- Home

- Functionalities

- Landing Page Software Features for Professionals

- Create your opt-in page for Mortgage loan processors

Make your tailored opt-in page for Mortgage loan processors

Empower Mortgage loan processors with Instapage to deliver impactful opt-in page experiences and boost conversions.

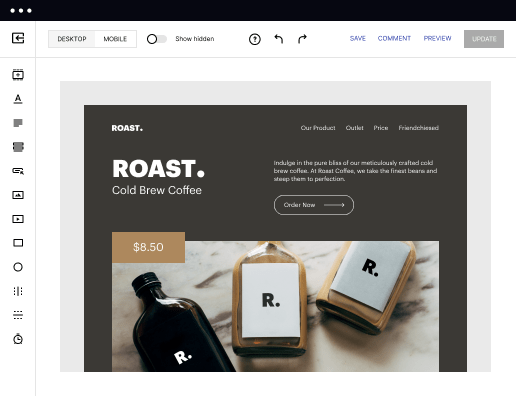

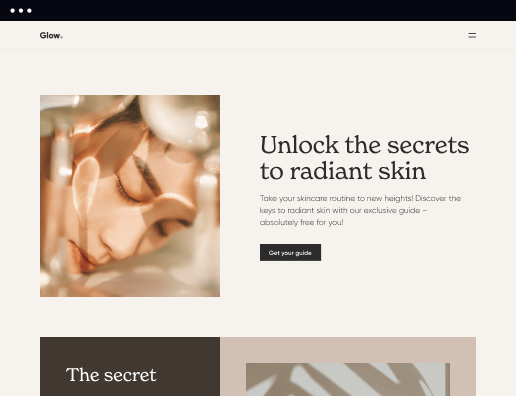

Build landing pages that get results

Build landing pages that get results

Drive ad campaign performance using targeted landing pages. With over 500+ layouts, AI-content generation, built-in collaboration, Instablocks®, and quick page load technology, you can easily create landing pages that deliver an unparalleled user experience that gets more people buying.

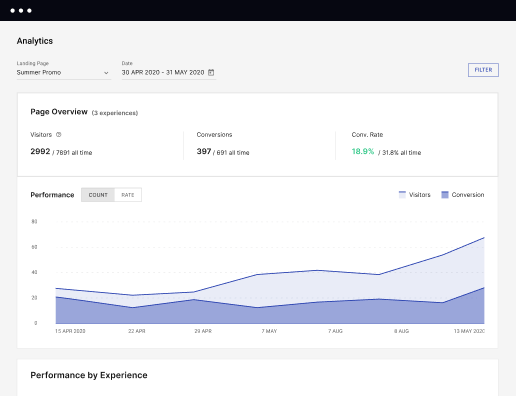

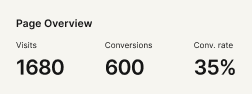

Boost results through landing page optimization

Boost results through landing page optimization

Optimize your landing pages using Instapage’s variety of testing tools. Track and analyze user behavior with heatmaps, run A/B testing to single-out the best performing version, or launch AI-assisted experiments that automatically analyze ad traffic and route it to best-performing.

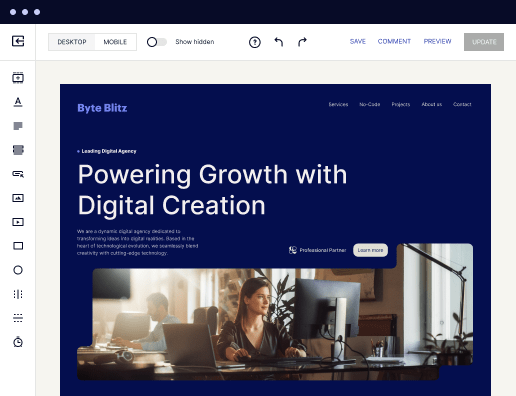

Personalize experiences for higher engagement and ROI

Personalize experiences for higher engagement and ROI

Craft unique and high-performing landing pages that align with your ad messaging and resonate with your target audience. By crafting a landing page experience that resonates with your audience, you'll engage more visitors, maximize conversions, and reduce acquisition costs.

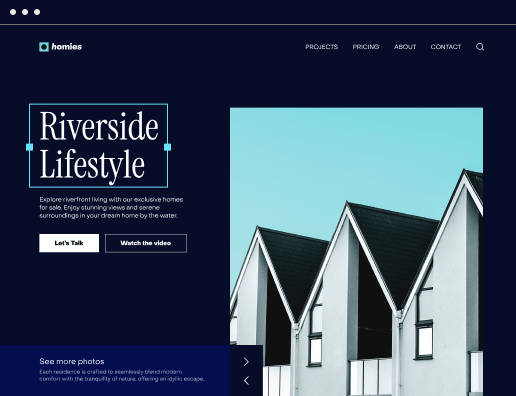

Maximize campaign efficiency with ad mapping

Maximize campaign efficiency with ad mapping

Efficiently manage campaigns by visualizing your ads and mapping them to corresponding landing pages in one place. Define what campaigns need a personalized experience and connect them with relevant ads to increase conversion rates and decrease CPA.

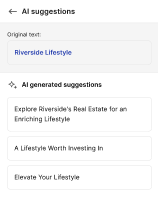

Power up landing pages with AI

Power up landing pages with AI

Instantly create high-performing content for each audience segment and separate ad campaigns with the AI assistant. From catchy headlines to converting CTAs for A/B tests – access and use AI directly on your Instapage. No more writer’s block or workflow interruptions.

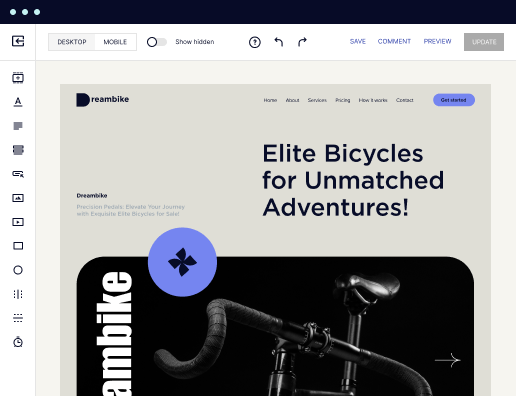

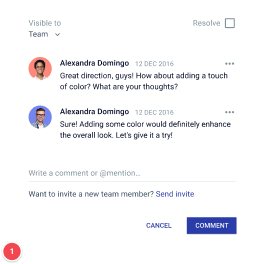

Improve alignment across your creative team

Improve alignment across your creative team

Get your campaigns off the ground faster with efficient teamwork that happens in real time. Empower your team members to provide immediate feedback, make edits to page versions, and securely share information with outside stakeholders all from a single secure space.

Create your opt-in page for Mortgage loan processors effectively with Instapage

Establishing your opt-in page for mortgage loan processors is essential for enhancing customer engagement and conversion rates. Instapage offers a flexible and user-friendly platform to help marketers streamline this process, allowing for the rapid creation of tailored landing pages that resonate with various audiences across the USA. With access to over 100 conversion-focused layouts and Instablocks, you can publish professional-grade pages without requiring any coding skills.

Understanding your target audience

The first step in creating an effective opt-in page is understanding your audience. Mortgage loan processors target a diverse range of consumers, and tailoring content to meet their specific needs is crucial. Identify key demographics and preferences, such as:

- Home buyers looking for mortgage options: Highlight special offers and loan products tailored to first-time buyers.

- Real estate agents seeking reliability: Emphasize your professionalism and past success stories.

- Investors exploring refinancing options: Provide insights on different financial strategies and benefits.

Utilizing Instapage’s templates and tools

With Instapage, you can easily access and customize templates designed specifically for mortgage loan campaigns. Begin by selecting a template that aligns with your marketing goals, then tailor it to your branding needs. Key features to consider in your design include:

- Dynamic text replacement: Use this feature to personalize messages for different audience segments, ensuring your opt-in page speaks directly to their interests.

- AdMaps: These help connect your ad campaigns to dedicated landing pages, enabling streamlined user experiences from click to conversion.

- Analytics dashboard: Leverage this tool to track performance metrics and optimize your landing page for better conversion rates.

Incorporating effective call-to-action strategies

An effective opt-in page must include compelling calls-to-action that encourage visitors to take immediate action. Consider these best practices for optimizing your CTAs:

- Clear and concise language: Use actionable phrases like 'Get your free quote today' or 'Join our newsletter for exclusive offers'.

- Visibility: Ensure your CTAs are prominent and visually appealing to capture attention immediately.

- Urgency: Consider implementing limited-time offers to instill a sense of urgency that drives conversions.

By following these steps, you can create a high-converting opt-in page for mortgage loan processors that not only attracts but also retains your audience's interest.

Utilizing Instapage’s tools empowers marketers across various industries to build relevant landing page experiences, optimize their strategies, and increase brand trust.

Ready to enhance your marketing strategy? Start creating high-performance opt-in pages with Instapage today and transform your conversion rates!

Get more out of Create your opt-in page for Mortgage loan processors

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

“Instapage gives us the ability to tailor our landing page content and layout to tell a unique story for each geographical target. The platform also enables us to create different variations with content that performs well for each unique channel. Every marketing team needs this!”

"Instapage has truly maximized our digital advertising performance by enabling us to offer matching, personalized experiences for every ad and audience. Now we can scale our landing page experiences as efficiently and effectively as we scale the ads themselves."

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

“Instapage gives us the ability to tailor our landing page content and layout to tell a unique story for each geographical target. The platform also enables us to create different variations with content that performs well for each unique channel. Every marketing team needs this!”

"Instapage has truly maximized our digital advertising performance by enabling us to offer matching, personalized experiences for every ad and audience. Now we can scale our landing page experiences as efficiently and effectively as we scale the ads themselves."

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

Leading the way in building high-performing landing pages

FAQs

What is Create your opt-in page for Mortgage loan processors?

Creating your opt-in page for mortgage loan processors involves designing a dedicated landing page specifically aimed at capturing leads from potential customers interested in mortgage services.

How does Instapage create an opt-in page for Mortgage loan processors work?

Instapage provides a user-friendly platform that allows marketers to quickly design, customize, and optimize landing pages using templates tailored for mortgage loan processors without needing any coding skills.

What are the key features of Instapage's opt-in page for Mortgage loan processors?

Some key features include dynamic text replacement for personalized messaging, A/B testing for optimization, and analytics tools to track page performance and user behavior.

Why is Instapage a good choice for creating an opt-in page for Mortgage loan processors?

Instapage stands out due to its comprehensive set of templates, ease of use, collaboration features, and robust data analysis tools, which collectively streamline the creation of high-converting landing pages.

What are the benefits of using a Create your opt-in page for Mortgage loan processors like Instapage?

Benefits include increased conversion rates, enhanced customer engagement through personalized experiences, and better analysis of user interactions to continually improve strategies.

What to consider when choosing a Create your opt-in page for Mortgage loan processors?

Consider aspects like audience targeting, template design flexibility, integration capabilities, and the tool's ability to provide detailed analytics for measuring success.

What are common challenges and solutions related to creating an opt-in page for Mortgage loan processors?

Challenges include low conversion rates and lack of engagement. Solutions involve using A/B testing to refine approaches and leveraging analytics to understand user behavior better.

How does Instapage address issues related to creating an opt-in page for Mortgage loan processors?

Instapage addresses these issues through built-in optimization tools, responsive design capabilities, and robust analytics that help marketers understand and improve user interaction.

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started

People also ask about Create your opt-in page for Mortgage loan processors

Do you need a degree to be a mortgage loan processor?

A high school diploma or GED is required, but many employers prefer a bachelorʼs degree in accounting or finance.

Is a loan processor a stressful job?

This is an extremely stressful career especially at first. Any field where you are managing hundreds of thousands of dollars and any one of the infinite number of moving pieces can wreck your loan and ruin your month is going to cause a few nights of loss sleep.

Do mortgage loan processors make commission?

The more loans that a mortgage officer closes, the more they can earn. Mortgage loan processors, however, are usually paid a fixed salary or hourly rate and do not earn commissions based on loan volume. Compensation for loan processors is generally more stable, though typically not as high as a loan officerʼs.

How do loan processors make money?

Mortgage lenders can make money in a variety of ways, including origination fees, yield spread premiums, discount points, closing costs, mortgage-backed securities (MBS), and loan servicing. Closing costs fees that lenders may make money from include application, processing, underwriting, loan lock, and other fees.

What is the average commission on a mortgage loan?

They typically earn a commission of around 1%-2% of the loan value, which the borrower or the lender can pay. When you take out a larger loan, your mortgage broker makes more money. A mortgage brokerʼs total compensation can be paid in various ways, including in cash or via an addition to the loan balance.

What is a processor for mortgage loans?

Mortgage Loan Processors A loan processor is a natural person who: Receives, collects, distributes, or analyzes information that is commonly used for the processing of a residential mortgage loan; and. Communicates with a consumer to obtain the information necessary for the activities described above.

How do loan processors get paid?

Mortgage loan processors, however, are usually paid a fixed salary or hourly rate and do not earn commissions based on loan volume. Compensation for loan processors is generally more stable, though typically not as high as a loan officerʼs.

Do mortgage loan officers get commission?

The typical MLO is paid 1% of the loan amount in commission. On a $500,000 loan, a commission of $5,000 is paid to the brokerage, and the MLO will receive the percentage they have negotiated. If the portion of the commission for the MLO is 80%, they will receive $4,000 of the $5,000 brokerage percentage fee.