company's brand, optimize content that appeals to your target audience, and get unmatched conversions with minimal effort and investment in your pages.

Reverse mortgage website templates: Your ultimate how-to guide

For reverse mortgage companies seeking to enhance their online presence, Instapage offers a powerful landing page creation platform that simplifies the process. Built for marketers, Instapage allows you to build engaging landing pages that not only look great but are also optimized for conversions, helping you reduce costs and boost customer engagement.

Understanding Reverse Mortgages

A reverse mortgage is a specialized loan option available for homeowners, typically aged 62 or older, allowing them to convert a portion of their home equity into cash. As a reverse mortgage company, conveying clear, informative, and trustworthy content on your landing pages is crucial for instilling confidence in potential clients. Utilize Instapage's extensive library of conversion-focused layouts to illustrate complex concepts effectively.

- Build confidence: Use testimonials and success stories from satisfied clients to enhance credibility.

- Visual guides: Incorporate infographics to illustrate reverse mortgage processes clearly.

- FAQs and resources: Provide detailed FAQs that address common concerns about reverse mortgages.

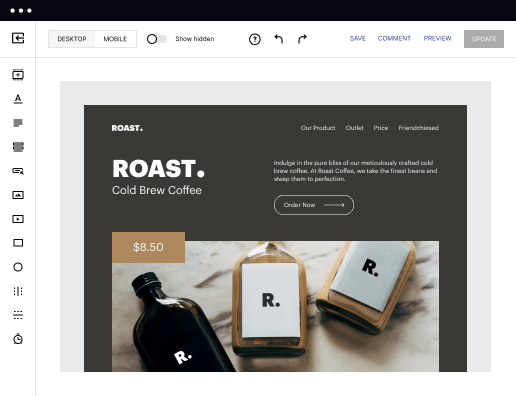

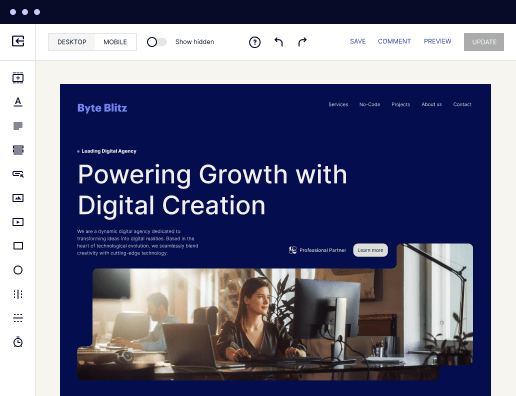

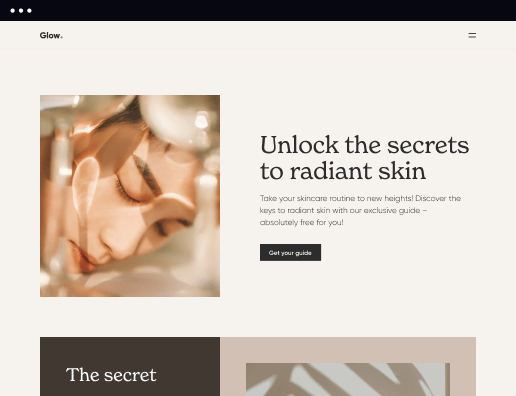

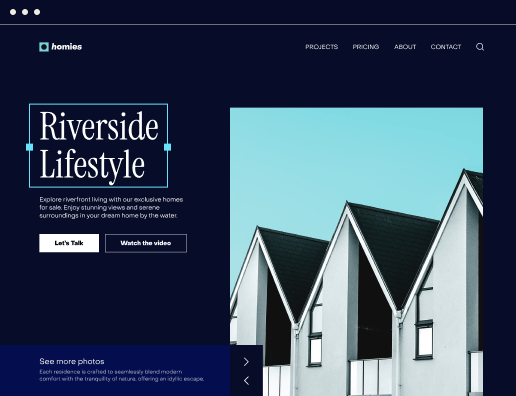

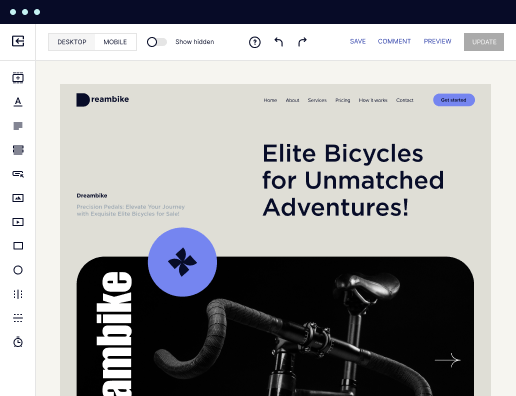

Designing Your Landing Page

Creating your landing page requires strategic planning to capture your target audience's attention. Consider incorporating personalization elements, such as dynamic text replacement, to tailor the message based on visitor demographics.

- Dynamic content: Change headlines and offers based on the user’s profile for enhanced relevance.

- Clear call-to-action: Place prominent CTA buttons urging visitors to get a consultation or download a guide.

- Mobile-friendly design: Ensure your landing page is optimized for all devices, considering that many users will access it via smartphones.

Optimizing for Performance

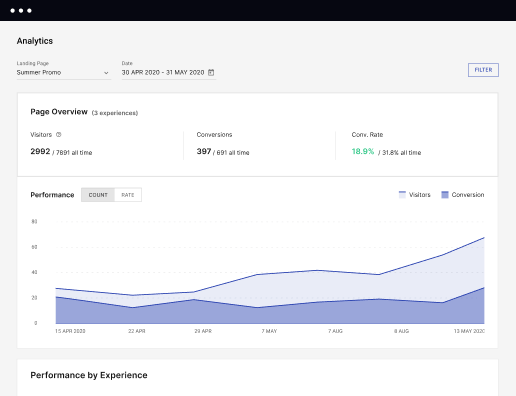

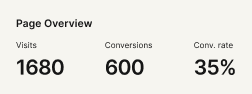

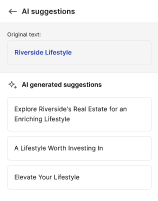

Once your landing page is live, the next step is to analyze its performance. Instapage's built-in experimentation features allow you to conduct A/B tests and use heatmaps to understand user interactions.

- A/B Testing: Experiment with different headlines, images, or CTAs to determine which performs best.

- Heatmaps: Analyze visitor behavior to see where they click, scroll, and lose interest.

- Analytics dashboard: Use the insights gained to continuously tweak and improve your landing pages.

In summary, creating a compelling landing page for reverse mortgage companies can significantly impact your conversion rates. By utilizing Instapage’s powerful features, you can enhance brand trust and customer loyalty.

Start today by visiting Instapage and see how you can transform your approach to online lead generation for reverse mortgages.

Get more out of Create your web page for reverse mortgage companies

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to create your web page for reverse mortgage companies in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started