Make your tailored click-through page for Mortgage processors

Empower Mortgage processors with Instapage to deliver impactful click-through page experiences and boost conversions.

Build your click-through page for mortgage processors

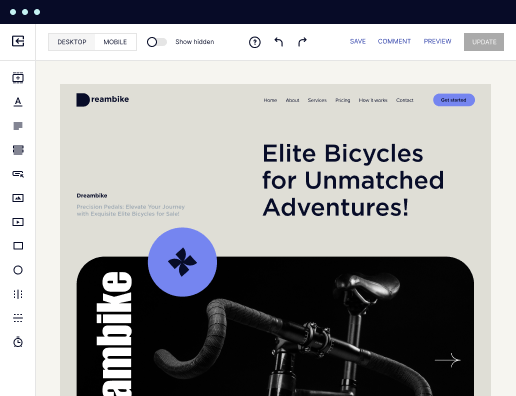

Creating an effective click-through page is crucial for mortgage processors aiming to drive conversions and enhance customer trust. Instapage offers a user-friendly platform that simplifies the process of building landing pages, allowing marketers to develop tailored experiences without the need for extensive coding skills or developer assistance.

Understanding the Importance of a Click-Through Page

A click-through page acts as a bridge between your marketing efforts and the desired conversion actions. For mortgage processors, this means delivering clear, compliant, and engaging content that resonates with potential clients. Utilizing Instapage’s library of over 100 customizable templates, you can streamline your design process while ensuring your messaging aligns with your audience's needs.

- Conveys essential information: Each click-through page should highlight the key offerings of your mortgage products, making it easy for visitors to understand their benefits.

- Guides the user journey: Effective navigation and clear calls-to-action can lead potential customers smoothly through the decision-making process.

- Optimizes user experience: By employing features like personalization and A/B testing, you can significantly boost engagement and conversion rates.

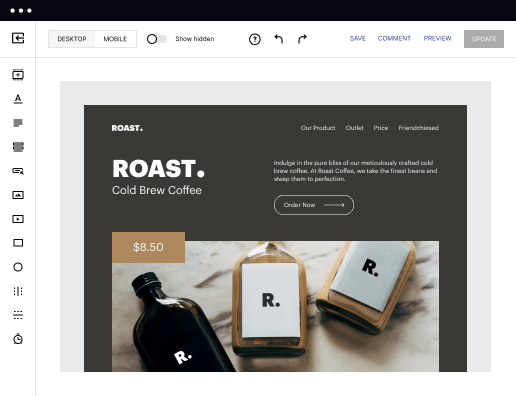

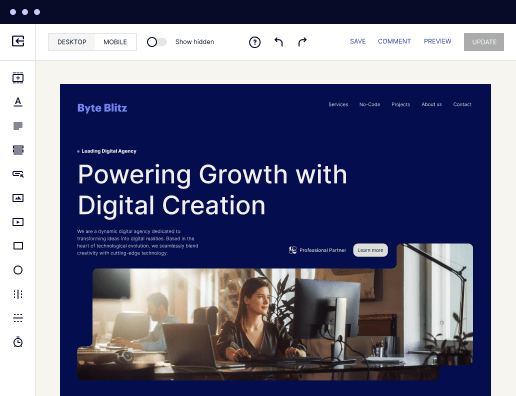

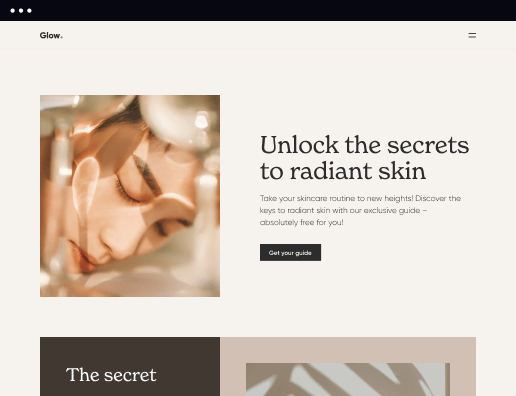

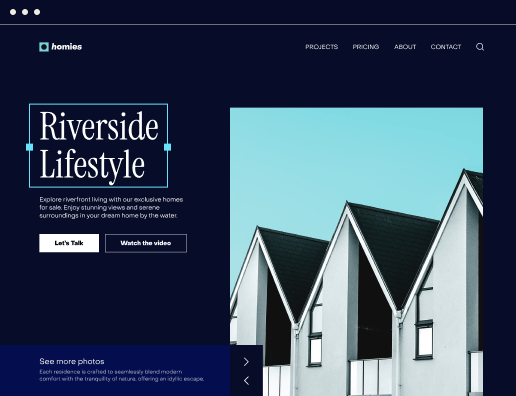

Step 1: Choose a Conversion-Focused Template

Start with selecting a template from Instapage’s extensive library. These templates are specifically designed to maximize conversions by incorporating proven structures and layouts that have been tested for effectiveness.

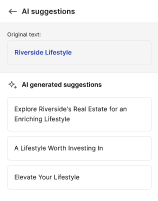

Step 2: Customize Your Content

Once you've selected a template, it's time to customize it to fit your audience. Tailor your messaging and visuals to resonate with mortgage seekers. Use dynamic content options available through Instapage to provide a personalized experience, ensuring alignment with the specific traits and interests of your target segment.

- Dynamic text replacement: Engage different segments by inserting relevant copy that speaks directly to each audience group.

- Use AdMaps: Link specific ads to unique landing pages, enhancing relevance and improving conversion odds.

- Incorporate testimonials and trust signals: These elements can build credibility and encourage users to proceed with their inquiries.

Step 3: Optimize and Iterate

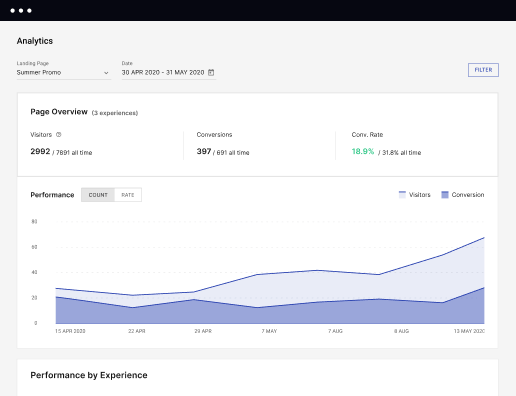

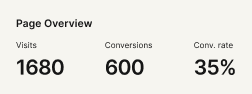

Optimization is crucial in maintaining a high-performing click-through page. Leverage Instapage’s analytics and heatmaps to understand user behaviors and preferences. Use these insights to run A/B tests and make data-driven adjustments to maximize overall effectiveness.

- Track metrics: Review key performance indicators (KPIs) to assess which elements drive conversions and where drop-offs occur.

- Experiment with different headlines and CTAs: Small changes can lead to significant increases in conversion rates.

- Regularly update content: Ensure the information is current and reflects any new offerings or changes in market conditions.

Implementing these steps will create a strong click-through page tailored specifically for mortgage processors, leading to improved customer interactions and higher conversion metrics.

Ready to create your tailored landing page? Start using Instapage today and unlock the full potential of your marketing efforts!

Get more out of Build your click-through page for Mortgage processors

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to build your click-through page for mortgage processors in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started