Make your tailored product page for Loan processors

Empower Loan processors with Instapage to deliver impactful product page experiences and boost conversions.

Create your product page for Loan processors with Instapage

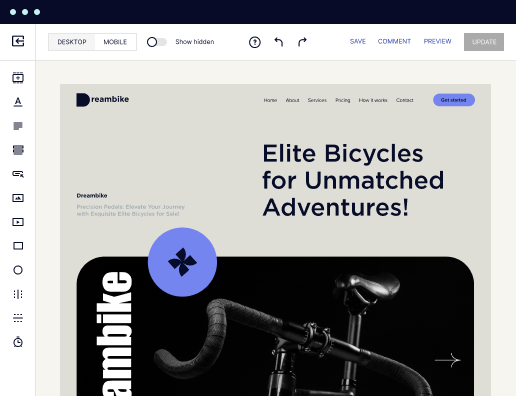

Designing a product page specifically for loan processors requires an understanding of both user needs and effective marketing strategies. Instapage's intuitive landing page creation platform is tailored to empower marketers, allowing easy customization to engage potential clients effectively. In this guide, we will outline the steps to create a compelling product page that maximizes conversions and enhances customer trust.

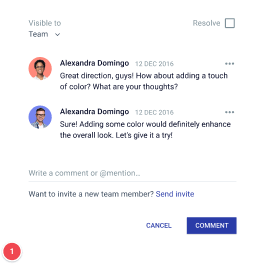

Understanding Your Audience

Identifying your core audience is crucial for a successful loan processor product page. As you begin this process, consider the demographics and pain points of your potential clients. Factors such as whether they're from the education sector or tech/SaaS can influence the design and messaging of your page. With Instapage’s tools, you can analyze this data effectively, allowing you to tailor your content accordingly.

- Market segmentation helps identify specific demographics to tailor your messaging.

- Utilizing tools like customer surveys will uncover key pain points to address.

- Engage in competitive analysis to gauge what works in your industry.

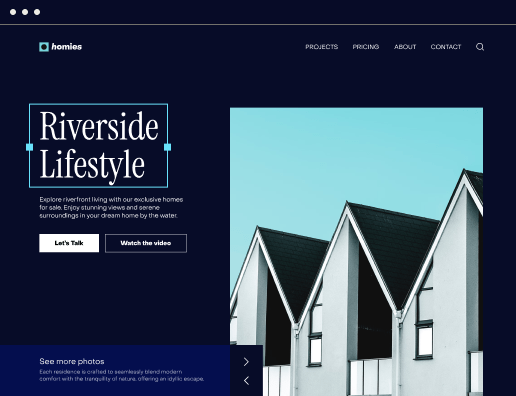

Choosing the Right Layout

Select a layout that resonates with your audience’s preference for clarity and ease of navigation. Instapage offers over 100 conversion-focused templates that are fully customizable. An effective layout presents information in a way that smoothly guides users towards your call to action.

- Responsive design ensures that your product page looks good on all devices.

- Highlight key features of your loan processing service prominently on the page.

- Include testimonials to build trust and provide social proof.

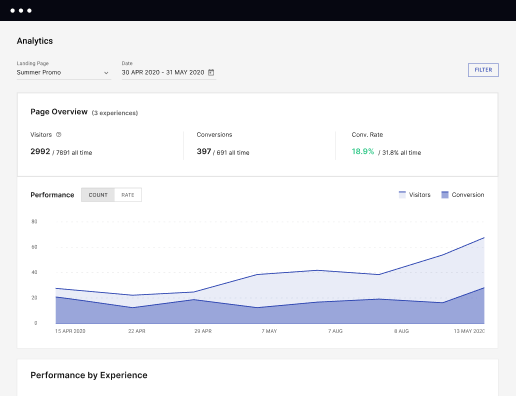

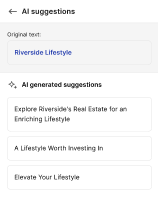

Implement A/B Testing for Optimal Results

Once your landing page is live, it's vital to gather performance data to understand user behavior. Instapage’s built-in experimentation features allow you to run A/B tests swiftly. By analyzing heatmaps and conversion rates, you can refine and enhance your page for better performance over time.

- Test different headlines to gauge which resonates more with your audience.

- Experiment with CTA placements to identify the most effective positions.

- Utilize A/B testing to compare variations of your product descriptions.

By following these steps and leveraging Instapage’s advanced features, you can create a product page for loan processors that stands out. The combination of detailed audience understanding, effective layout choices, and data-driven optimization will significantly enhance your conversion rates.

Begin building your loan processor product page today with Instapage’s user-friendly interface and powerful tools that facilitate quick customization and optimization.

Ready to enhance your marketing efforts? Start your free trial with Instapage today and see how easy it can be to create tailored landing pages that convert!

Get more out of Create your product page for Loan processors

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to create your product page for loan processors in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started