- Home

- Functionalities

- Landing Page Software Features for Professionals

- Make your click-through page for Mortgage loan officers

Make your tailored click-through page for Mortgage loan officers

Empower Mortgage loan officers with Instapage to deliver impactful click-through page experiences and boost conversions.

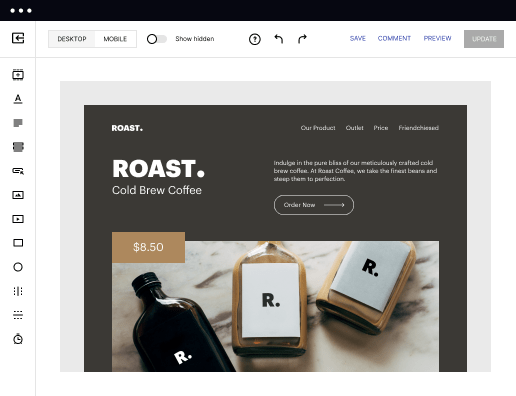

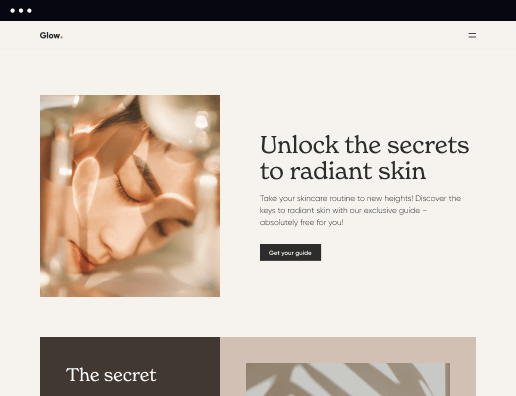

Build landing pages that get results

Build landing pages that get results

Drive ad campaign performance using targeted landing pages. With over 500+ layouts, AI-content generation, built-in collaboration, Instablocks®, and quick page load technology, you can easily create landing pages that deliver an unparalleled user experience that gets more people buying.

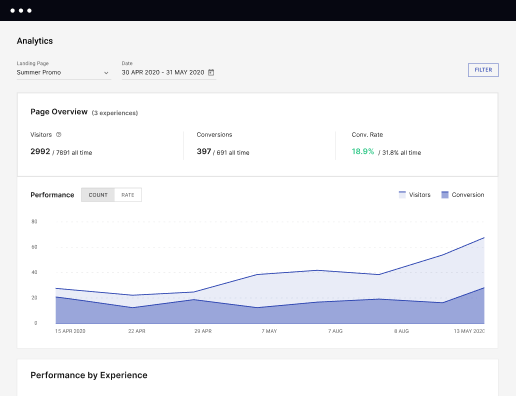

Boost results through landing page optimization

Boost results through landing page optimization

Optimize your landing pages using Instapage’s variety of testing tools. Track and analyze user behavior with heatmaps, run A/B testing to single-out the best performing version, or launch AI-assisted experiments that automatically analyze ad traffic and route it to best-performing.

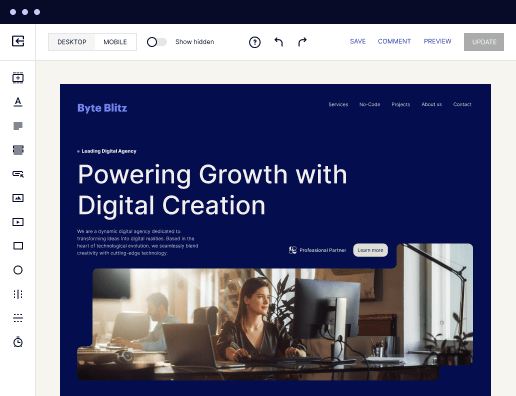

Personalize experiences for higher engagement and ROI

Personalize experiences for higher engagement and ROI

Craft unique and high-performing landing pages that align with your ad messaging and resonate with your target audience. By crafting a landing page experience that resonates with your audience, you'll engage more visitors, maximize conversions, and reduce acquisition costs.

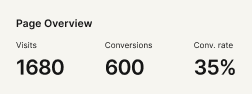

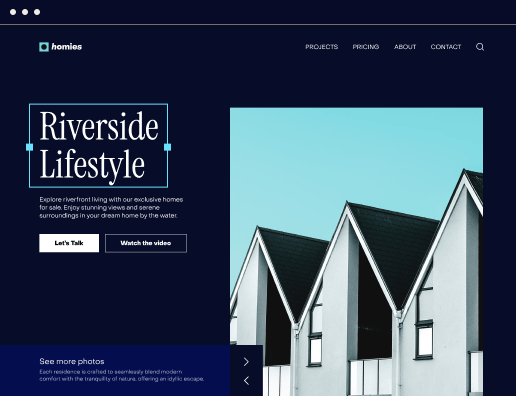

Maximize campaign efficiency with ad mapping

Maximize campaign efficiency with ad mapping

Efficiently manage campaigns by visualizing your ads and mapping them to corresponding landing pages in one place. Define what campaigns need a personalized experience and connect them with relevant ads to increase conversion rates and decrease CPA.

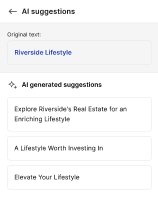

Power up landing pages with AI

Power up landing pages with AI

Instantly create high-performing content for each audience segment and separate ad campaigns with the AI assistant. From catchy headlines to converting CTAs for A/B tests – access and use AI directly on your Instapage. No more writer’s block or workflow interruptions.

Improve alignment across your creative team

Improve alignment across your creative team

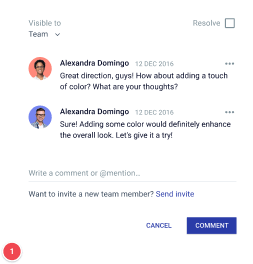

Get your campaigns off the ground faster with efficient teamwork that happens in real time. Empower your team members to provide immediate feedback, make edits to page versions, and securely share information with outside stakeholders all from a single secure space.

Use an intuitive site builder to create your tailored click-through page for Mortgage loan officers

The task to create your tailored click-through page for Mortgage loan officers depends on your goals and resources. If you're aiming for a unique, tailor-made site, working with a web designer is probably the way to go. They can surely craft something that's perfectly aligned with your concept. However, if you're just getting your feet wet and budget is a concern, don't worry. Web page creators like Instapage are an excellent choice.

Instapage offers an affordable and user-friendly way to get your site up and running without the need for deep technical skills or a considerable budget. And here’s how to do it:

Follow these steps to build your tailored click-through page for Mortgage loan officers

- Create an account with Instapage. Set up your account, select a plan, and register for a free 14-day trial.

- Proceed to make your tailored click-through page for Mortgage loan officers. In your dashboard, hit CREATE PAGE → pick between a pre-uploaded template or a blank canvas for a custom design.

- Personalize the look of your page. Use the editor to add text and images and personalize your page's layout to reflect your brand's identity.

- Customize your page settings to enhance user engagement. Add dynamic elements like forms or CTAs and adjust settings for SEO and social media for better functionality.

- Check the responsiveness of your web page. Check your page on mobile devices and desktop clients.

- Add the last details. Verify metadata, gather collaborative feedback, integrate analytics, and set notifications before going live.

- Implement advanced features: Utilize tools like A/B testing to refine and enhance your page's performance.

Don’t delay. Start your journey with Instapage and create your online presence while keeping things affordable. Try our super user-friendly web builder today!

Get more out of Make your click-through page for Mortgage loan officers

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

“Instapage gives us the ability to tailor our landing page content and layout to tell a unique story for each geographical target. The platform also enables us to create different variations with content that performs well for each unique channel. Every marketing team needs this!”

"Instapage has truly maximized our digital advertising performance by enabling us to offer matching, personalized experiences for every ad and audience. Now we can scale our landing page experiences as efficiently and effectively as we scale the ads themselves."

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

“Instapage gives us the ability to tailor our landing page content and layout to tell a unique story for each geographical target. The platform also enables us to create different variations with content that performs well for each unique channel. Every marketing team needs this!”

"Instapage has truly maximized our digital advertising performance by enabling us to offer matching, personalized experiences for every ad and audience. Now we can scale our landing page experiences as efficiently and effectively as we scale the ads themselves."

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

Leading the way in building high-performing landing pages

FAQs

How do Templates assist you to build your click-through page for Mortgage loan officers?

Templates are ready-made industry-specific website landing page layouts that you can use. Every template is customizable and designed to drive your conversions, and you don’t need any coding knowledge to implement them. Instapage offers more than 500 templates you can use to make your click-through page for Mortgage loan officers.

How do you optimize your click-through page?

Landing page optimization is the process of enhancing your page components to boost your conversions. All Instapage layouts are pre-optimized for your convenience. Simultaneously, it is possible to try out Instapage’s AI tools that help you with your A/B tests: AI content generation and AI Experiments tools for the best results. When you create your click-through page for Mortgage loan officers, be sure always to test different variations and versions of your page. Learn other Instapage tools for the best optimization of your ad campaign right now.

Can I integrate a CRM into my click-through page?

Yes, you can easily integrate more than 120 marketing tools, from CRM to third-party analytics. Gain access to your Dashboard and click on your account. Pick Workspace settings and then click on the Integrations page. Finalize your configurations and optimize your productivity without stress.

Does Instapage offer a free trial?

Yes! Instapage offers a 14-day trial to discover flexible and safe tools that simplify the landing page creation process for small teams and companies. Create and edit your landing pages, drive conversions, and handle your analytics easily in a single place. Start your free trial right now!

See how to make your click-through page for mortgage loan officers in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started

People also ask about Make your click-through page for Mortgage loan officers

How do MLOS make money?

The typical MLO is paid 1% of the loan amount in commission. On a $500,000 loan, a commission of $5,000 is paid to the brokerage, and the MLO will receive the percentage they have negotiated. If the portion of the commission for the MLO is 80%, they will receive $4,000 of the $5,000 brokerage percentage fee.

How to make money as a mortgage loan officer?

Depending on what study you read, some rank typical loan officer stress levels as average while others rank the typical stress levels as above average. Ultimately, feeling confident in your work environment and skills along with properly caring for your physical and mental health can go a long way in reducing stress.

How to get clients as a mortgage loan officer?

Mortgage originators use technology to find prospects who are more likely to do deals with them, but they also can build more powerful cold-call scripts that are tailored specifically to the borrowers. They can then get directly in touch with a decisionmaker.

How does a mortgage loan officer get clients?

Mortgage loan officers get clients through networking, referrals, online marketing, and community engagement. Relationships with real estate agents, financial advisors, and past clients can generate referrals. Social media, email marketing, and educational workshops can also attract new clients.

How much commission does a mortgage loan officer make?

Some loan officers are paid a flat salary or an hourly rate, while others earn a commission based on sales in addition to their normal salary. Most loan officers are paid between 0.2% and 2% of the total loan amount in commission, ing to Indeed.

Do mortgage loan officers make good money?

A Very Good Salary Range Compensation is always an important consideration when choosing a career. Being a mortgage loan officer is known to be financially rewarding. ing to Indeed.com, the average base salary per year for a loan officer in the U.S. is over $186,000. By all accounts, that is a desirable salary.

Do mortgage loan officers make cold calls?

Theyʼre often paid on commission, meaning a percentage of the loan amount will go to the mortgage loan officer. This amount can come from one of two places: either the loan originator (like the bank or mortgage seller), or from a loan origination fee paid by the borrower.