- Home

- Functionalities

- Landing Page Software Features for Professionals

- Guardian debt relief review

Make your web page for Debt relief attorneys and convert leads into revenue

Power up and optimize your campaigns with Instapage. Effortlessly create your web page for Debt relief attorneys to highlight your expertise, attract your target audience, and achieve superior conversion outcomes.

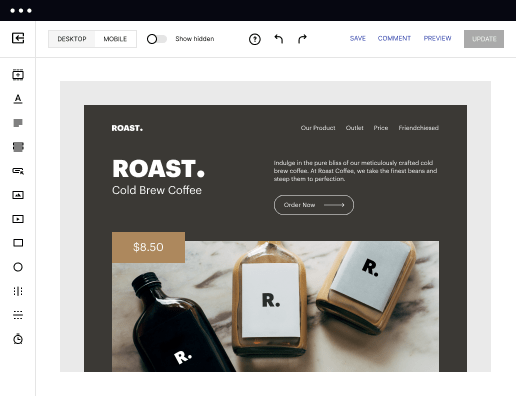

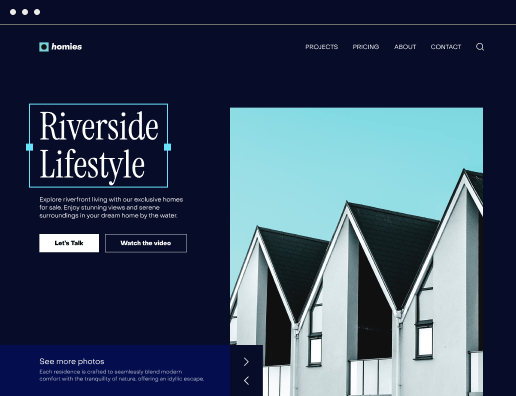

Build landing pages that get results

Build landing pages that get results

Drive ad campaign performance using targeted landing pages. With over 500+ layouts, AI-content generation, built-in collaboration, Instablocks®, and quick page load technology, you can easily create landing pages that deliver an unparalleled user experience that gets more people buying.

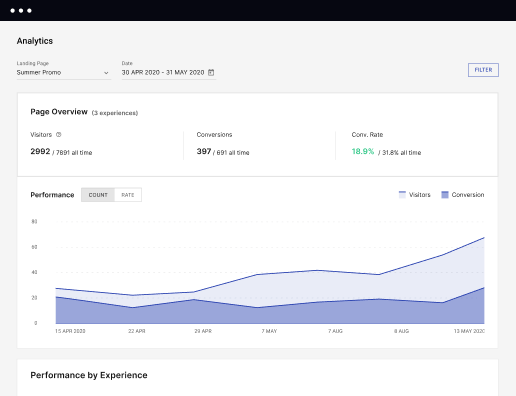

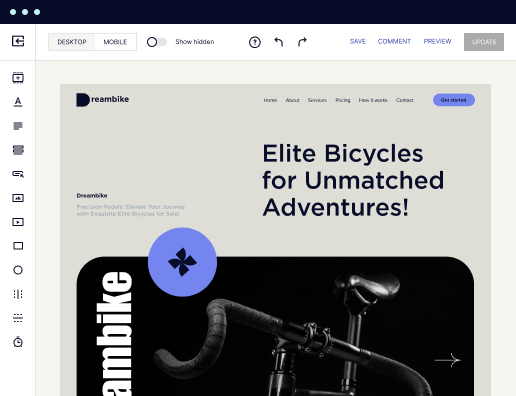

Boost results through landing page optimization

Boost results through landing page optimization

Optimize your landing pages using Instapage’s variety of testing tools. Track and analyze user behavior with heatmaps, run A/B testing to single-out the best performing version, or launch AI-assisted experiments that automatically analyze ad traffic and route it to best-performing.

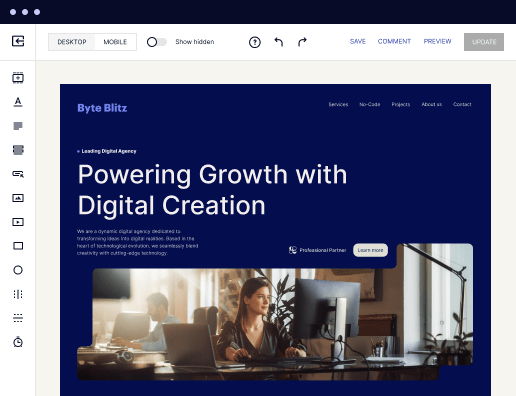

Personalize experiences for higher engagement and ROI

Personalize experiences for higher engagement and ROI

Craft unique and high-performing landing pages that align with your ad messaging and resonate with your target audience. By crafting a landing page experience that resonates with your audience, you'll engage more visitors, maximize conversions, and reduce acquisition costs.

Maximize campaign efficiency with ad mapping

Maximize campaign efficiency with ad mapping

Efficiently manage campaigns by visualizing your ads and mapping them to corresponding landing pages in one place. Define what campaigns need a personalized experience and connect them with relevant ads to increase conversion rates and decrease CPA.

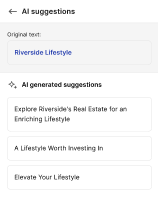

Power up landing pages with AI

Power up landing pages with AI

Instantly create high-performing content for each audience segment and separate ad campaigns with the AI assistant. From catchy headlines to converting CTAs for A/B tests – access and use AI directly on your Instapage. No more writer’s block or workflow interruptions.

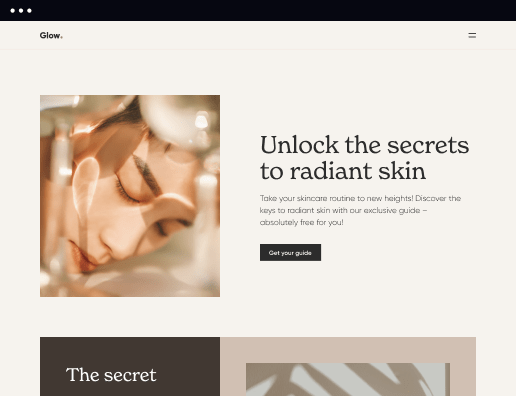

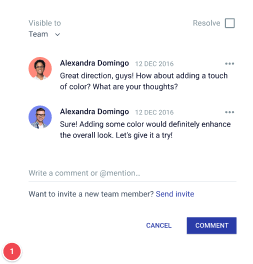

Improve alignment across your creative team

Improve alignment across your creative team

Get your campaigns off the ground faster with efficient teamwork that happens in real time. Empower your team members to provide immediate feedback, make edits to page versions, and securely share information with outside stakeholders all from a single secure space.

Build your web page for Debt relief attorneys in no time

If you’re looking for ways to amplify your online presence, build your web page for Debt relief attorneys with Instapage. This platform is a powerhouse that helps turn clicks into loyal customers, revolutionizing how businesses get in touch with their audience. One of the key benefits the platform offers is the customization of advertising. Draft, create, personalize and optimize landing pages for every campaign, ensuring a unique experience for every visitor.

Additionally, Instapage highlights the importance of collaboration in a marketing and advertising team. The platform offers innovative ways for teams to manage their accounts jointly, fostering an environment where ideas can thrive and strategies can be fine-tuned to perfection. Instapage also encourages businesses to explore overlooked marketing channels. From leveraging messaging platforms and affiliate marketing to optimizing business blogs and socials, it guides businesses in harnessing the potential of these channels. Regardless of your design skills, the interface will guide you through the experience until you publish your landing.

Follow these steps to make your web page for Debt relief attorneys

- Open the Instapage site and authenticate in your account. If you do not have an account yet, create it utilizing your current email address.

- You will be redirected to your Dashboard. Click CREATE PAGE to start.

- Choose the most suitable type of page: desktop standard or AMP. You can also upload an Instapage document if you have one.

- Browse the template catalog and choose the most suitable one based on your aims. If nothing fits, select BLANK and design forms from scratch.

- Set up the settings for your online queries, conversion goals, and social accounts.

- Click EDIT DESIGN to personalize your page’s contents utilizing the toolbar on the left.

- Click PREVIEW to ensure the page appears as you intended.

- Click PUBLISH to finish editing and publish the landing.

Use this platform to create your web page for Debt relief attorneys and expand your marketing opportunities. Create your account to try it right now!

Get more out of Build your web page for Debt relief attorneys

Improve your Quality Score with quick load technology for landing pages

Increase conversions with content that aligns with your ads and audiences

Achieve maximum ROI by scaling your marketing initiatives

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

“Instapage gives us the ability to tailor our landing page content and layout to tell a unique story for each geographical target. The platform also enables us to create different variations with content that performs well for each unique channel. Every marketing team needs this!”

"Instapage has truly maximized our digital advertising performance by enabling us to offer matching, personalized experiences for every ad and audience. Now we can scale our landing page experiences as efficiently and effectively as we scale the ads themselves."

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

“Instapage gives us the ability to tailor our landing page content and layout to tell a unique story for each geographical target. The platform also enables us to create different variations with content that performs well for each unique channel. Every marketing team needs this!”

"Instapage has truly maximized our digital advertising performance by enabling us to offer matching, personalized experiences for every ad and audience. Now we can scale our landing page experiences as efficiently and effectively as we scale the ads themselves."

"If we have to wait on a developer, our creative velocity plummets. But Instapage has made it possible for us to exponentially grow our advertising programs and convert more customers"

Leading the way in building high-performing landing pages

FAQs

How does Instapage help make your web page for Debt relief attorneys?

Instapage features a straightforward drag-and-drop website builder that helps you create your web page for Debt relief attorneys. Effortlessly create mobile-friendly landing pages, integrate your favorite applications, and enhance the entire process. Sign up for a 14-day trial, enhance how you engage with your audience, and build customer loyalty.

Is it difficult to build your web page for Debt relief attorneys?

Instapage takes the website-building process to a different level with a simple and intuitive interface. You can make your web page for Debt relief attorneys completely from scratch, even if you do not have experience with coding or web design. The web template collection makes it even easier to visualize and set up your landing page. Select a web template that suits your case, customize it, and adjust other configurations to access your analytics.

Does Instapage offer CRM integrations?

Instapage features dozens of well-known CRM integrations, marketing automation, statistics, and many other apps for simplifying your day-to-day workflows. You just need to link your account with Instapage in Workspace settings. Contact our team if you want to include a customized solution or need help with the integration process.

Is Instapage safe?

Instapage prioritizes your security and features all advanced safety measures to safeguard you and your web page visitors. Instapage encrypts all user actions and complies with SOC 2 Type II, GDPR, CCPA and EU-US DPF standards. The solution also utilizes innovative backup and anti-DoS measures. For additional information on Instapage safety, please visit our security portal.

See how to build your web page for debt relief attorneys in action

Ready to skyrocket conversions?

Supercharge your ad campaigns with high-performing landing pages.

Get started

People also ask about Build your web page for Debt relief attorneys

Can a lawyer help you with credit card debt?

An experienced credit card debt attorney can help you explore your options and figure out what to do with no pressure and no blame. One way to get rid of credit card debt is to pay it off, but when you can only afford monthly minimum payments, it can take decades to pay off the debt.

How does debt resolution work?

Debt settlement companies work with your creditors on your behalf to negotiate your total debt amount with the aim of reducing your repayment responsibility. These services arent free; youll be charged a fee typically between 15 to 25 percent of your total debts enrolled after your debts are settled.

Are debt lawyers worth it?

In almost all cases, its better to hire a reputable attorney rather than a debt settlement company if you want help negotiating debt settlements. A lawyer can negotiate on your behalf, defend you in court if you get sued, and tell you about your legal options.

Is it a good idea to get a debt relief company?

Working with a debt settlement company may lead to a creditor filing a debt collection lawsuit against you. Unless the debt settlement company settles all or most of your debts, the built-up penalties and fees on the unsettled debts may wipe out any savings the debt settlement company achieves on the debts it settles.

What is the success rate of debt settlement?

Completion rates vary between companies depending upon a number of factors, including client qualification requirements, quality of client services and the ability to meet client expectations regarding final settlement of their debts. Completion rates range from 35% to 60%, with the average around 45% to 50%.

What happens when a debt goes to a lawyer?

A debt settlement lawyer who is working on your behalf can attempt to settle the debt for you. You may be able to reduce the amount you owe by as much as 60% or more. If the debt collector agrees to a settlement, you simply pay the money, and they will report the debt as paid.

Is debt settlement better than collections?

Obviously, debt settlement is a better option for positive credit history versus not paying it at all and later dealing with collection agencies and its bad consequences after, says Kayikchyan. Once the account goes to collections, youll likely get aggressive phone calls and letters.