Make your personalized waitlist signup page for invoice factoring companies

Deliver personalized experiences with waitlist signup page that build brand trust for invoice factoring companies and foster customer loyalty.

Create an effective waitlist signup page for invoice factoring companies

Building a compelling waitlist signup page for invoice factoring companies is crucial to capture leads and enhance customer engagement. With Instapage, marketers have the tools to create dynamic landing pages that cater to specific audiences in sectors such as Business Services, Marketing and Advertising, Tech/SaaS, Education, Energy & Utilities, Financial Services, Government, and Insurance in the USA.

Understanding your audience

Before designing your signup page, understanding your target audience is essential. Identify the unique pain points and needs of invoice factoring companies and tailor your message accordingly. Insights into audience behavior can inform your content strategy and page design.

- Conduct market research: Gather data on demographics, preferences, and challenges faced by invoice factoring companies.

- Utilize audience personas: Create detailed profiles of your ideal audience segments to guide content creation.

- Analyze competitor offerings: Evaluate other invoice factoring companies' waitlist pages to identify gaps and opportunities.

Designing the waitlist signup page

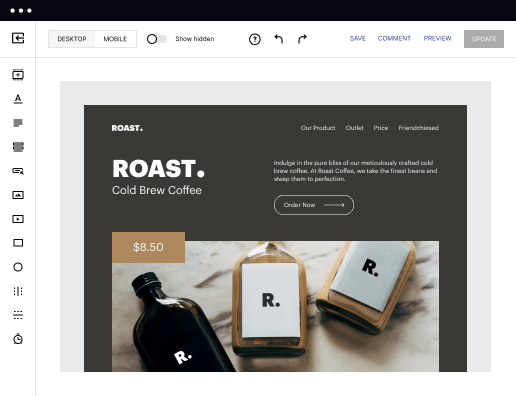

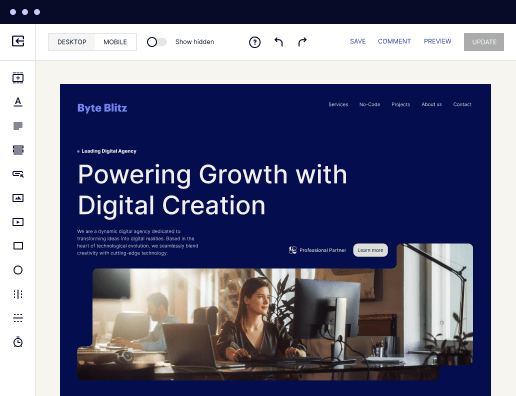

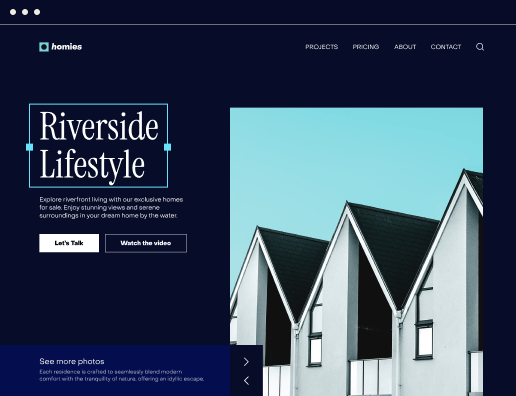

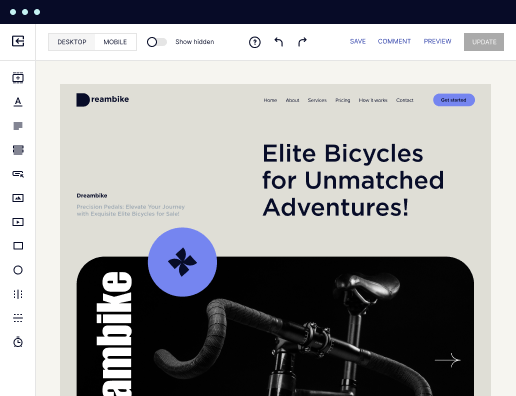

The design of your signup page is critical for conversion. Use Instapage's 100+ customizable templates and Instablocks to create an attractive and user-friendly experience.

- Choose a clean layout: Ensure that the design is visually appealing and not overcrowded, with clear calls-to-action (CTAs).

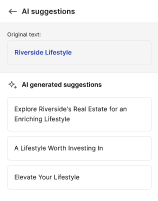

- Incorporate dynamic text replacement: Personalize the page by dynamically changing text based on the user's origin, enhancing relevance.

- Add testimonials and trust signals: Include testimonials from existing clients and trust badges to increase credibility and encourage signups.

Optimizing for conversions

After designing your waitlist signup page, it's vital to implement optimization strategies that enhance user engagement and conversion rates.

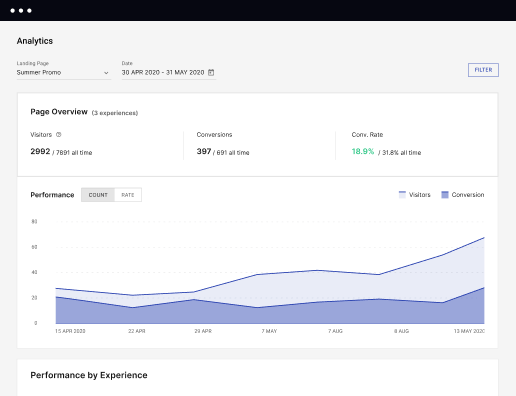

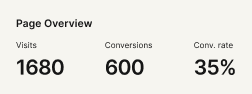

- Conduct A/B testing: Test different headlines, images, and button placements to determine what resonates best with your audience.

- Utilize heatmaps: Analyze user interactions on your page to understand where visitors click and how they navigate.

- Integrate analytics tools: Monitor your page's performance and track key metrics to refine your strategies continually.

Creating a waitlist signup page for invoice factoring companies can effectively grow your customer base and enhance brand loyalty. By leveraging Instapage's features, you can craft a highly relevant and conversion-oriented experience.

Ready to get started on your waitlist signup page? Explore Instapage's robust features to make your project a success!

Get more out of Make your waitlist signup page for invoice factoring companies

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started