Make a captivating pricing page that makes mortgage banks shine

Instapage helps you reduce costs, increase conversions, and deliver relevant experiences for your mortgage banks.

Build your pricing page for mortgage banks – A comprehensive step-by-step guide

Creating an effective pricing page can be a game-changer for mortgage banks looking to enhance their online presence. With Instapage's extensive library of templates and customizable options, marketers can swiftly design pages that not only capture attention but also convert visitors into leads. This guide walks you through the essential steps to build your pricing page for mortgage banks, ensuring that you leverage the powerful tools at your disposal for maximum conversion rates.

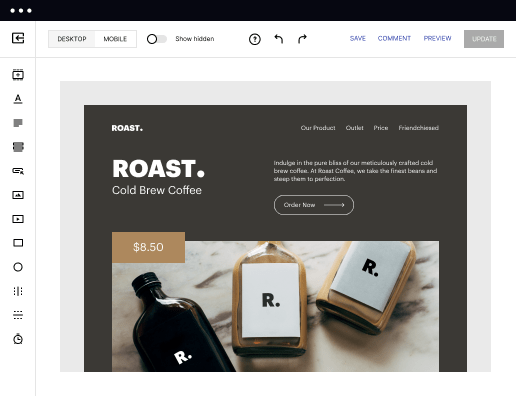

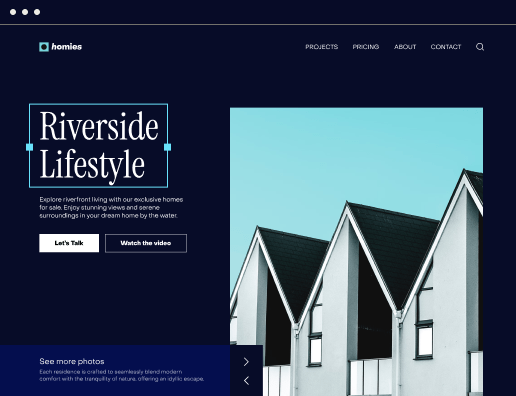

Step 1: Choose the right template

Start by selecting a landing page template that aligns with your business services. Instapage offers a variety of conversion-focused layouts specifically designed to cater to the financial services sector. When choosing a template, consider the following:

- User-Friendly Design: Ensure the layout is intuitive and highlights your pricing clearly.

- Responsive Features: The template should look great on both desktop and mobile devices.

- Customization Options: Opt for a template that allows for easy modifications to fit your brand's aesthetic.

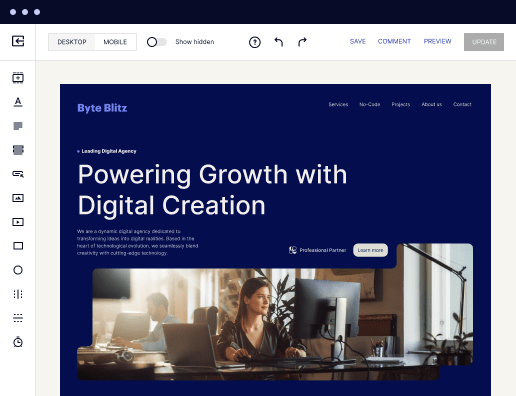

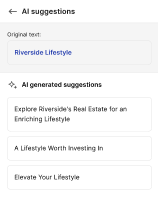

Step 2: Integrate dynamic content

Personalization is key when creating your pricing page for mortgage banks. Utilize Instapage’s dynamic text replacement feature to customize the experience based on the audience. Tailor the content based on specific metrics, such as location, to respond to user needs effectively. Incorporate elements like:

- Local Data: Use geographic information to display relevant pricing plans that resonate with prospective clients in specific regions of the USA.

- Audience-Specific Messaging: Craft messages that speak directly to different segments of your target audience, enhancing customer relevance.

- Adaptive Call-to-Action: Adjust your CTA based on visitor behavior to improve conversion rates.

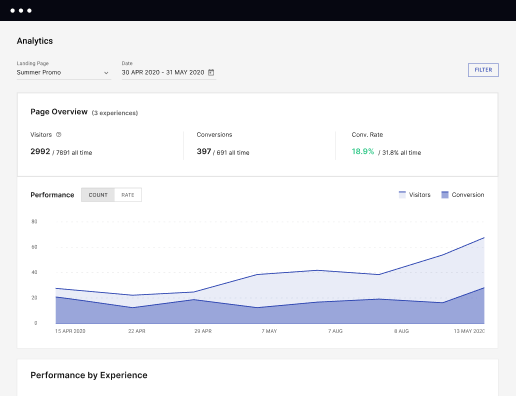

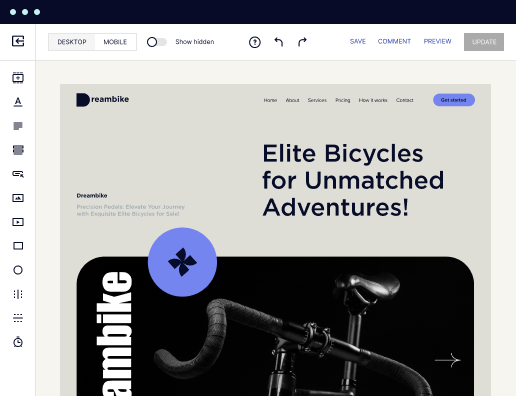

Step 3: Optimize for conversions

Optimization doesn’t end with creating your landing page. Utilize A/B testing to ascertain which elements perform best. Take advantage of Instapage’s built-in experimentation features, such as:

- Heatmaps: Analyze user interactions to understand how visitors navigate your page.

- Performance Dashboard: Utilize analytics to track engagement metrics and make data-driven improvements.

- Testing Variants: Experiment with different headings, images, or CTAs to identify what compels users to convert.

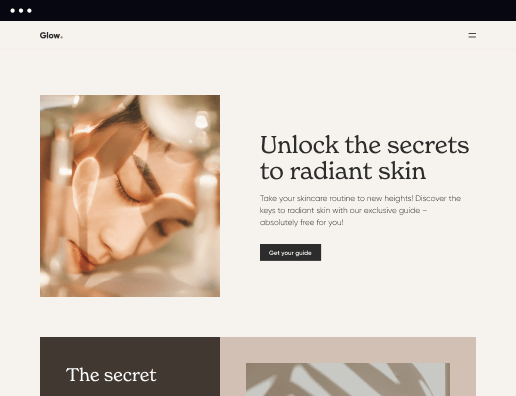

Following these steps will equip your mortgage bank with a pricing page that not only showcases your offerings but also fosters customer trust and loyalty. To further enhance your strategy, consider leveraging Instapage’s collaborative features to streamline production and feedback.

Building a pricing page for mortgage banks with Instapage is not just about aesthetics; it’s about crafting an experience that converts potential leads into loyal customers. Enhance your digital marketing efforts by following these essential steps and utilizing the tools available at your fingertips.

Ready to create your pricing page? Start with Instapage today and explore how its robust features can turn visitors into conversions.

Get more out of Build your pricing page for mortgage banks

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to build your pricing page for mortgage banks in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started