Make a custom website for Mortgage underwriters

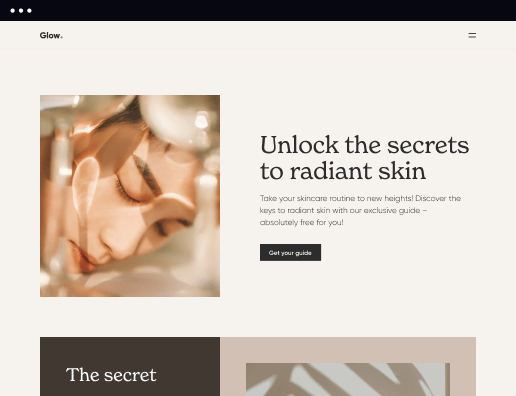

Elevate your market presence with a sophisticated and polished website for professionals. Instapage offers the digital solution you need.

Transform your online campaigns and build your website for Mortgage underwriters

A lot of specialists must pay more attention to the effectiveness of a well-designed landing page. With our user-friendly solution, you may quickly build your interactive website and take your online campaigns to another level. Whether promoting a product, service, or cause, engaging online presence is vital in today's digital age.

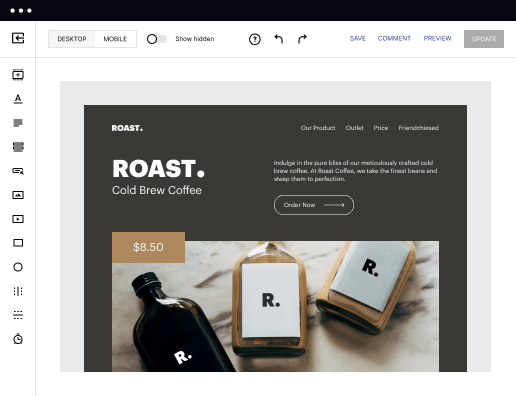

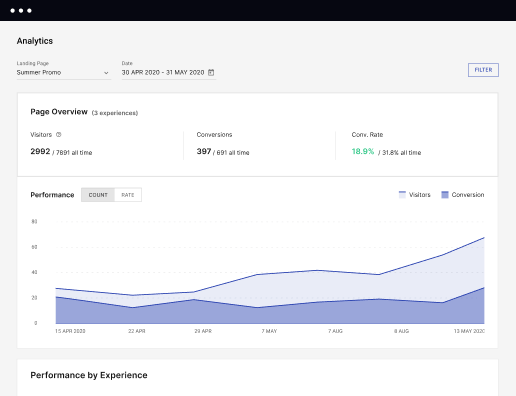

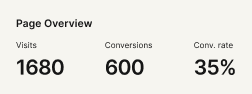

Instapage provides a variety of easy to customize templates and features that enable you to create your website for Mortgage underwriters. Not only does an interactive website get more guests, but it also encourages them to stay on your page for a longer time and increases their chances of converting into customers or followers. Our solution offers analytics tools to monitor guest engagement and measure the success of your campaigns.

Effortlessly build your website for Mortgage underwriters in several steps

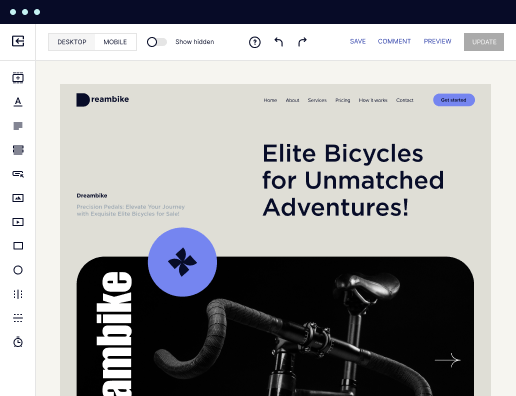

- Register a free Instapage account.

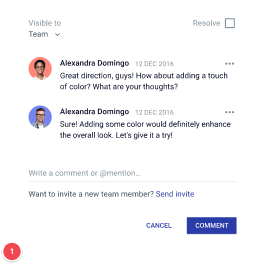

- Set up your profile, offer important information, and invite your teammates.

- Visit your Dashboard to make your website for Mortgage underwriters.

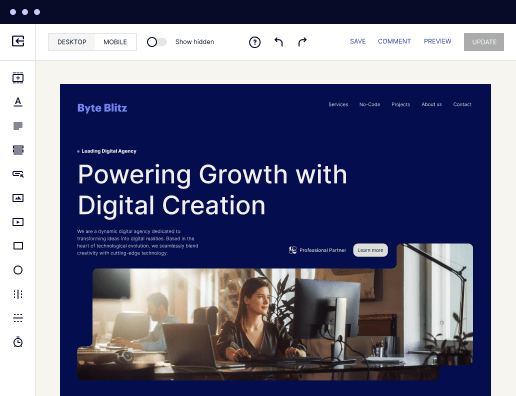

- Click Create Page and select a page template or start crafting it from scratch.

- Include various blocks and page elements, and modify the page design.

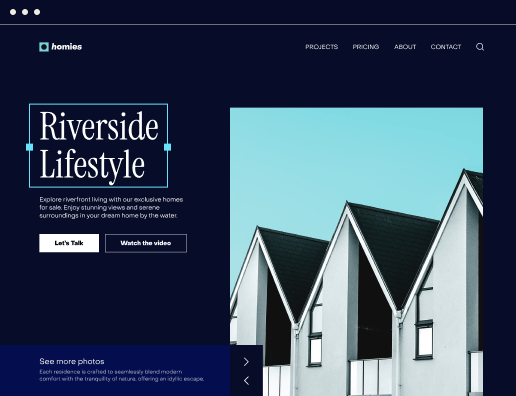

- Try our AI capabilities to create content suggestions and test your site.

- Once all set, click on Publish to launch your landing page.

Start your free trial today and create your website for Mortgage underwriters. Discover all the possibilities of a personalized approach to your viewers. Accomplish more with Instapage!

Get more out of Make your website for Mortgage underwriters

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to make your website for mortgage underwriters in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started