Make your personalized pre-launch page for auto loan companies

Deliver personalized experiences with pre-launch page that build brand trust for auto loan companies and foster customer loyalty.

Create your pre-launch page for auto loan companies with Instapage

A compelling pre-launch page for auto loan companies can significantly enhance your online marketing efforts, providing a streamlined experience that captures leads effectively. With Instapage's user-friendly features, you can create conversion-focused landing pages quickly and efficiently, without needing any coding skills. This guide will walk you through the essential steps to build a successful pre-launch page that boosts your brand's presence and trust within the financial services sector.

Understanding the Purpose of a Pre-Launch Page

Before diving into the creation process, it’s vital to understand the purpose of a pre-launch page. It serves as a dedicated online space designed to capture interest and leads before your official launch. The benefits include:

- Lead Generation: Capture potential customer information and create a list for future marketing efforts.

- Brand Awareness: Highlight your auto loan offerings and inform potential customers about what to expect.

- SEO Benefits: Improve online visibility with targeted keywords related to auto loans in your content.

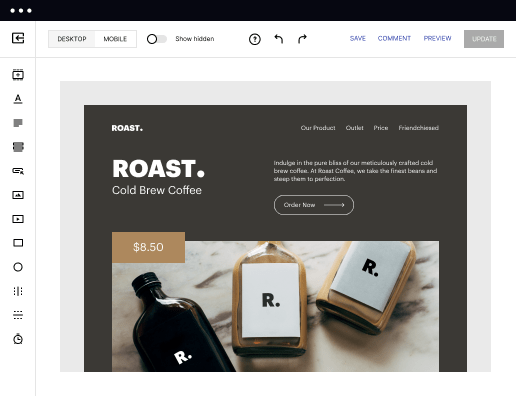

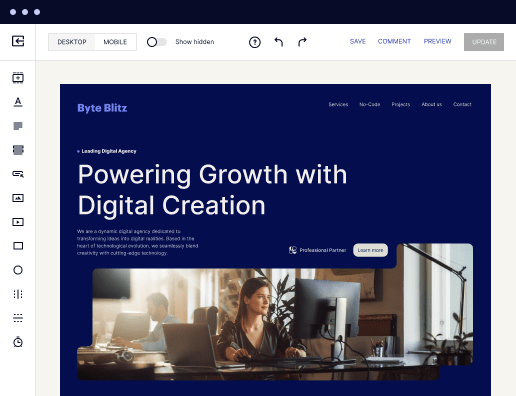

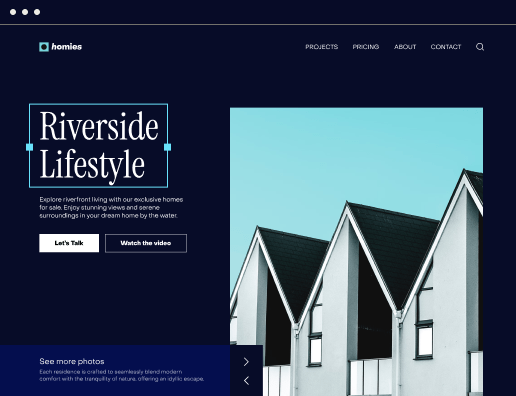

Step 1: Choosing the Right Template

Getting started with Instapage is simple thanks to its library of over 100 customizable templates. Choose a layout that aligns with your brand identity and resonates with your target audience. When selecting a template, consider the following:

- Relevance: Ensure the template is specifically designed for financial or auto loan products.

- Flexibility: Opt for a design that allows for quick edits, allowing you to adapt as necessary.

- Mobile Responsiveness: Check that your chosen template performs well on mobile devices, ensuring accessibility.

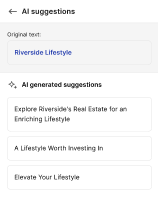

Step 2: Customizing Your Page Content

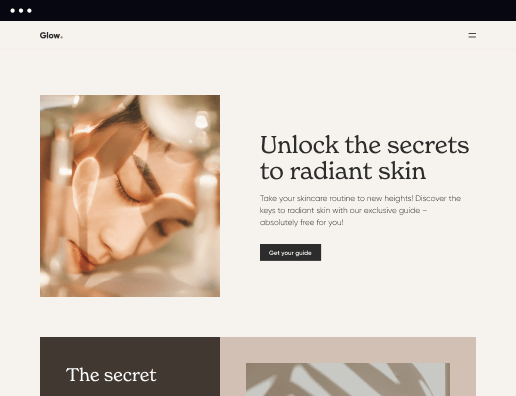

Personalizing the content on your pre-launch page is crucial for engaging your audience. Focus on clear and compelling messaging that addresses their specific needs. Include these elements:

- Value Proposition: Clearly state how your auto loan services can benefit potential customers.

- Call-to-Action (CTA): Use strong CTAs to encourage sign-ups or inquiries, making it easy for visitors to express interest.

- Visual Hierarchy: Employ a clear visual structure that guides visitors through your offerings effectively.

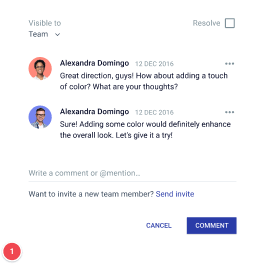

Step 3: Implementing Lead Capture Elements

The ultimate goal of your pre-launch page is to capture leads. Utilize Instapage's built-in lead capture forms and ensure your page includes:

- Simple Forms: Keep sign-up forms short to prevent drop-offs.

- Incentives: Offer eBooks or discounts as an incentive for users who enter their information.

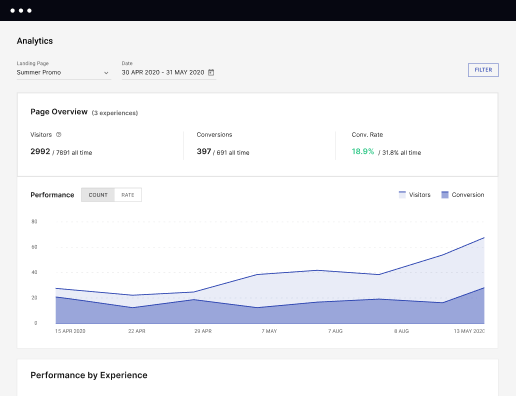

- Monitoring Tools: Use heatmaps and performance analytics to understand visitor engagement.

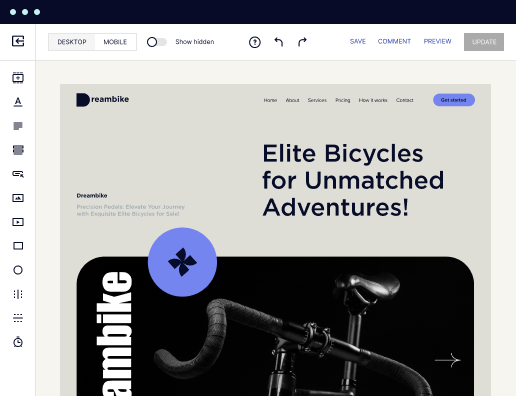

Finally, ensure your pre-launch page is optimized for conversions with A/B testing features offered by Instapage. This data-driven approach allows you to experiment with different designs and messaging, iterating based on performance.

Ready to create a stunning pre-launch page that drives conversions and builds trust? Start using Instapage today to unlock your marketing potential!

Get more out of Create your pre-launch page for auto loan companies

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to create your pre-launch page for auto loan companies in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started