A go-to one pager software for Mortgage loan processors to create professional websites

Enjoy a range of website building and optimization options our one pager creator for Mortgage loan processors offers, from affordable to premium, without needing technical skills.

Enhancing mortgage loan processing with One pager software

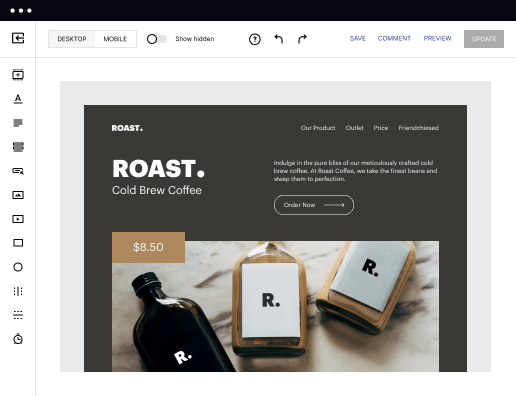

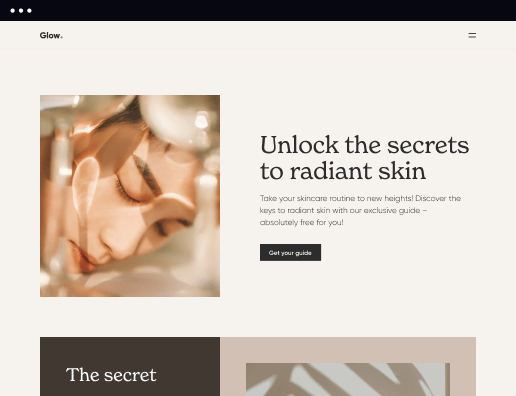

Creating efficient one-pager documents is essential for mortgage loan processors. With Instapage's intuitive interface, you can design landing pages that streamline communications and highlight key offerings. Leverage more than 100 customizable layouts tailored to boost conversions while enhancing user engagement through personalization.

Understanding the role of One pager software in mortgage lending

One pager software simplifies the display of essential mortgage information, making it accessible and visually appealing. A well-structured one-pager can effectively present loan options, eligibility requirements, and corresponding benefits, enabling faster decision-making for both lenders and borrowers.

- Increased clarity: Presenting loan details in a concise format reduces confusion and enhances understanding.

- Visual appeal: Customize designs to capture attention and maintain reader engagement.

- Enhanced branding: Maintain consistent brand messaging while delivering relevant loan information.

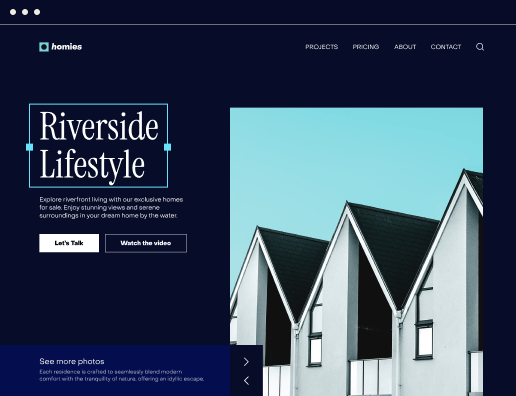

Step 1: Choosing the right templates

Select templates within Instapage that resonate with your target audience in the mortgage sector. Look for those that incorporate industry-specific elements to foster trust and confidence.

- Focus on layout: Utilize templates that emphasize key loan attributes and ensure easy navigation.

- Include testimonials: Incorporating customer testimonials can elevate brand trust and encourage conversions.

- Mobile optimization: Ensure that your one-pager adapts to various devices for accessibility.

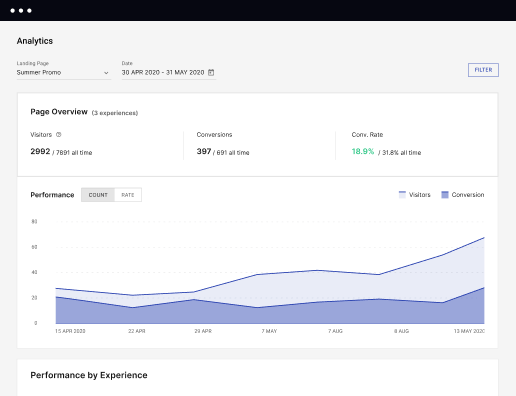

Step 2: Optimizing with data-driven insights

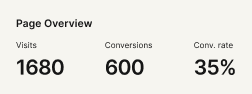

Use Instapage's built-in analytics to monitor user interactions with your one-pager. Implement A/B testing to refine content and improve conversion rates based on real user data.

- Identify hotspots: Utilize heatmaps to see where users click most, allowing for targeted improvements.

- A/B testing variations: Experiment with different headlines, images, and CTAs to discover what resonates best.

- Track performance metrics: Use analytics dashboards to monitor traffic, conversion rates, and improvement over time.

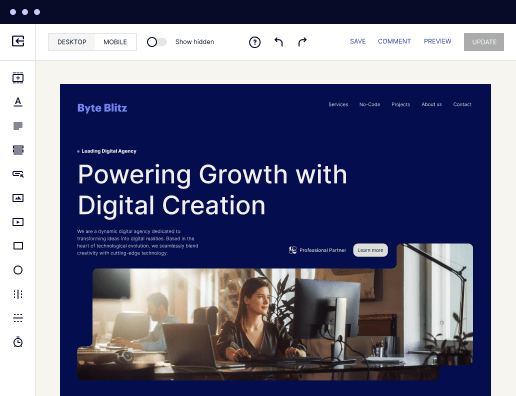

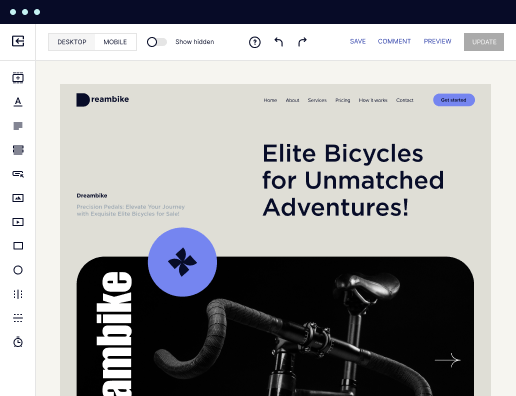

Step 3: Personalizing the user experience

Personalization enhances engagement, especially in the competitive mortgage industry. Utilize features like dynamic text replacement to tailor messages for different segments of your audience.

- Segment audiences: Create different one-pagers for various demographics or credit profiles.

- Dynamic content: Modify messaging based on user behavior or previous interactions with your brand.

- Metric tracking: Continuously assess the impact of personalization on conversion rates and adjust strategies accordingly.

Creating an effective one-pager software solution transforms the way mortgage loan processors communicate with clients. Tailoring content for maximum impact ensures that your marketing efforts are met with higher conversion rates.

Start leveraging Instapage for your one-pager software needs today and watch as your mortgage loan processing efficiencies soar. Sign up now for a free trial!

Get more out of One pager software for Mortgage loan processors

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See one pager software for mortgage loan processors in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started