- Home

- Functionalities

- Landing Page Software Features for Organizations

- Create your home page for credit reporting agencies

Make your personalized home page for credit reporting agencies

Deliver personalized experiences with home page that build brand trust for credit reporting agencies and foster customer loyalty.

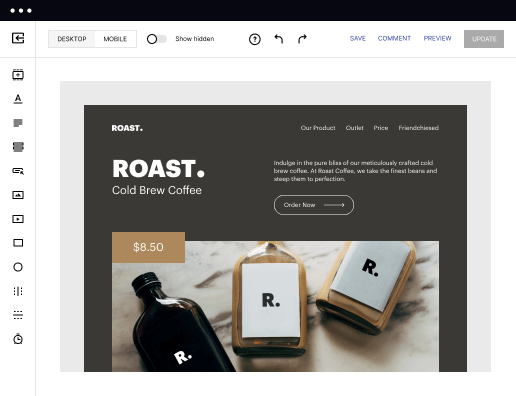

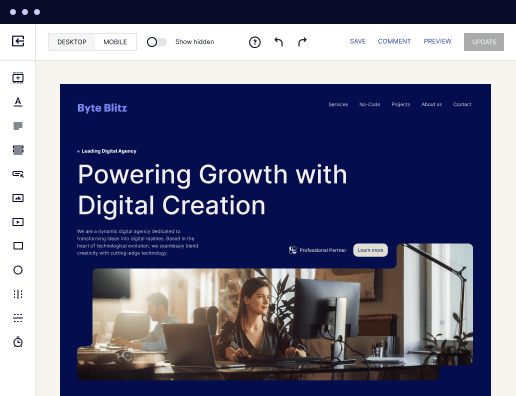

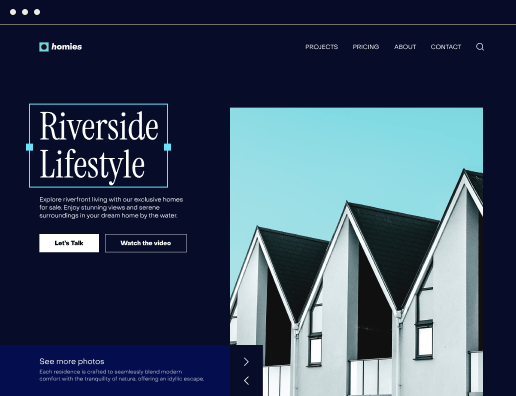

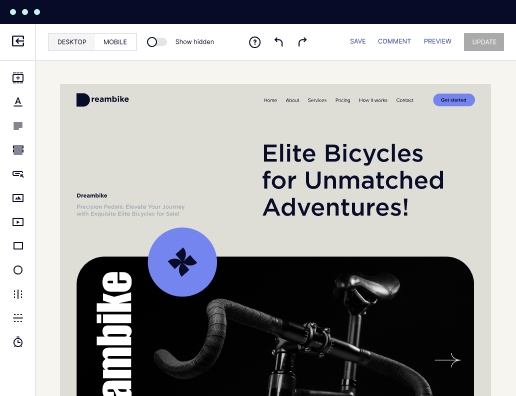

Build landing pages at scale without coding

Build landing pages at scale without coding

With Instapage’s intuitive drag-and-drop page builder with diverse design features, over 5,000 fonts, and 33 million images, anyone can easily create professional-looking, top-performing landing pages without technical or design skills.

Increase conversions with fast-loading pages

Increase conversions with fast-loading pages

Reduce bounce rates and increase engagement with lightning-fast landing pages. Our Thor Render Engine™, back-end technology delivers 3x faster-loading landing pages so you won't lose a single lead.

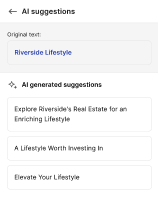

Boost productivity with AI content generation

Boost productivity with AI content generation

Scale page creation and overcome writer’s block or generate copy variations for A/B tests with the AI Content Generator. Create high-quality and engaging content for each audience and ad group, including paragraphs, CTAs, or entire copies directly in the Instapage builder.

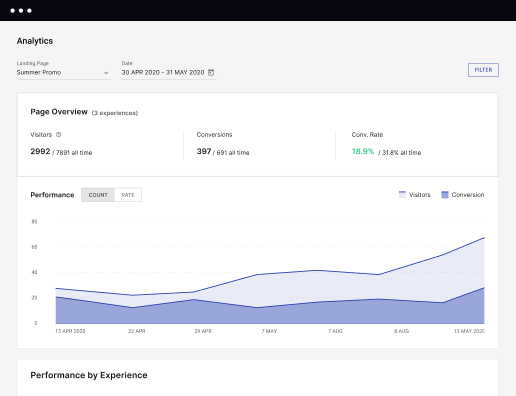

Make the most of analytic insights

Make the most of analytic insights

Get data-backed insights about your campaigns and page performance so you can test and optimize for higher ROI. Track visitors, conversions, conversion rates, cost-per-visitor, and cost-per-lead in real time. View heatmaps to understand user behavior - all without leaving Instapage.

Optimize traffic with AI experiments

Optimize traffic with AI experiments

Improve page performance fast with an AI-powered experimentation tool. It tracks your ongoing experiments and directs traffic to top-performing page variations, no matter how many versions you have. Achieve faster optimization insights without sacrificing the quality of your results.

Secure your business data

Secure your business data

Instapage safeguards business data and your customer's privacy with enterprise-grade security measures, including SSL certification, two-factor authentication, SSO, and more. Instapage also maintains compliance with GDPR, SOC 2, and CCPA regulations.

Create your home page for credit reporting agencies with Instapage

Building a powerful and effective home page for credit reporting agencies starts with understanding the unique needs of your audience. By using Instapage, marketers can create tailored landing pages that enhance user experience, drive conversions, and ultimately increase brand trust. With over 100 conversion-focused layouts at your fingertips, developing a landing page that resonates with your target audience in the USA has never been easier.

Step 1: Define Your Target Audience

Knowing your audience is crucial when creating your home page. Define their demographics, interests, and needs specific to credit reporting. This insight will help you tailor your content, design, and messaging. Engage with your audience through surveys or feedback forms to gather valuable data.

Step 2: Utilize Conversion-Focused Layouts

Instapage offers a diverse library of landing page templates that are optimized for high conversions. Choose a layout that best represents your credit reporting agency and aligns with your brand's voice. Focus on the following elements:

- Clear headlines: Ensure your main message is immediately visible.

- Call-to-action buttons: Strategically place CTAs to guide users toward taking specific actions.

- Visual elements: Use relevant images or videos to enhance user engagement.

Step 3: Optimize with A/B Testing

Regularly testing your landing pages is key to improving conversion rates. Utilize Instapage’s built-in experimentation features. Implement the following strategies:

- A/B test different headlines and CTAs to see which performs better.

- Analyze heatmaps to see where users are clicking or dropping off on your page.

- Utilize analytics dashboards to track performance and audience behavior.

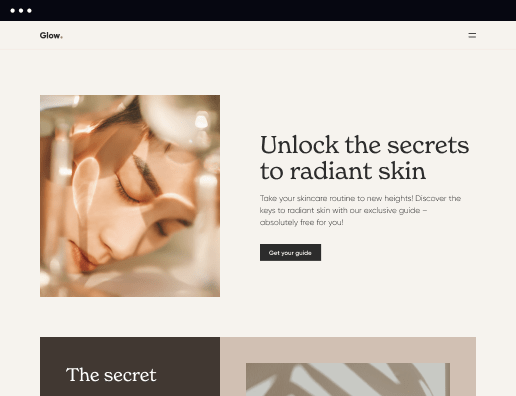

Step 4: Personalize User Experience

Personalization ensures that your landing page speaks directly to individual users. Leverage dynamic text replacement to customize messaging based on user demographics or behavior. Additionally, use AdMaps to align your ads with the respective landing pages users will see.

- Dynamic text: Update your content based on user profiles for higher engagement.

- Segmented audience metrics: Understand how different segments interact with your page.

- Remarketing strategies: Target past visitors with tailored content.

In conclusion, using Instapage allows credit reporting agencies to create impactful home pages that foster conversions and enhance brand trust. With the right tools and strategies, your landing pages can reflect the unique offerings of your services effectively.

Take the first step towards creating your own optimized home page with Instapage. Start building today and watch your conversions soar!

Get more out of Create your home page for credit reporting agencies

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

“Instapage gives us the ability to tailor our landing page content and layout to tell a unique story for each geographical target. The platform also enables us to create different variations with content that performs well for each unique channel. Every marketing team needs this!”

"Instapage has truly maximized our digital advertising performance by enabling us to offer matching, personalized experiences for every ad and audience. Now we can scale our landing page experiences as efficiently and effectively as we scale the ads themselves."

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

“Instapage gives us the ability to tailor our landing page content and layout to tell a unique story for each geographical target. The platform also enables us to create different variations with content that performs well for each unique channel. Every marketing team needs this!”

"Instapage has truly maximized our digital advertising performance by enabling us to offer matching, personalized experiences for every ad and audience. Now we can scale our landing page experiences as efficiently and effectively as we scale the ads themselves."

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

Leading the way in building high-performing landing pages

FAQs

What is Create your home page for credit reporting agencies?

Creating a home page for credit reporting agencies involves designing a user-friendly landing page that effectively communicates your services, builds trust with potential customers, and optimizes conversion rates using tools such as Instapage.

How does Instapage help in creating a home page for credit reporting agencies?

Instapage simplifies the process of creating a home page with its extensive library of customizable templates, A/B testing features for optimization, and detailed analytics to track user behavior and engagement.

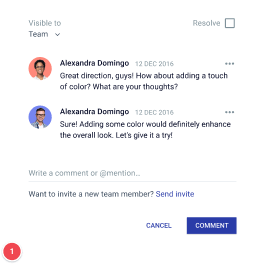

What are the key features of Instapage for creating a home page?

Instapage offers features such as responsive layouts, dynamic text replacement, collaboration tools for team input, A/B testing for optimizing performance, and analytics dashboards to measure page effectiveness.

Why is Instapage a good choice for creating a home page for credit reporting agencies?

Instapage is an excellent choice because it empowers marketers with user-friendly tools to quickly design and optimize landing pages with proven layouts that enhance user experience and increase conversion rates.

What are the benefits of using a landing page builder like Instapage?

Benefits include faster page creation, a focus on conversion optimization, the ability to personalize user experiences, and access to real-time performance analytics, leading to better decision making.

What to consider when choosing a design for a home page for credit reporting agencies?

Consider factors such as your target audience's needs, your branding elements, the importance of clear calls-to-action, and the integration of trust signals like testimonials or certifications.

What are common challenges and solutions related to creating a home page for credit reporting agencies?

Common challenges include balancing informative content with engaging design. Solutions involve leveraging A/B testing to understand user preferences and continuously iterating your design based on performance metrics.

How does Instapage address issues related to home page creation for credit reporting agencies?

Instapage provides tools that address potential issues with user engagement and conversion by offering customization options, real-time feedback mechanisms, and comprehensive analytics to inform future adjustments.

See how to create your home page for credit reporting agencies in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started

People also ask about Create your home page for credit reporting agencies

Where does Equifax get their information from?

We collect personal data from companies that offer financial products or services to consumers, like loans, financial or investment advice, or insurance. This includes banks, mortgage lenders, loan brokers, some financial or investment advisors, insurance companies, and debt collectors.

How do business report to credit bureaus?

Businesses must first establish an account with the credit bureau and then begin transferring consumer information to that service. To ensure that the business knows how to report information accurately, the various credit bureaus conduct inspections before signing a reporting contract with the business.

How does credit bureau verify information?

Credit bureaus collect biographical data to confirm your identity, like your Social Security number and address, and they review public records for financial information as well. It is common for a credit event to appear on one bureaus report but not the others.

How do companies report to credit bureaus?

Businesses must first establish an account with the credit bureau and then begin transferring consumer information to that service. To ensure that the business knows how to report information accurately, the various credit bureaus conduct inspections before signing a reporting contract with the business.

How long does it take for a company to report to credit bureau?

However, Experian says that card issuers commonly report a cardholders data at the end of each billing cycle. In actuality, every lender reports to the bureaus following its own schedule, ing to Experian, and it typically happens every 30 to 45 days.

Who reports to credit bureaus in Canada?

Credit bureaus receive information from your lenders, creditors and others. Some creditors report to both bureaus, but some may report to only one or none at all.

Which credit bureau is the most accurate?

Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving a loan.

Where do credit bureaus get their information?

Q: Where do credit bureaus get their information? A: Credit bureaus get information from your creditors, such as a bank, credit card issuer, or auto finance company. They also get information about you from public records, such as property or court records.

How are employers added to credit report?

Your employment history may be listed on your credit report if you provided information about where you work to a creditor. Lenders typically ask for employer information on credit applications to help verify your identity but theyre not obligated to report your job history to the credit bureaus.

How do creditors report to the credit bureaus?

Once every 30 days, information about a consumers ongoing credit activity is relayed directly by their creditors to the three national consumer reporting agencies separately. The consumer reporting agencies receive, compile, and maintain the history provided by the creditors and lenders.