- Home

- Functionalities

- Landing Page Software Features for Professionals

- Make your blog page for Mortgage loan processors

Make your tailored blog page for Mortgage loan processors

Empower Mortgage loan processors with Instapage to deliver impactful blog page experiences and boost conversions.

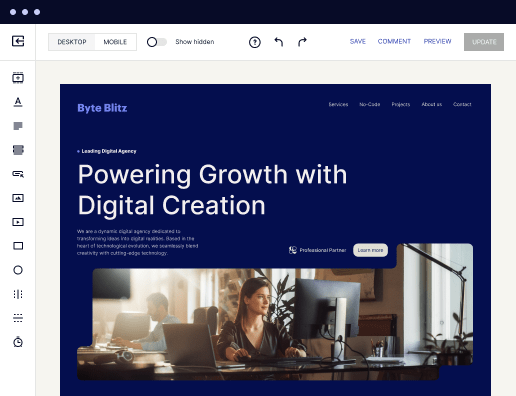

Build landing pages at scale without coding

Build landing pages at scale without coding

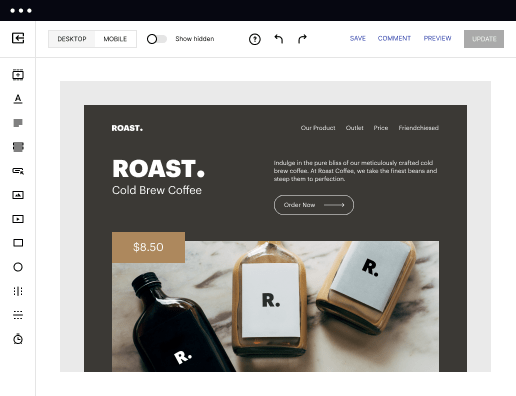

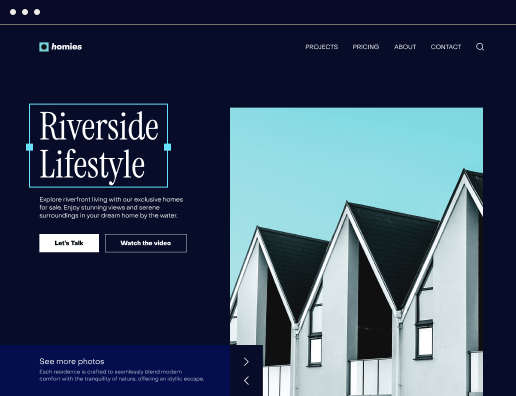

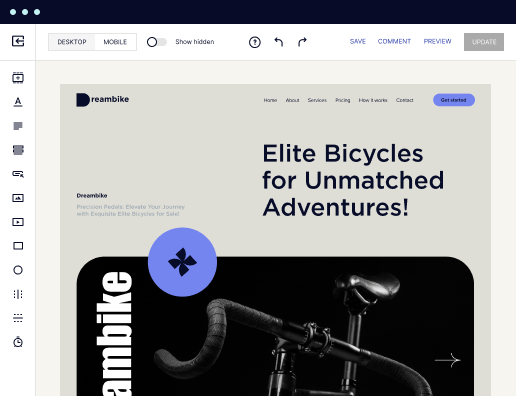

With Instapage’s intuitive drag-and-drop page builder with diverse design features, over 5,000 fonts, and 33 million images, anyone can easily create professional-looking, top-performing landing pages without technical or design skills.

Increase conversions with fast-loading pages

Increase conversions with fast-loading pages

Reduce bounce rates and increase engagement with lightning-fast landing pages. Our Thor Render Engine™, back-end technology delivers 3x faster-loading landing pages so you won't lose a single lead.

Boost productivity with AI content generation

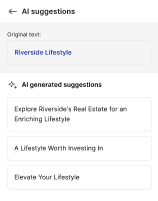

Boost productivity with AI content generation

Scale page creation and overcome writer’s block or generate copy variations for A/B tests with the AI Content Generator. Create high-quality and engaging content for each audience and ad group, including paragraphs, CTAs, or entire copies directly in the Instapage builder.

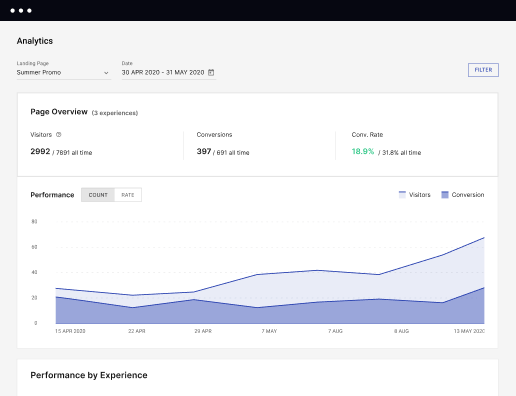

Make the most of analytic insights

Make the most of analytic insights

Get data-backed insights about your campaigns and page performance so you can test and optimize for higher ROI. Track visitors, conversions, conversion rates, cost-per-visitor, and cost-per-lead in real time. View heatmaps to understand user behavior - all without leaving Instapage.

Optimize traffic with AI experiments

Optimize traffic with AI experiments

Improve page performance fast with an AI-powered experimentation tool. It tracks your ongoing experiments and directs traffic to top-performing page variations, no matter how many versions you have. Achieve faster optimization insights without sacrificing the quality of your results.

Secure your business data

Secure your business data

Instapage safeguards business data and your customer's privacy with enterprise-grade security measures, including SSL certification, two-factor authentication, SSO, and more. Instapage also maintains compliance with GDPR, SOC 2, and CCPA regulations.

Create your blog page for mortgage loan processors with Instapage

Creating a blog page specifically designed for mortgage loan processors can greatly enhance your marketing strategy. Instapage provides a versatile landing page creation platform, allowing you to build high-quality, conversion-focused pages without any coding requirements. By utilizing our extensive library of templates and tools, you can effectively reach your target audience and drive business growth.

Step 1: Choose a relevant template

Begin by selecting a template that resonates with your audience’s needs. Our library boasts over 100 conversion-optimized layouts tailored specifically for professionals in the mortgage industry. This selection allows for customization tailored to your specific goals.

- Responsive Design: Ensure your page looks great on all devices, catering to users on mobile and desktop.

- Financial Services Focus: Utilize layouts that highlight services relevant to mortgage loan processing, like loan calculators or application forms.

- User-Centric Features: Opt for pages that guide users through your offerings seamlessly, helping them find the information they need quickly.

Step 2: Optimize for conversions

Once your template is in place, it’s essential to fine-tune it for maximum conversions. Instapage offers built-in experimentation tools to monitor visitor trends and enhance engagement.

- A/B Testing: Utilize this feature to compare different versions of your landing page and understand what resonates best with visitors.

- Heatmaps: Analyze user interactions to identify hot spots where users are clicking or dropping off.

- Analytics Dashboard: Keep track of key metrics such as conversion rates and user behavior, allowing for informed decisions.

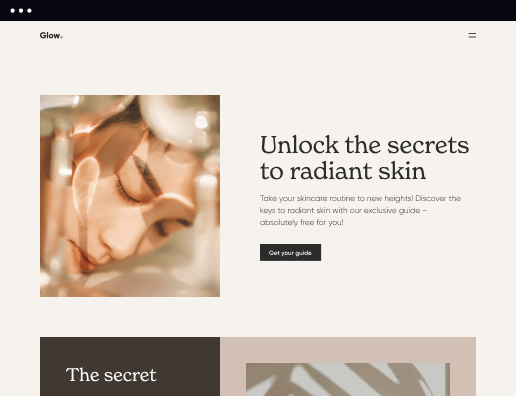

Step 3: Personalize your content

Dynamically deliver personalized content tailored to your audience's preferences. Instapage's personalization tools help ensure that visitors receive messages and offers that align with their unique circumstances.

- Dynamic Text Replacement: Customize landing page elements to fit the language and needs of different customer segments.

- AdMaps: Align your ads with specific landing pages to enhance relevance and increase clicks.

- Audience Tracking: Use our data tools to evaluate demographic engagement and adjust content accordingly.

Tailoring your blog page for mortgage loan processors not only boosts trust and loyalty but also fosters conversions that benefit your business in the long term. By following these steps on Instapage, you can create an effective online presence.

For the best results, leverage Instapage's powerful features to evolve your mortgage loan processor blog into a high-performing marketing tool.

Ready to take your online marketing to the next level? Explore how Instapage can empower your mortgage loan processing blog today!

Get more out of Make your blog page for Mortgage loan processors

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

“Instapage gives us the ability to tailor our landing page content and layout to tell a unique story for each geographical target. The platform also enables us to create different variations with content that performs well for each unique channel. Every marketing team needs this!”

"Instapage has truly maximized our digital advertising performance by enabling us to offer matching, personalized experiences for every ad and audience. Now we can scale our landing page experiences as efficiently and effectively as we scale the ads themselves."

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

“Instapage gives us the ability to tailor our landing page content and layout to tell a unique story for each geographical target. The platform also enables us to create different variations with content that performs well for each unique channel. Every marketing team needs this!”

"Instapage has truly maximized our digital advertising performance by enabling us to offer matching, personalized experiences for every ad and audience. Now we can scale our landing page experiences as efficiently and effectively as we scale the ads themselves."

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

Leading the way in building high-performing landing pages

FAQs

What is a blog page for mortgage loan processors?

A blog page for mortgage loan processors is a dedicated platform where mortgage-related content is shared, aimed at educating and attracting potential clients seeking loan processing services.

How does Instapage help create a blog page for mortgage loan processors?

Instapage provides flexible, user-friendly templates and conversion-focused tools specifically designed for the mortgage industry, enabling quick and effective page creation.

What are the key features of an Instapage blog page for mortgage loan processors?

Key features include A/B testing, dynamic text replacement for personalized content delivery, detailed heatmaps for understanding user interaction, and a powerful analytics dashboard.

Why is Instapage a good choice for mortgage loan processors?

Instapage offers a comprehensive toolkit that simplifies creating customized landing pages, optimizes user experience, and ultimately enhances conversion rates for mortgage loan processing businesses.

What benefits does using Instapage have for creating mortgage loan processor blog pages?

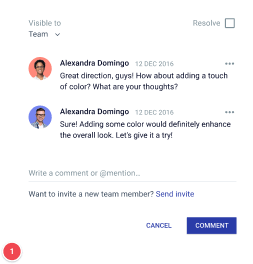

Using Instapage contributes to reduced costs of page production, faster iteration through collaboration features, and enhanced content personalization, leading to better engagement and trust.

What to consider when choosing a platform for my mortgage loan processor blog page?

Consider factors such as ease of use, customization options, built-in optimization tools, and collaboration capabilities that can facilitate the creation of targeted landing pages.

What challenges might I face with a blog page for mortgage loan processors?

Common challenges include creating engaging content that resonates with your audience and optimizing for conversions without technical expertise, which Instapage effectively addresses.

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started

People also ask about Make your blog page for Mortgage loan processors

How do loan services make money?

The interest rate charged for the loans will be higher than the rate they are paying to customers or borrowing for, and they make revenue on the difference. This is generally known as net interest income (interest income from loans minus interest expense from deposits).

Do mortgage loan processors make commission?

That commission is based off the loan amount and can vary depending on the organizationʼs structure. The more loans that a mortgage officer closes, the more they can earn. Mortgage loan processors, however, are usually paid a fixed salary or hourly rate and do not earn commissions based on loan volume.

What is the job outlook for a mortgage loan processor?

Average salary and job outlook for loan processors ing to the United States Bureau of Labor Statistics , the expected growth rate of loan processors is 4% from 2021 to 2031 . This is about the same growth rate as all other occupations during the same period.

How do I market myself as an MLO?

Network and connect: Build relationships with real estate agents and others in the industry to increase long-term success. Use various marketing strategies: Utilize online and offline methods, such as email marketing, attending local events, and creating eye-catching flyers, to reach a wide range of potential clients.

How do loan agents make money?

Loan officers either earn commission from an origination fee or from the lender. The mortgage loan officer canʼt receive compensation both ways, as this is considered illegal as per Regulation Z of the 2010 Dodd-Frank Act.

How do loan processors make money?

Mortgage lenders can make money in a variety of ways, including origination fees, yield spread premiums, discount points, closing costs, mortgage-backed securities (MBS), and loan servicing. Closing costs fees that lenders may make money from include application, processing, underwriting, loan lock, and other fees.

How much commission do loan officers get?

While 2% is a common benchmark, itʼs not uncommon for commission rates to vary. Some brokers may offer higher commissions for more complex loans or lower commissions for high-volume producers. Itʼs essential to tailor the commission structure to align with the brokerageʼs overall business strategy and goals.

How do loan processors get paid?

Mortgage loan processors, however, are usually paid a fixed salary or hourly rate and do not earn commissions based on loan volume. Compensation for loan processors is generally more stable, though typically not as high as a loan officerʼs.