Make your tailored home page for Mortgage underwriters

Empower Mortgage underwriters with Instapage to deliver impactful home page experiences and boost conversions.

Make your home page for Mortgage underwriters with Instapage

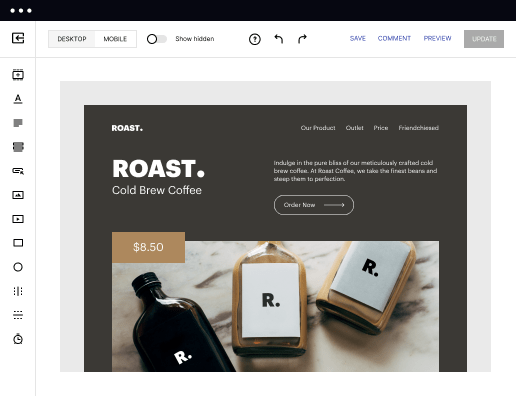

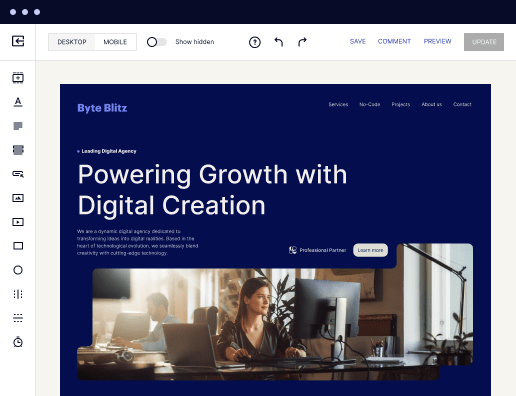

Creating a tailored home page for mortgage underwriters can significantly enhance user engagement and conversion rates. Instapage provides powerful tools that empower marketers to build landing pages quickly, utilizing over 100 conversion-focused layouts and Instablocks, ensuring that no coding skills are needed. The flexibility and ease of use offered by Instapage make it a prime choice for professionals in the mortgage sector seeking to optimize their digital presence.

Understanding the Importance of a Dedicated Home Page

A dedicated home page for mortgage underwriters serves as the first point of contact with potential clients, establishing your credibility and expertise in the industry. The key components include capturing leads, showcasing offerings, and directing users to apply for services. Crafting a user-friendly experience is crucial, given the nature of financial services where trust is paramount.

- Lead generation: A well-designed page can effectively capture leads through forms and calls-to-action, facilitating easy interaction with potential clients.

- Showcasing services: Highlighting specific mortgage products and services can guide visitors toward making informed decisions.

- Trust-building: Utilizing client testimonials and industry certifications directly on the home page can enhance your credibility.

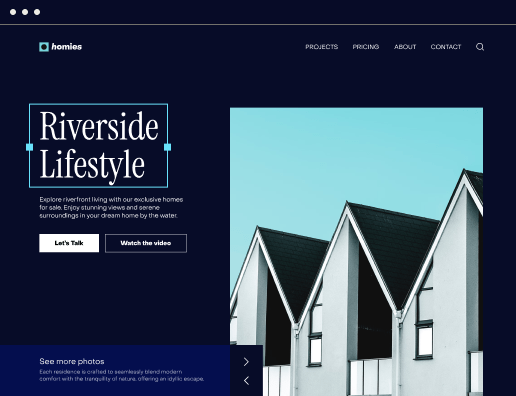

Step 1: Utilizing Conversion-Focused Layouts

Start by choosing a layout from Instapage's library that aligns with your business objectives. Incorporating high-quality visuals and clear messaging will help in keeping visitors' attention.

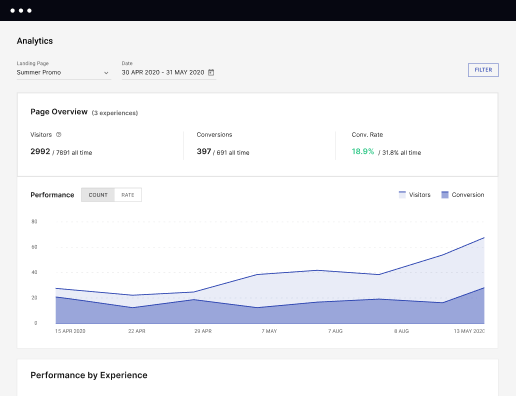

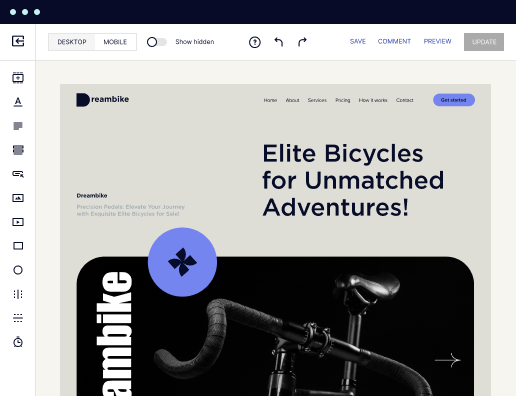

Step 2: Implementing A/B Testing for Optimization

To achieve the best performance, continuously test different versions of your landing page components. A/B testing allows you to identify effective headlines, images, and calls-to-action.

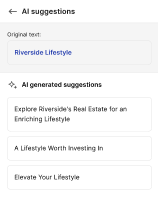

- Headlines: Experiment with different titles to see which resonates more with your audience.

- CTA placement: Test the effectiveness of various button placements to discover what prompts higher conversion rates.

- Visual content: Assess which images or icons lead to better engagement from potential clients.

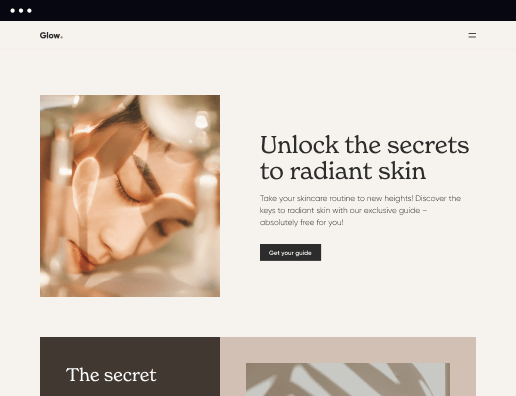

Step 3: Personalize the User Experience

Dynamic text replacement and audience segmentation tools allow you to tailor the experience based on the visitor's profile. This personalization can significantly increase relevant engagement and drive conversions.

- Dynamic content: Utilize data from prior interactions to modify the content displayed to return visitors, making them feel recognized.

- Audiences segmentation: Group visitors based on demographics to deliver personalized messages that resonate with them.

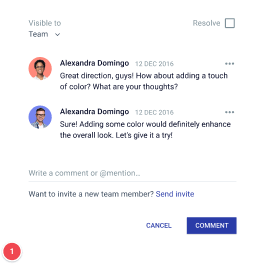

- Performance tracking: Leverage analytics dashboards to monitor interactions and make informed decisions for future improvements.

By following these steps, mortgage underwriters can craft a compelling home page that not only attracts visitors but also converts them into loyal clients. Instapage's robust platform makes it easy to implement these strategies effectively.

Optimize your mortgage underwriting services today by creating a powerful home page with Instapage. Start a free trial today and see how effective landing pages can help you improve your conversion rates.

Get more out of Make your home page for Mortgage underwriters

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

Leading the way in building high-performing landing pages

FAQs

See how to make your home page for mortgage underwriters in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started