Make your personalized opt-in page for short term loan companies

Deliver personalized experiences with opt-in page that build brand trust for short term loan companies and foster customer loyalty.

Building your opt-in page for short-term loan companies

Creating an effective opt-in page for short-term loan companies is crucial in today’s competitive online market. Instapage, with its user-friendly interface and rich library of customizable templates, allows marketing teams to swiftly design landing pages tailored for financial service audiences. This guide will highlight the essential steps and strategies needed to successfully build your opt-in page, leveraging our powerful tools to boost conversions and enhance your marketing efforts.

Why your opt-in page matters

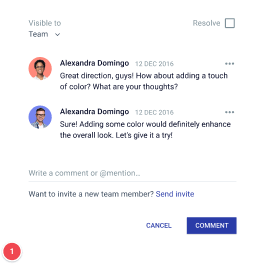

An opt-in page serves as a direct gateway for potential customers to engage with your financial products. By understanding the specific needs of your audience, you can create a personalized experience that encourages them to share their contact information. Effective opt-in pages can improve both customer loyalty and brand trust, crucial for short-term loan companies looking to maintain a competitive edge.

- Engagement: Use compelling CTAs that resonate with your audience’s urgency for financial solutions.

- Trust: Leverage testimonials and industry certifications to enhance credibility.

- Simplicity: Design a clear, distraction-free layout that emphasizes the opt-in form.

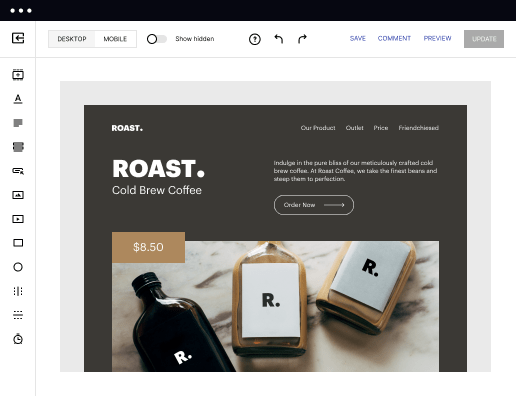

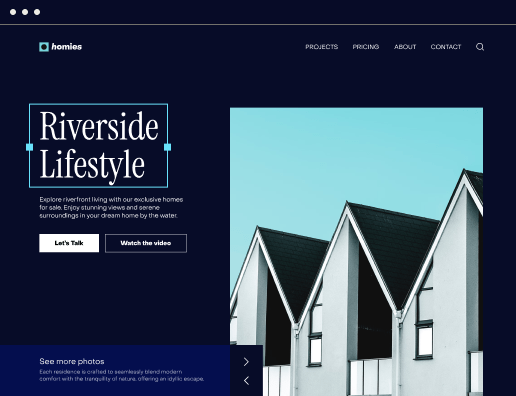

Step 1: Choose the right template

The first step in building your opt-in page is selecting a suitable template from Instapage’s extensive library. This template should align with the visual identity of your brand and cater specifically to the short-term loan sector. A well-structured template facilitates intuitive user navigation and simplifies the opt-in process.

- Select a template that highlights your unique selling points to engage visitors effectively.

- Choose layouts that feature a prominent opt-in form without clutter.

- Utilize images and local context relevant to your audience in the USA to establish familiarity.

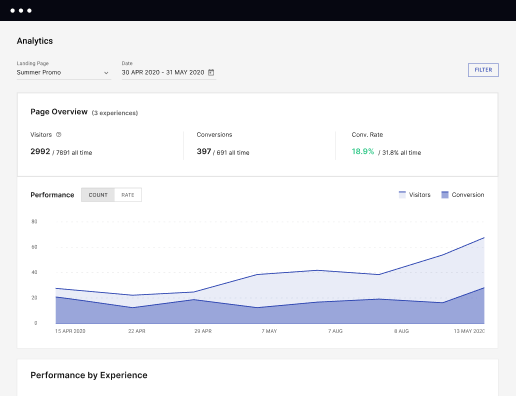

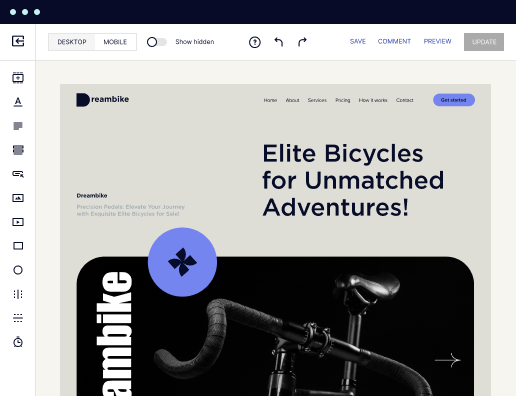

Step 2: Optimize for conversions

Once you have chosen a template, the next step is to optimize your page for maximum conversions. Utilize Instapage’s built-in A/B testing tools to experiment with different headlines, images, and calls to action to see what resonates best with your target audience. This data-driven approach helps refine your landing page.

- Analyze heatmaps to understand user interactions and adjust elements accordingly.

- Test different opt-in form placements to find the most effective positioning.

- Incorporate urgency-driven language that prompts immediate action, such as 'Limited Time Offer'.

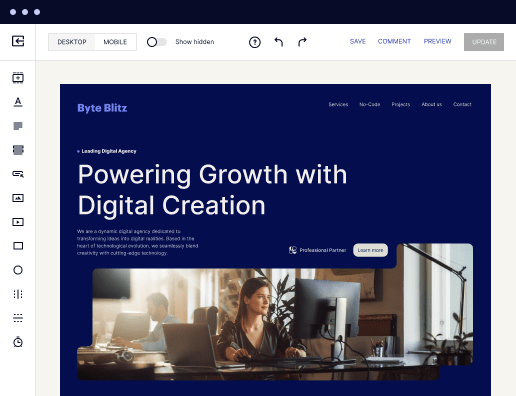

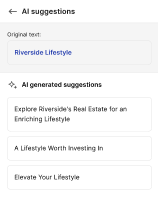

Step 3: Personalize the experience

Personalization is key in attracting and retaining potential clients, especially within the short-term loan industry. Instapage allows you to dynamically change text and offers based on user data, ensuring that each visitor feels addressed and valued on a personal level.

- Utilize dynamic text replacement to match user searches with relevant content on the page.

- Employ AdMaps to align paid ads with corresponding landing pages for a seamless experience.

- Track visitor data to tailor messages according to user demographics or interests.

In conclusion, building an efficient opt-in page for short-term loan companies involves choosing appropriate templates, optimizing for conversions, and personalizing user experiences. By leveraging Instapage's features, you can significantly enhance your marketing strategy.

Ready to take your marketing efforts to the next level? Start creating your opt-in page for short-term loan companies today with Instapage and see immediate improvements in engagement and conversion rates.

Get more out of Build your opt-in page for short term loan companies

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to build your opt-in page for short term loan companies in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started