Make your tailored sign-up page for Tax consultants

Empower Tax consultants with Instapage to deliver impactful sign-up page experiences and boost conversions.

Create an effective sign-up page for tax consultants with Instapage

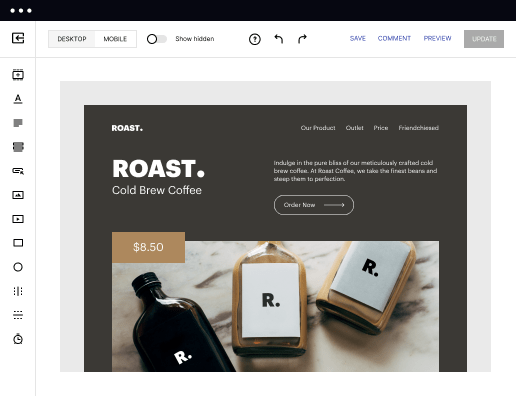

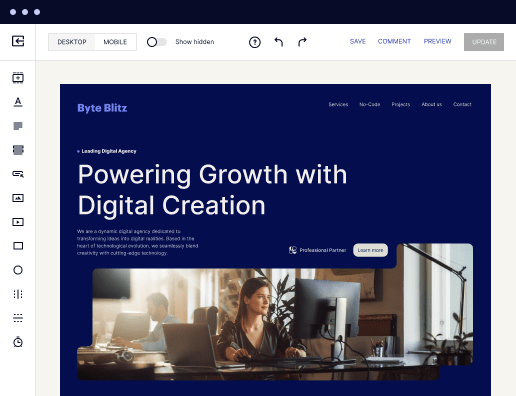

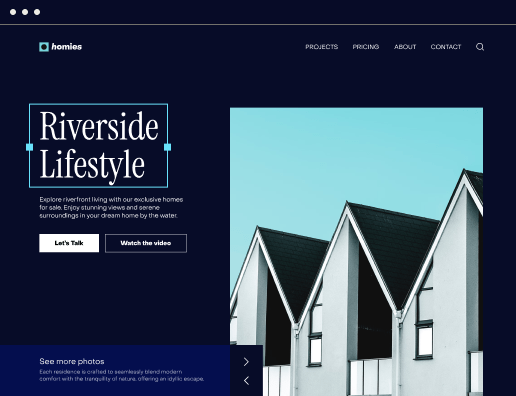

Designing a compelling sign-up page for tax consultants is crucial for attracting potential clients and maximizing conversions. Instapage empowers marketers with the ability to build landing pages quickly and efficiently, ensuring each visitor receives a personalized and relevant experience. By leveraging Instapage's extensive library of templates and intuitive tools, tax consultants can create landing pages tailored to their unique offerings without the need for coding or developer assistance.

Step 1: Choose the Right Template

Select a template that resonates with your target audience. Instapage provides over 100 conversion-focused layouts, making it easy to find one that meets the specific needs of tax consultants. Consider these factors:

- Brand alignment: The template should reflect your branding and style.

- Clarity: Ensure the message is clear and concise, highlighting your unique value proposition.

- Mobile responsiveness: Choose a layout that adapts seamlessly to mobile devices.

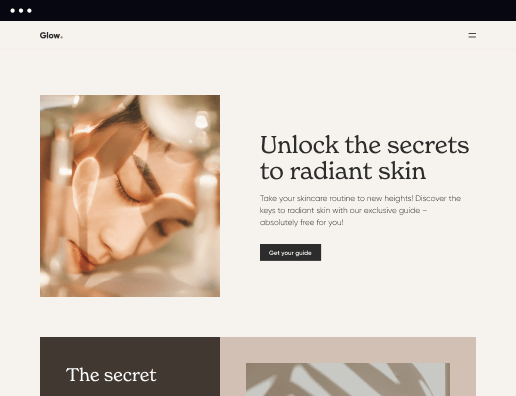

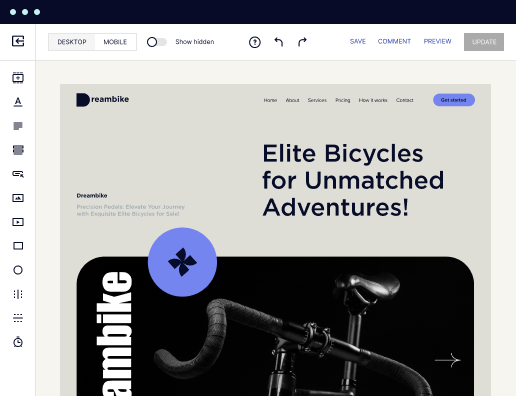

Step 2: Customize Your Landing Page Content

Once you've selected a template, it’s time to customize the content. Focus on creating compelling and relevant messaging that resonates with your audience. Consider including:

- Key services: Clearly outline the services you offer as a tax consultant.

- Testimonials: Add client testimonials to build trust and credibility.

- Call-to-action (CTA): Craft persuasive CTAs that encourage visitors to sign up immediately.

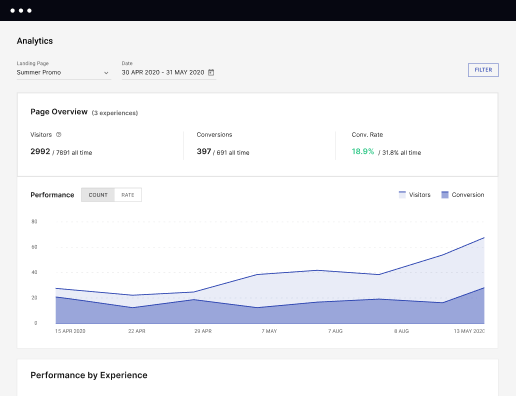

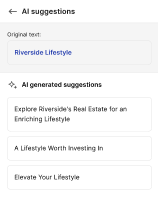

Step 3: Optimize for Conversions

To maximize the effectiveness of your landing page, utilize Instapage's built-in optimization features. Here's how:

- A/B testing: Experiment with different headlines and CTAs to see what resonates best with your audience.

- Heatmaps: Use heatmaps to analyze user behavior and adjust the layout accordingly.

- Analytics: Regularly review performance metrics to understand what elements are driving conversions.

Incorporating these strategies will ensure your sign-up page for tax consultants not only looks great but also performs effectively in converting visitors into leads.

Take your marketing strategy to the next level by leveraging the power of Instapage for your sign-up page. Boost conversions, save costs, and enhance your brand's online presence today.

Ready to get started? Sign up for Instapage today and experience the benefits of a professionally designed landing page.

Get more out of Make your sign-up page for Tax consultants

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to make your sign-up page for tax consultants in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started